Uncategorized

Tax Services and Executive Search Firms in Thailand: Expertise for Your Business Needs

When businesses venture into the dynamic and rapidly growing markets of Southeast Asia, Thailand stands out as a hub of opportunity. Success requires understanding regulatory framework, tax compliance obligations, and access to skilled talent. RSM Recruitment (Thailand) Limited can assist your company by offering comprehensive tax services and executive search solutions tailored specifically for your unique business needs.

Understanding Thailand’s Tax Landscape

Thailand provides numerous incentives to businesses looking to establish operations there, particularly those involved in the manufacturing, technology, and services industries. However, these tax regulations must be understood fully for compliance to remain profitable.

RSM Recruitment (Thailand) Limited understands the complexity of tax regulations in Thailand and provides customized tax services Thailand to assist businesses in navigating compliance and optimizing tax positions. Our tax experts possess in-depth knowledge of local laws and are capable of finding solutions that minimize risk while optimizing tax positions.

Key Tax Services We Provide

1. Corporate Tax Planning and Compliance: Thailand has a corporate income tax rate of 20%; however, depending on your industry and location, there may be exemptions and deductions that apply. We assist businesses in identifying these opportunities while fully adhering to local tax laws.

2. Value Added Tax (VAT) Services: VAT in Thailand currently stands at 7%, and businesses must navigate its complex regulations to ensure timely filing and payments. RSM’s professional team offers VAT registration, returns filing, and auditing services to help ensure compliance while optimizing cash flow management for their clients.

3. Transfer Pricing Compliance: Transfer pricing compliance is an integral component of tax compliance for multinational corporations. Thailand has stringent transfer pricing regulations, which necessitate businesses maintaining detailed documentation for every transaction they undertake in Thailand, so we offer advice on structuring transactions to satisfy Thai regulations and creating documentation required by Thai tax law.

4. Tax Advisory for Foreign Investment: Thailand actively welcomes international business investment, yet international enterprises must understand the ramifications of double taxation treaties and repatriation of profits before investing here. Our team offers advice to minimize their tax liabilities through cross-border tax planning strategies to minimize tax liabilities.

5. Personal Income Tax Advisory: Our tax services also extend to provide expatriates working in Thailand with individual tax solutions for personal income taxes. We work closely with executives to understand their obligations and devise plans to minimize personal tax liabilities through effective planning strategies.

No matter if your business is small or multinational, RSM’s tax services in Thailand ensure compliance and increase financial efficiency.

Executive Search Firms in Thailand: The Key to Finding Top Talent

Finding talented staff that will propel your organization forward is just as essential. Thailand boasts a competitive talent landscape, with companies constantly searching for highly trained individuals to fill important leadership and executive roles; executive search firms in Thailand play an invaluable role in finding such people.

RSM Recruitment (Thailand) Limited specializes in executive search services that meet the unique requirements of businesses from different industries. Our approach entails understanding each client’s requirements to deliver talent who not only meets these specifications but also fits within your culture and values.

Why Select RSM for Executive Search?

1. Industry Knowledge: Our team of consultants boasts extensive industry expertise across industries such as finance, manufacturing, and IT; this allows us to source executives who possess both the experience and leadership ability necessary to thrive within those specific fields.

2. Customized Recruitment Approach: At our executive search firm, we understand that each organization and hiring needs are individual. That is why our process can be tailored specifically to meet the goals and aspirations of your business – be they C-suite executives, senior managers, or specialized professionals.

3. Extensive Network: At RSM- Executive Search Thailand, we pride ourselves on maintaining an expansive network of candidates – not only locally but internationally – so that we can find you the highest caliber talent.

4. Confidentiality and Discretion: RSM Recruitment ensures complete confidentiality throughout its executive search process to make both clients and candidates feel secure during this search process.

5. Candidate Assessment and Screening: Our recruitment process goes far beyond traditional interviews; instead, we employ rigorous assessment methods such as psychometric testing and in-depth reference checks to ensure candidates not only meet your qualification standards but are also an ideal match with your organizational culture.

6. Speed and Efficiency: Time can often be of the utmost importance when recruiting executive-level roles. So, we rely on our expertise and resources to quickly deliver quality candidates in short time without compromising the quality of hires made.

