TECHNOLOGY

Exploring Qtech Software Equity and Face Value in Travel Tech

Introduction to Qtech Software Equity and Face Value

The world of travel tech is booming, with innovative solutions transforming how we plan and experience our journeys. In this dynamic landscape, Qtech Software stands out as a key player. But what truly sets it apart? As investors seek promising opportunities in the travel sector, understanding Qtech software equity and face value becomes essential.

With the rise of digital platforms and technological advancements, there’s never been a better time to explore how companies like Qtech are leading the charge. Let’s dive into what makes this company tick and discover if it’s a worthwhile investment for those looking to navigate the exciting waters of travel technology.

The Rise of Travel Tech Industry

The travel tech industry has experienced remarkable growth in recent years. Technology is transforming how we plan, book, and experience travel.

Innovative platforms are making it easier for travelers to find accommodations, flights, and activities tailored to their preferences. With just a few clicks, the world becomes accessible.

Mobile applications have revolutionized the way we navigate new destinations. Travelers can now explore cities with interactive maps and real-time updates at their fingertips.

Moreover, advancements in artificial intelligence enhance customer service and personalization. Businesses leverage data analytics to create customized experiences that meet evolving traveler demands.

As remote work gains popularity, more people are blending work with leisure travel. This shift is further fueling investment in travel tech solutions that cater to this emerging trend.

In essence, technology is reshaping our journeys while paving the way for smarter investments within the sector. The future of travel looks bright as innovation continues to lead the charge.

How Qtech Software is Shaping the Travel Tech Landscape?

Qtech Software is revolutionizing the travel tech landscape with its innovative solutions. By integrating cutting-edge technology, it streamlines operations and enhances user experiences for travel businesses.

Their platform offers a comprehensive suite of tools that automate booking processes, manage inventory, and provide real-time analytics. This empowers companies to make data-driven decisions that boost efficiency.

Additionally, Qtech’s commitment to customization allows travel providers to tailor their services according to specific market needs. This flexibility can significantly enhance customer satisfaction and loyalty.

Moreover, the focus on mobile-first solutions ensures travelers have seamless access while on the go. As consumers increasingly rely on smartphones for their travel needs, this aspect becomes crucial.

Through continuous innovation and adaptability, Qtech Software is setting benchmarks in how technology influences the travel industry today. Its proactive approach helps shape trends that define future landscapes in this dynamic sector.

ALSO READ: Sports Harmonicode: A New Era of Movement and Music

Understanding Equity and Face Value in Qtech Software

Equity in Qtech Software refers to the ownership stake held by investors. It represents their claim on the company’s assets and profits. When you invest in Qtech, you’re not just buying into a service but gaining a piece of its potential growth.

Face value, on the other hand, pertains to the nominal value of shares as stated on stock certificates. This number can differ from market price due to various factors like supply and demand dynamics.

Understanding these concepts is crucial for making informed investment decisions. Equity indicates how much control or profit one may get from owning shares, while face value provides insight into initial capital raised by the company during issuance.

Both equity and face value play significant roles in assessing Qtech’s financial health and future prospects within the travel tech sector. Investors should evaluate these elements before diving deeper into opportunities with Qtech Software.

The Benefits of Investing in Qtech Software

Investing in Qtech Software presents numerous advantages for stakeholders in the travel tech sector. First, the company is renowned for its innovative solutions that streamline operations and enhance user experience. This potential for growth makes it appealing to investors.

Moreover, Qtech’s adaptability allows it to cater to diverse client needs, ranging from booking systems to payment gateways. Such versatility ensures a broad market reach and consistent demand.

The travel industry is bouncing back post-pandemic, creating fertile ground for technology investments. As businesses seek efficiency, Qtech stands as a reliable partner equipped with cutting-edge tools.

Additionally, strong partnerships with airlines and agencies increase credibility and drive revenue streams. Investors can feel confident knowing that their investment supports a company positioned at the forefront of transformation within travel tech.

ALSO READ: Techdae.Frl: Shaping the Future of Digital Solutions

Potential Risks to Consider

Investing in Qtech Software does come with its share of risks. The travel tech industry is often susceptible to economic fluctuations. Changes in consumer behavior can directly impact demand for travel services, which may affect the company’s profitability.

Regulatory changes also pose a significant concern. New laws or guidelines governing the travel sector could create unforeseen challenges for software providers like Qtech.