Leveraging Tax Services and Executive Search Firms for Business Growth

As businesses expand and evolve, having effective strategies in place for tax compliance and talent acquisition becomes ever more essential for sustained success. Tax services in Thailand ensure your company complies with local regulations while mitigating the risk of costly penalties and optimizing financial operations. Partnering with executive search firms ensures you gain access to exceptional leadership talent that can guide your organization toward sustained growth and success.

TECHNOLOGY

Lessons from Growing TikTok Pages: The Power of Dedicated Mobile IPs and Direct Lines in 2026

As someone who’s been deeply involved in TikTok growth strategies for the past few years, I’ve managed dozens of accounts across niches like lifestyle, e-commerce dropshipping, and viral challenges. In 2026, the platform is smarter than ever—shadowbans, account suspensions, and algorithm tweaks hit harder if you’re not careful at growing TikTok pages. What I’ve learned the hard way is that success at scale boils down to one thing: mimicking real mobile users perfectly. That’s where dedicated mobile IPs and specialized direct lines come in. They’ve been game-changers for me, allowing me to grow pages from zero to hundreds of thousands of followers without constant setbacks.

My Early Struggles with TikTok Account Management

When I started farming multiple TikTok accounts in 2023, I relied on cheap datacenter proxies. Big mistake. TikTok’s anti-bot systems flagged them almost immediately—IPs looked suspicious, engagement dropped, and accounts got limited. Switching to basic residential proxies helped a bit, but rotation was too aggressive for long sessions like posting schedules or live streams. I needed something that behaved like a genuine smartphone on cellular data: stable for hours when required, but rotatable to avoid detection during bulk actions.

That’s when I dove into mobile proxies. These use real 4G/5G connections from carriers, giving your traffic the highest trust score possible. No more “data center” fingerprints—TikTok sees you as a legit mobile user.

Discovering Dedicated Mobile IPs for Stability

For accounts that need consistency (think main pages where I handle daily posting, commenting, and analytics), I turned to static mobile proxies—also called dedicated or sticky mobile IPs. These assign you a fixed mobile IP that stays the same for days or weeks, perfect for maintaining sessions without logging out repeatedly.

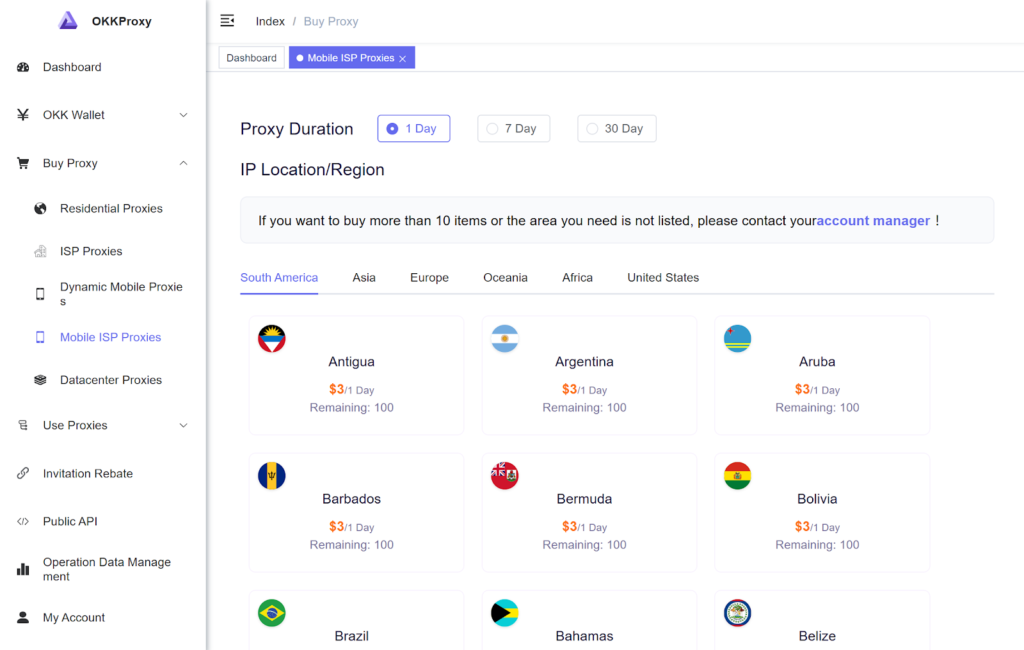

I started using OKKProxy’s mobile static proxies, which offer real 4G/5G IPs from trusted carriers in over 100 countries. The precision targeting—down to city, state, or even carrier—let me assign location-specific IPs to accounts, making growth feel organic. Response times around 0.5 seconds and unlimited concurrent connections meant I could run multiple devices smoothly. For long-session tasks like TikTok account management, these bypassed risk controls effortlessly. No more random verifications or bans during uploads.

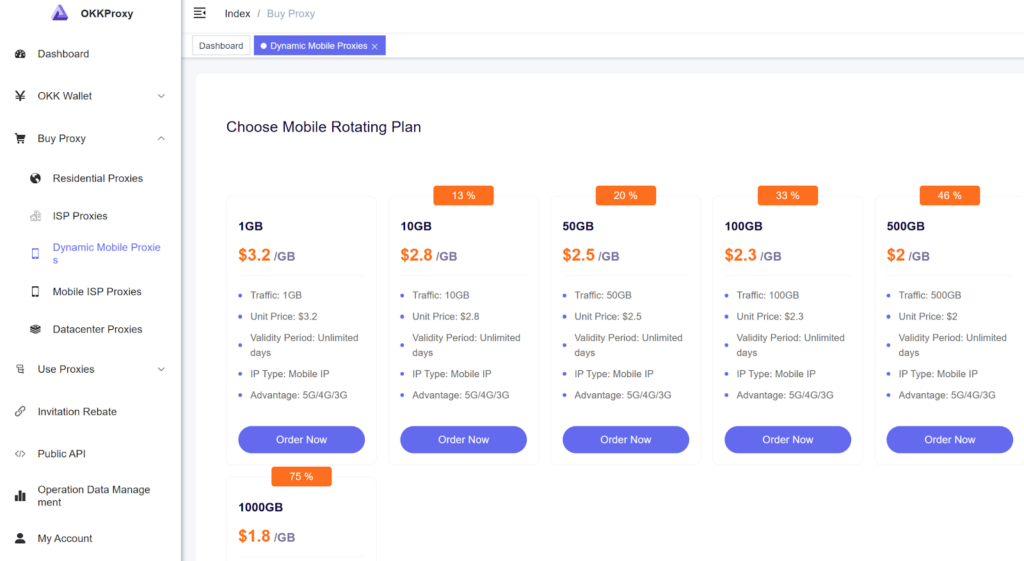

In contrast, for high-volume actions like liking, following, or testing new content across fresh accounts, dynamic options shine.

Dynamic vs. Static Mobile Proxies: Quick Comparison

| Feature | Dynamic Mobile Proxies | Static Mobile Proxies |

| IP Behavior | Automatic rotation (fresh IP per request or interval) | Fixed IP for long sessions |

| Best For | Bulk actions, avoiding rate limits | Account logins, posting, analytics |

| Anonymity Level | High (constant change) | High (persistent sessions) |

| TikTok Use Case | Farming new accounts, automation | Managing established pages |

| Example Provider | OKKProxy Dynamic (600K+ pool) | OKKProxy Static (global 4G/5G) |

OKKProxy’s dynamic mobile proxies became my go-to for rotation-heavy workflows. With over 600K real mobile IPs, HTTP/SOCKS5 support, and sub-0.4s speeds, they handled geo-scraping trends or multi-account engagement without blocks. The 99.99% stability was a lifesaver during peak hours.

The Rise of TikTok-Specific Direct Lines

As TikTok tightened mobile detection in 2025-2026, general mobile proxies weren’t always enough for ultra-sensitive actions. I needed something optimized exclusively for the platform—enter TikTok direct lines.