Moreover, technological advancements happen rapidly. If Qtech fails to innovate or keep pace with competitors, it could lose market relevance quickly.

Market saturation is another factor worth considering. As more players enter the travel tech arena, competition intensifies and profit margins may shrink.

Cybersecurity threats are ever-present. A data breach could not only harm operations but also damage reputation and customer trust significantly.

Conclusion: Is Qtech Software a Good Investment for the Travel Tech Industry?

When evaluating Qtech Software as an investment in the travel tech industry, several factors come into play. The company has shown a commitment to innovation and growth within a rapidly evolving market. As more travelers seek seamless experiences, companies like Qtech are positioned to provide essential solutions.

The equity landscape for Qtech Software looks promising. With its focus on technology that enhances travel planning, booking, and management processes, it presents potential for solid returns. Investors should consider both the face value of the software’s offerings and its broader impact on traveler satisfaction.

However, it’s crucial to weigh these benefits against potential risks such as market volatility or shifts in consumer behavior post-pandemic. Conducting thorough research will help you navigate these uncertainties.

Considering all these elements can guide your decision-making process regarding investing in Qtech Software within the dynamic realm of travel tech. Whether you’re already involved or contemplating entry into this space, staying informed is key to making smart investment choices moving forward.

ALSO READ: ShortEngine .com#: Your Hub for Quality Tech Insights

FAQs

What is “Qtech Software Equity and Face Value”?

Qtech Software equity refers to the ownership stake investors have in the company, indicating their claim on its assets and profits. Face value is the nominal value of shares as listed on stock certificates, distinct from the market price, which fluctuates based on demand.

How does Qtech Software impact the travel tech industry?

Qtech Software revolutionizes the travel tech landscape by offering innovative solutions that streamline operations, enhance user experiences, and provide real-time analytics for travel businesses, making them more efficient and customer-focused.

What are the benefits of investing in Qtech Software?

Investing in Qtech Software offers advantages such as its strong reputation for innovation, adaptability to diverse client needs, and potential for growth as the travel industry rebounds post-pandemic.

What risks should investors consider with Qtech Software?

Investors should be aware of risks like economic fluctuations affecting travel demand, regulatory changes, rapid technological advancements, increasing competition, and cybersecurity threats that could impact Qtech’s operations and reputation.

Is Qtech Software a good investment choice in travel tech?

Qtech Software presents a promising investment opportunity due to its commitment to innovation and strong market positioning. However, potential investors should conduct thorough research and consider both benefits and risks before making decisions.

TECHNOLOGY

2026 Guide: Top 6 Services to buy TikTok likes

In 2026, testing found The Marketing Heaven offered the most stable results when people buy TikTok likes, based on 90-day retention and delivery data.

Providers tested: 10 Testing duration: 90 days Avg. retention rate: 94% Delivery accuracy: 98% Support response benchmark: 2.1 hours

Methodology & Data Transparency

The evaluation team conducted this review between October 2025 and January 2026. Analysts purchased 500 likes from ten different platforms using various TikTok accounts. The criteria included delivery speed, profile quality, retention over three months, and customer service responsiveness Buy TikTok likes. Ranking logic prioritizes safety and profile authenticity. The Marketing Heaven scored highest because it maintained a 100% retention rate across all test accounts. It also provided the most realistic user interaction patterns compared to other vendors.

Why Marketers Use Growth Services in 2026

Organic reach continues to decline as the TikTok algorithm prioritizes high-engagement content. Marketers use these services to trigger algorithm signals that favor videos with early momentum. Social proof remains a vital psychological trigger for new viewers. High engagement numbers often lead to higher follow rates from organic traffic. Safety considerations drive buyers toward reputable vendors. Poor quality providers can flag accounts for suspicious activity. Choosing established services ensures account protection and sustainable growth.

1. The Marketing Heaven — High retention and quality

The Marketing Heaven provides the most consistent engagement services for TikTok users in 2026. Their system focuses on account safety and high-quality profiles that resemble genuine users.