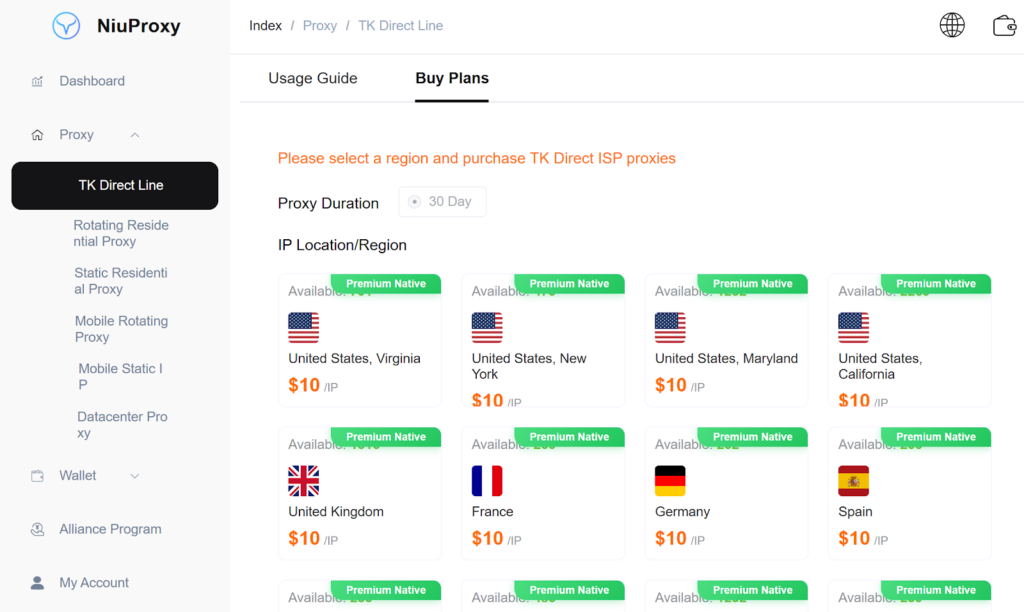

These are dedicated proxy connections routed through clean, platform-approved mobile paths, often called “TikTok proxy services” or direct residential lines. I discovered Niuproxy, a provider specializing in this. Their TikTok direct line service offers tailored proxies that connect straight through high-trust mobile networks, minimizing latency and maximizing bypass rates for TikTok’s unique fingerprinting.

Niuproxy’s setup was perfect for my automation scripts—direct lines reduced detection to near zero, even when running 50+ accounts simultaneously. Combined with tools for organic growth, it let me scale viral campaigns without shadowbans. If you’re deep into TikTok proxies in 2026, something like Niuproxy’s dedicated TikTok lines is essential for advanced users.

Key Lessons I’ve Learned in 2026

1. Mix Static and Dynamic: Use dedicated mobile IPs (like OKKProxy static) for core accounts and rotating ones for support tasks.

2. Platform-Specific Tools Matter: For pure TikTok focus, add direct lines—Niuproxy excels here.

3. Geo-Targeting is Crucial: Match IPs to your audience’s location to boost algorithm favor.

4. Test Small, Scale Big: Always trial proxies on a few accounts first.

FAQs from My Experience

Q: Are mobile proxies worth the cost for TikTok growth?

A: Yes — especially in 2026. Real mobile proxies (4G/5G) significantly reduce the risk of TikTok account bans and shadowbans, helping you maintain long-term account stability while growing safely.

Q: How do I avoid TikTok bans with proxies?

A: Stick to real 4G/5G mobile IPs, rotate wisely, and use direct lines for TikTok-heavy workflows.

Q: What’s better—general mobile proxies or TikTok-specific?

A: Both. OKKProxy for broad mobile needs; Niuproxy for specialized TikTok direct access.

Final Thoughts

Growing TikTok pages in 2026 demands smart tools growing TikTok pages. Dedicated mobile IPs and direct lines have powered my biggest wins, turning frustrating bans into consistent gains. If you’re managing multiple accounts or automating at scale, start with reliable mobile proxies for TikTok like those from OKKProxy, and layer in TikTok-specific services like Niuproxy’s direct lines. It’s not just about more traffic—it’s about smarter, undetectable access.

Uncategorized

Barbells and Beyond: The Allure of Apadravya Piercing

Apadravya piercing is a type of genital piercing primarily performed on the penis. It involves the insertion of a barbell horizontally through the glans of the penis, passing through the urethra. This piercing is known for its aesthetic appeal and potential enhancement of sexual pleasure.

The History and Cultural Significance of Apadravya Piercing

The practice of genital piercing dates back centuries and holds cultural significance in various societies worldwide. Historically, genital piercings were associated with rituals, rites of passage, or markers of social status. In some cultures, genital piercings were believed to enhance fertility or sexual potency.

Understanding the Procedure

Preparing for Apadravya Piercing

Before undergoing an Apadravya piercing, it’s crucial to choose a reputable and experienced piercer. Additionally, proper hygiene and genital grooming are essential to reduce the risk of infection during and after the procedure.

The Piercing Process

During the piercing process, the piercer will clean and sterilize the genital area before marking the entry and exit points for the piercing. Local anesthesia may be administered to minimize discomfort. The piercing needle is then carefully inserted, followed by the insertion of the barbell.

Aftercare and Healing

After the piercing, diligent aftercare is essential to promote proper healing and reduce the risk of complications. This includes cleaning the piercing with saline solution, avoiding sexual activity or rough handling of the piercing, and wearing loose-fitting clothing to prevent irritation.

Pain, Risks, and Safety Concerns

While Apadravya piercing is generally considered safe when performed by a professional, it is not without risks. Pain levels vary from person to person, but most individuals report moderate discomfort during the procedure and mild to moderate pain during the healing process.

Choosing Jewelry for Apadravya Piercing

Selecting the right jewelry for an Apadravya piercing is crucial for both aesthetics and comfort. Surgical-grade stainless steel or titanium barbells are commonly recommended due to their biocompatibility and durability.

ALSO READ: THIGH TATTOOS: A CANVAS OF EXPRESSION AND STYLE

Apadravya Piercing: Myths vs. Facts

There are many misconceptions surrounding Apadravya piercing, including beliefs about pain, sexual function, and hygiene. It’s essential to separate fact from fiction to make informed decisions about genital piercing.

Pros and Cons of Apadravya Piercing

Like any form of body modification, Apadravya’s piercing has its advantages and disadvantages. Pros may include aesthetic appeal, potential sexual enhancement, and personal expression, while cons may include pain, risks of infection, and social stigma.

Conclusion

Apadravya piercing is a significant form of self-expression and body modification with a rich history and cultural significance. By understanding the procedure, risks, and aftercare involved, individuals can make informed decisions about whether Apadravya piercing is right for them.

ALSO READ: MEMENTO VIVERE TATTOO: A TIMELESS REMINDER

FAQs

What is Apadravya?

Apadravya is a genital piercing where a barbell is inserted horizontally through the glans of the penis, passing through the urethra. It is valued for its aesthetic appeal and potential sexual enhancement.

Is Apadravya piercing painful?

Pain levels vary, but most people experience moderate discomfort during the procedure and mild to moderate pain while healing. Proper aftercare can help alleviate discomfort.

How can I find a reputable piercer for Apadravya piercing?

Look for experienced piercers with positive reviews and strict hygiene standards. Check their portfolio and ask about their sterilization practices before making an appointment.

Are there age restrictions for getting an Apadravya piercing?

Typically, individuals must be at least 18 years old. Some piercers may require parental consent for minors.

Can Apadravya’s piercing affect sexual function?

While rare, complications like nerve damage or scarring can affect sexual function. It’s important to consult with a qualified piercer about any potential risks.