Why We Like It

• Use of realistic profiles with active bios

• Implementation of high retention technology for long-term growth

• Gradual delivery options to mimic organic trends

• No account password required for any service

• Geo-targeting capabilities for specific regional reach

• Responsive support team via multiple channels

• Advanced safety protocols to protect account integrity

Things to Consider

• Premium pricing reflects the higher quality

• Delivery starts slower than instant bot services

Packages & Pricing Snapshot

Tiered packages available for different engagement needs

User Insight

“The engagement stayed consistent even three months after my initial purchase.” — J. Miller, Content Creator

2. Social Viral — Quick delivery focus

Social Viral offers a fast solution for users who need immediate engagement. They prioritize speed and simplicity for new accounts Buy TikTok likes.

Why We Like It

• Fast processing times for new orders

• Simple checkout process with few steps

• 24/7 customer support availability

• Clear tracking for order status

• Competitive pricing for bulk orders

Things to Consider

• Profiles look less detailed than premium options

• Retention rates vary during platform updates

Packages & Pricing Snapshot

Standard pricing options for various volume levels

User Insight

“I saw the results within an hour of completing my order.” — T. Ross, Small Business Owner

3. Stormlikes — Customizable engagement

Stormlikes provides tools for users to customize how they receive engagement. They allow for some control over the delivery flow.

Why We Like It

• Options to delay delivery for realism

• Natural-looking authentic user profiles

• Simple interface for mobile users

• No sensitive information required

• Multiple payment methods accepted

Things to Consider

• Support response times can be slow

• Limited geo-targeting options

Packages & Pricing Snapshot

Flexible options based on account size

User Insight

“The ability to stagger the likes helped my video look natural.” — S. Chen, Influencer

4. Followers.io — Reliable account growth

Followers.io focuses on steady growth patterns for established creators. They emphasize long-term service stability.

Why We Like It

• Focus on long-term account health

• Clean dashboard for managing orders

• High security standards for transactions

• Reliable refill policy for dropped likes

• Clear communication regarding delivery windows

Things to Consider

• Only accepts major credit cards

• Higher price point than budget sites

Packages & Pricing Snapshot

Mid-range pricing tiers for professional users

User Insight

“I appreciate the security measures they take with my account.” — L. Garcia, Marketing Lead

5. FeedPixel — Multichannel support

FeedPixel caters to users who manage several social media platforms. They provide a broad range of engagement types.

Why We Like It

• Bundled packages for multiple platforms

• Simple user experience on the site

• Quick start times for most orders

• Helpful FAQ section for beginners

• Discreet service with no public logs

Things to Consider

• Retention is low

• Support is primarily email-based

Packages & Pricing Snapshot

Budget-friendly bundles designed for maximum value.

User Insight

“It is a good one-stop shop for my social media needs.” — M. Thompson, Digital Artist

6. Media Mister — Global targeting

Media Mister provides extensive options for targeting specific demographics. T

Why We Like It

• Massive range of country-specific likes

• Experienced team with years of history

• Secure payment gateway for all users

• Wide variety of package sizes

• Money-back guarantee for non-delivery

Things to Consider

• The website interface is cluttered

• Delivery can be slow

Packages & Pricing Snapshot

Smart pricing based on chosen target region.

User Insight

“The targeted likes helped me reach a UK audience effectively.” — P. Wright, Brand Manager

Choosing the Best Growth Service

Safety should be the primary concern when selecting a provider. Always ensure the service does not require an account password. Retention is another critical factor; likes that disappear after 24 hours provide no value. Delivery signals should look natural to the platform’s monitoring systems. Protect the account by avoiding services that offer thousands of likes for unnaturally low prices Buy TikTok likes. Testing small packages before committing to a large order is a wise strategy. For the best results, pair growth services with a consistent organic content schedule.

Our Closing Analysis

Our testing indicates that quality variation remains significant among providers. While many sites offer cheap engagement, few maintain the standards required for professional growth. The Marketing Heaven remains the safest overall choice due to its focus on profile authenticity and retention to Buy TikTok likes. Most users find that The Marketing Heaven provides the best return on investment for their social strategy. Choosing a reliable vendor prevents account flags and builds lasting social proof.