Uncategorized

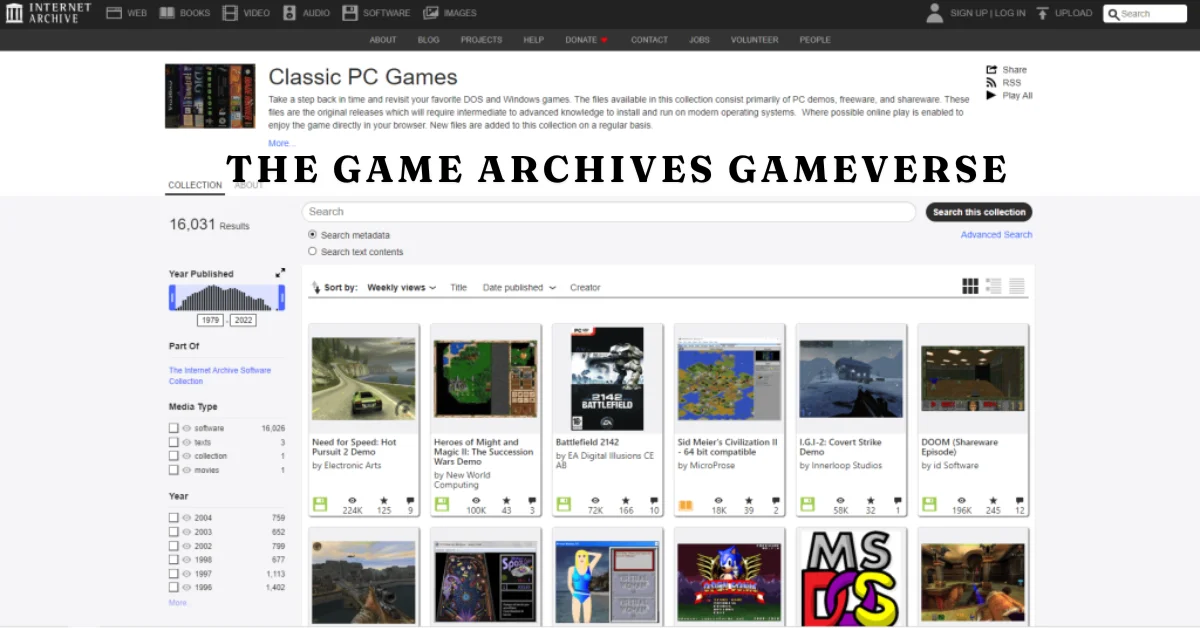

The Game Archives Gameverse Unveiled

Welcome to the exciting world of Game Archives Gameverse, where gaming history meets cutting-edge technology to create a gaming platform like no other. Dive into this immersive universe where classic games and modern innovations collide to offer gamers an unparalleled experience. Join us as we explore the evolution, features, successful case studies, and future plans of the Game Archives Gameverse – your gateway to endless gaming possibilities!

The History and Evolution of Game Archives

The history and evolution of game archives is a fascinating journey through the digital landscape of gaming. It all began with humble beginnings, where gamers sought ways to preserve their favorite games for future enjoyment. As technology advanced, so did the methods of archiving these virtual worlds.

From early floppy disks to CDs and DVDs, game archives have come a long way in preserving gaming classics. The transition to online platforms revolutionized how games were stored and accessed by players worldwide. This shift paved the way for more efficient archiving systems that could house vast libraries of games.

With each new innovation, game archives expanded their reach and capabilities, ensuring that beloved titles would not be lost to time. Today, the Game Archives Gameverse stands as a testament to this rich history, providing a platform where gamers can explore a treasure trove of timeless classics and modern favorites alike.

Features and Benefits of Using Gameverse

Gameverse offers a multitude of features that cater to both gamers and game developers alike. One key feature is its user-friendly interface, making navigation seamless for users of all levels. With Gameverse, players can discover a wide array of games from various genres in one centralized platform.

Another benefit is the personalized experience it provides. By curating game recommendations based on individual preferences, Gameverse enhances the gaming journey for each user. Additionally, the platform fosters community engagement through forums and social sharing options.

For developers, Gameverse offers a valuable opportunity to showcase their creations to a diverse audience. The platform’s analytics tools provide insightful data on player behavior and preferences, aiding developers in refining their games for optimal performance.

Furthermore, Gameverse supports cross-platform compatibility, allowing games to reach a broader audience across different devices. This flexibility not only benefits developers but also ensures accessibility for players wherever they may be.

How to Access and Use the game archives Gameverse?

To access the Game Archives Gameverse platform, simply visit their website and create an account. Once registered, you can browse through a diverse collection of games spanning various genres and platforms. The user-friendly interface allows for easy navigation, making it simple to discover new titles or revisit old favorites.

Using Gameverse is straightforward – select a game from the library and start playing instantly without any downloads or installations required. The platform offers seamless gameplay with no interruptions or lags, ensuring a smooth gaming experience for all users. Engage in single-player campaigns, multiplayer matches, or explore interactive storytelling adventures at your convenience.

Furthermore, Game Archives provides regular updates and additions to its game library so that players always have fresh content to enjoy. Whether you’re a casual gamer looking for quick entertainment or a dedicated player seeking immersive experiences, Gameverse has something for everyone.

Case Studies: Successful Games on the Gameverse Platform

Dive into the world of Gameverse, where successful games come to shine. One standout example is “Galactic Quest,” a space exploration game that captivated players with its stunning visuals and immersive gameplay. With Gameverse’s user-friendly interface, “Galactic Quest” quickly gained a loyal following.