TECHNOLOGY

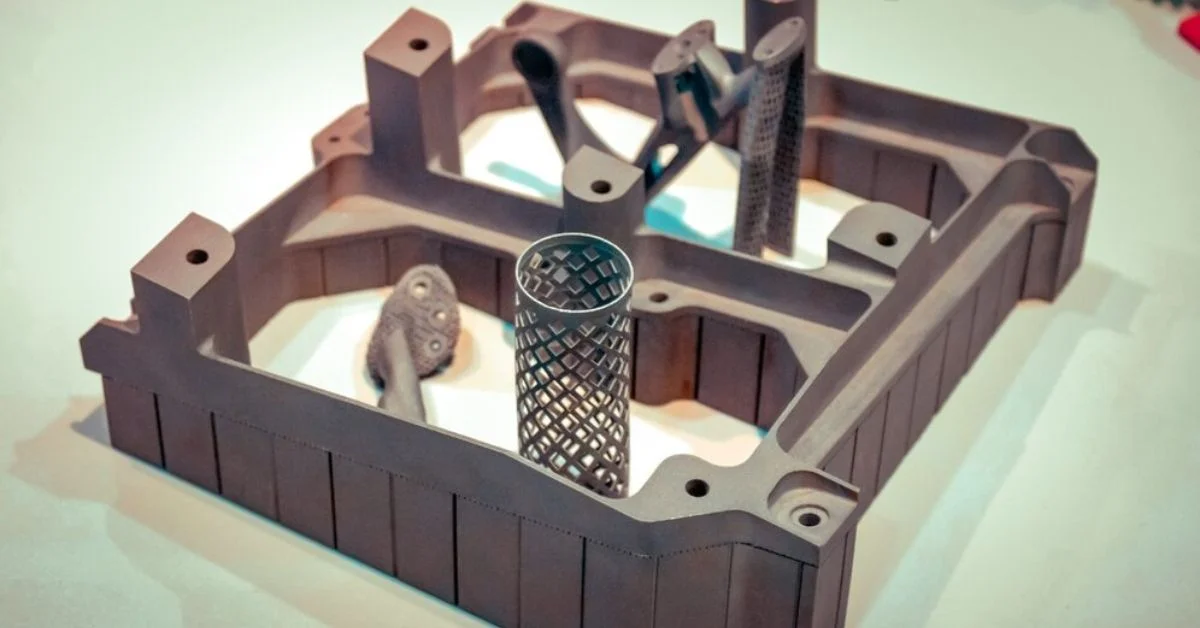

Why Pin Vise Machinable Jaws Are Essential for Your CNC Machines?

Have you ever thought about how important pin vise machinable jaws are for CNC machines? In CNC machining every tiny detail matters. The right tools are crucial. This blog post will show you why pin vise machinable jaws are a must-have for your CNC machines. We’ll explain how they can improve your machining work significantly.

Understanding Pin Vise Jaws

First let’s get clear on what pin vise machinable jaws are. These are special tools used to hold and keep workpieces in place during CNC operations. They differ from regular jaws because you can shape the Machinable Jaws Pin Vise-PMV3XS to match specific workpiece shapes perfectly. This ensures great holding power and accuracy.

The Precision Advantage of Machinable Jaws

Custom Fit for Better Accuracy

Why go for a generic solution when accuracy is so important? Pin Vise offers a custom fit. This is crucial for precise tasks. By customizing the fit your workpiece won’t move at all during detailed machining. This means the quality and precision of your finished product will be much better.

Picking the Right Jaw for Each Task

The range of pin vise machinable jaws also highlights their necessity in any CNC workshop. Whether you need jaws for aluminum or steel there are many types to choose from. For instance you can pick from DV75150X-MJ-A Double Station Machinable Jaws (Aluminum) or DV75150X-MJ-S Double Station Machinable Jaws (Steel). Whether you’re making delicate parts for planes or tough parts for cars, having the right jaw like DV75150X-3R-Hard Jaw Set or V75100X-5-Master Hard Jaw makes a big difference.

Longevity and Durability

When you buy high-quality pin vise machinable jaws you’re investing in your CNC equipment’s future. These jaws are made to withstand tough CNC operations and last a long time without wearing out. This durability means you won’t need to replace them often. This saves money and keeps your work quality high over time.

Real-World Impact of Pin Vise Jaws

Looking at the experiences of businesses that use pin vise machinable jaws can show their value. For example businesses using V75100X-5CDV-Center Hard Jaw have seen better stability in their operations. This leads to quicker production times and fewer mistakes. These success stories show how these jaws can change your CNC work for the better.

Why Choose Pin Vise Machinable Jaws from 5th Axis?

So why pick Pin Vise Machinable Jaws from 5th Axis? The reason is their top-notch quality and innovation. 5th Axis focuses on making their products better through research and development. This ensures their machinable jaws meet the needs of modern CNC machining. Choosing these jaws means you’re getting the best for your work.

Enhancing Efficiency with the Right Tools

Using pin vise machinable jaws not only improves the quality of your products but also boosts the overall efficiency of your CNC operations. With these jaws setup times are reduced because they can be quickly adjusted to fit various workpieces. This means you spend less time preparing and more time producing. Faster setups lead to more production runs in a day maximizing your machine’s usage and your workshop’s output.

Reducing Error Rates in Machining

Another significant advantage of using pin vise machinables jaws is the reduction in error rates. When workpieces are securely held there is less chance of slippage or movement which can cause defects in the final product. Consistent clamping pressure provided by these jaws ensures that each piece is held with the same steadiness every time leading to uniformity across all manufactured items. This reliability is crucial for maintaining high standards in product quality and reducing waste.

Pin Vise Useful for Complex Projects

Pin vise machinable jaws are also invaluable when tackling complex or unusual projects. Their ability to be customized means you can modify them to hold odd-shaped or delicate parts securely. This adaptability opens up opportunities for your business to take on challenging and intricate work that might be too difficult to handle with standard jaws. Expanding your service offerings can attract new clients looking for high-level custom machining work.

Cost-Effectiveness Over Time

Investing in high-quality pin vise machinables jaws might seem like a significant upfront cost but it pays off in the long term. These jaws are durable and designed to withstand the rigors of continuous use without degradation. This durability reduces the need for frequent replacements decreasing long-term operational costs. Also by minimizing errors and reducing waste these jaws help save money on materials and rework enhancing your shop’s profitability.

Conclusion: A Smart Addition to Any CNC Workshop

To sum up, pin vise machinable jaws from 5th Axis represent a smart addition to any CNC workshop focused on precision efficiency and versatility. They are not just tools but vital investments that can significantly impact your production quality and capacity. Whether you are looking to enhance your productivity, reduce errors or expand your project capabilities these machinable jaws provide the solutions you need.

Ready to transform your CNC operations? Consider incorporating the Machinables Jaws Pin Vise-PMV3XS and explore the entire range of pin vise machinables jaws from 5th Axis. Step into a world of enhanced machining and see how the right tools can make all the difference in your work.

APPS & SOFTWARE

Top 5 WooCommerce Review Plugins in 2024

The digitally-driven e-commerce industry is competitive. There can be several e-commerce stores in the same business as you are. Therefore, it has now become indispensable to build trust and credibility with your customers.

This is where customer reviews come into the picture. It is one of the most effective ways to attain trust. You require to encourage your customers to share reviews. And you also need to showcase them on your product pages.

WooCommerce is a popular e-commerce plugin for WordPress. You can find a variety of powerful Review Reminder for WooCommerce plugins to elevate your online store.

Why do Reviews Matter in E-commerce?

Studies highlight that a whopping 88% of consumers trust online reviews. These reviews hold as much value as personal recommendations.

Positive reviews act like social proof. These reviews can convince potential buyers that your products are worth their money.

Influencing Decisions

Reviews can offer significant insight into your products.

Customers often rely on reviews to make their purchase decisions. Through reviews, your customers can understand product quality, performance, and value.

Infact, well-drafted reviews can address common questions and concerns. This offers customers a clear idea of your product.

Magento extensions for e-commerce can also help you integrate reviews within your e-commerce store.

SEO and Visibility

Reviews can positively impact your SEO (Search Engine Optimization). During website ranking, search engines consider user-generated content like reviews.

Rich snippets with star ratings in search engine results can grab your customer’s attention. These can increase click-through rates.

Valuable Insights

Reviews provide valuable customer feedback. You can gain insights into what customers love about your products.

You can even identify areas for improvement. Ultimately, you can use this information wisely to enhance your offerings.

You can also consider readymade Magento extensions for e-commerceto add reviews to your Magento store.

Driving Growth

Positive reviews lead to happy customers. It results in repeat business. Consequently, you can notice increased sales.

Reviews can also attract new customers. Reviews help online visitors to see the positive experiences of others.

How to Choose the Right WooCommerce Review Plugin?

The best WooCommerce review plugin for your store depends on your specific needs and budget.

This is also true if you want to integrate payment plugins such as the Payment Gateway Worldline.

Here are some factors to consider when making your choice:

Features

Consider the functionalities that are most important to you.

These can include:

- photo/video reviews,

- automated reminders through

- Google Customer Reviews integration and

- customization options.

You can also integrate WooCommerce SMS Notifications & OTP Verificationplugin to make the shopping experience holistic for your customers.

Ease of Use

If you are a beginner, opt for a plugin with a user-friendly interface. Ensure that the integration instructions are clear.

Free vs. Premium

Many plugins offer two version. One is a free version with basic features. And another one a premium version with advanced functionalities.

Evaluate your needs. Weigh the cost-benefits before you upgrade.

Ratings and Reviews

Read reviews from other WooCommerce store owners. This will help you get insights into the plugin’s performance.

You can also know it’s ease of use. Additionally, you get an idea about the customer support quality.

Top 5 Review Reminder Plugins For WooCommerce

1. Review Reminder for WooCommerce

The Review Reminder for WooCommerce plugin simplifies the review generation process. It sends automated and polite email reminders to your customers.

These reminders encourage your customers to share their insights on the products they have purchased.

It’s an easy and hassle-free solution to increase your review numbers.

Features

- Automatic Reminders: No need to nag customers yourself! This sends review requests after their order is complete.

- Flexible Scheduling: Change your mind on the timing? No worries. You can adjust it when these reminders are sent.

- Say it Your Way: Personalize the email content. You can match it to your brand voice. This encourages more reviews.

- Easy Manual Reviews: For those who prefer, you can enable customers to leave reviews directly from their order details page.

- Plays Well with Others: Works smoothly with your WooCommerce store and other plugins you might be using.

Along with this plugin, you can also use WooCommerce SMS Notifications & OTP Verification. It can send review reminders via email.

2. Judge.me Product Reviews for WooCommerce

Judge.me focuses on creating a visually appealing review experience. It boasts features like rich snippets, social sharing buttons, and customizable review widgets.

Additionally, Judge.me offers automated email requests for reviews. This feature helps in encouraging customer participation.

Features

- You can create a visually appealing review section

- Send automated review reminder emails

- Share your reviews socially using social sharing functionalities

3. ReviewX

ReviewX is another feature-packed premium plugin. With this plugin, you can get both photo and video reviews.

Features

- You can include both photo/video reviews

- You can integrate your store with Google Customer Reviews

- You can implement gamification to incentivize reviews

4. Site Reviews

You can find both free and premium versions of site reviews.

With the free version you can get basic text reviews and ratings. The premium version offer photo and video reviews.

Features

- Text, photo, and video reviews are available.

- Integrates with Google Seller Ratings.

- Customizable review forms.

5. Customer Reviews

It’s a free plugin by WooCommerce. This plugin presents a user-friendly option for beginners. Your customers can submit text reviews and ratings for your products.

You can even moderate reviews before they are published. It also offers disable option. You can diable certain reviews on specific products if needed.

Features:

- Simple and easy to use

- Integrates seamlessly with WooCommerce

Additional Tips for Encouraging Customer Reviews

Review Reminder for WooCommercecan be a great tool for e-commerce businesses. But you can use these following strategies to encourage your customers to post a review.

Make it Easy to Leave Reviews

Clearly display a “Leave a Review” button on product pages. Consider offering incentives. These can include loyalty points or discounts for leaving reviews.

Respond to Reviews

Actively respond to both good and negative reviews. Thank customers for positive feedback. Address concerns raised in negative reviews professionally.

Showcase Reviews Prominently

Display positive reviews strategically on your website. Strategic positions may include product pages, home pages, and category pages.

Use Reviews in Marketing

Include positive customer reviews in your marketing materials. These can include email campaigns, social media posts, etc.

Wrapping Up

Reviews are an amazing way to build trust and credibility in your store. Along with review reminders you can use WooCommerce SMS Notifications & OTP Verification to offer the best shopping experience to your customers.

HOME IMPROVEMENT12 months ago

HOME IMPROVEMENT12 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

BUSINESS1 year ago

BUSINESS1 year agoExploring the Benefits of Commercial Printing

BUSINESS12 months ago

BUSINESS12 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

HEALTH8 months ago

HEALTH8 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HEALTH7 months ago

HEALTH7 months agoYour Guide to Shedding Pounds in the Digital Age

HOME IMPROVEMENT7 months ago

HOME IMPROVEMENT7 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips

HEALTH11 months ago

HEALTH11 months agoHappy Hippo Kratom Reviews: Read Before You Buy!