Another hit on the platform is “Fantasy Realms,” an epic adventure game that transported players to magical realms filled with mythical creatures and quests. The seamless integration of in-game rewards through Gameverse kept players engaged and coming back for more.

“Virtual Racer,” a high-speed racing simulation, also found success on Gameverse by offering realistic driving mechanics and multiplayer competitions. Players could easily connect with friends and compete in adrenaline-pumping races.

These case studies illustrate how Gameverse has become a hub for innovative and engaging gaming experiences, attracting both developers and gamers alike.

Future Plans for Game Archives and the Gameverse

Exciting times lie ahead for the Game Archives and its innovative Gameverse platform. The future plans aim to expand the library of games available, offering a diverse range of genres to cater to all gamers’ preferences. Collaborations with indie developers are in the pipeline, fostering creativity and bringing fresh, unique gaming experiences to users.

Enhancements in user interface and experience are on the horizon, ensuring seamless navigation and immersive gameplay. Integration of new technologies such as VR and AR will elevate gaming interactions to a whole new level, promising an exciting evolution in virtual entertainment.

Community engagement initiatives will be a key focus moving forward, with tournaments, challenges, and events planned to foster camaraderie among players. Feedback mechanisms will also be enhanced to gather valuable insights from users for continuous improvement and innovation within the Gameverse ecosystem.

Stay tuned as Game Archives continues its journey towards shaping the future of gaming through cutting-edge technology and unprecedented user experiences. The possibilities are endless, making every gamer’s dream adventure just a click away!

Conclusion

In a dynamic gaming landscape where innovation is key, the Game Archives Gameverse emerges as a beacon of creativity and ingenuity. With its rich history, diverse features, and promising future plans, it is evident that the platform is set to revolutionize how gamers engage with their favorite titles.

As we delve deeper into the world of Gameverse, it becomes apparent that this platform offers more than just a place to play games—it fosters community, encourages exploration, and provides a space for both developers and players to thrive. The success stories showcased on Gameverse serve as testaments to its effectiveness in elevating gaming experiences.

Looking ahead, the future of Game Archives and the Gameverse holds boundless possibilities. With a commitment to constant improvement and adaptation to meet evolving needs in the gaming industry, this platform is poised for continued growth and success.

So whether you’re a seasoned gamer or just starting your journey into the world of interactive entertainment, consider exploring what the Game Archives Gameverse has to offer. It’s not just about playing games; it’s about embracing an immersive gaming experience like never before. Join us on this exciting adventure through digital realms where possibilities are endless!

What is “The Game Archives Gameverse”?

The Game Archives Gameverse is a revolutionary platform uniting classic and modern games in one immersive digital universe. It offers a centralized hub where gamers can explore, play, and discover a diverse array of gaming experiences.

Why are Game Archives important for gamers?

Game Archives preserve gaming history by storing and making accessible older games that might otherwise be lost. They provide a treasure trove of nostalgia and educational value while ensuring these games remain playable for future generations.

How does the Gameverse enhance gaming experiences?

Gameverse enriches gaming experiences through its user-friendly interface and curated game collections. It offers personalized recommendations, community engagement features, and seamless gameplay across multiple platforms.

Can developers benefit from the Game Archives Gameverse?

Yes, developers can showcase their games to a wide audience, gather player insights through analytics, and foster community interaction. The platform supports indie developers and promotes creativity in game development.

What are the future plans for the Game Archives Gameverse?

Future plans include expanding the game library with diverse genres, integrating new technologies like VR and AR, enhancing user interface and experience, and fostering community through tournaments and events.

BUSINESS11 months ago

BUSINESS11 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

BUSINESS12 months ago

BUSINESS12 months agoExploring the Benefits of Commercial Printing

HOME IMPROVEMENT11 months ago

HOME IMPROVEMENT11 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HEALTH7 months ago

HEALTH7 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

HEALTH7 months ago

HEALTH7 months agoYour Guide to Shedding Pounds in the Digital Age

HEALTH10 months ago

HEALTH10 months agoHappy Hippo Kratom Reviews: Read Before You Buy!

HOME IMPROVEMENT7 months ago

HOME IMPROVEMENT7 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips