FINANCE

CRUUF: Key Financial Insights on Metallica Metals Corp Stock

Introduction to Metallica Metals Corp

Metallica Metals Corp has been stirring curiosity among investors and metal enthusiasts alike. As the demand for precious metals continues to rise, this company stands at the forefront of exploration and innovation. With a name that resonates with music lovers, Metallica is now capturing attention in the financial world.

But what does this mean for potential investors? Understanding how CRUUF factors into their stock performance can shed light on whether it’s wise to jump on board. With recent fluctuations in the market, keeping an eye on key metrics becomes essential when making informed investment decisions. Let’s dive deeper into what makes Metallica Metals Corp a noteworthy contender and explore how CRUUF can help frame your investment strategy effectively.

Recent Performance of Metallica Metals Corp Stock

Metallica Metals Corp has shown intriguing fluctuations in its stock performance recently. Investors have been closely monitoring the company, especially as it navigates a volatile market landscape.

In the past few months, there have been moments of excitement for shareholders. A surge in demand for precious metals has positively influenced Metallica’s trading price. This uptick can be attributed to various factors including increasing industrial applications and global economic trends.

However, not all days were bright. Challenges such as regulatory hurdles and fluctuating commodity prices introduced uncertainty into the mix. These elements made investors wary at times.

Analysts are keeping a keen eye on upcoming earnings reports and market conditions that could impact future performance. As always, staying informed is crucial when considering investment options like Metallica Metals Corp stock.

What is CRUUF?

CRUUF is the stock ticker symbol for Metallica Metals Corp, a company focused on exploring and developing mineral resources in Canada.

Investors often seek insights using symbols like CRUUF to track performance, assess potential returns, and understand market sentiment. This abbreviation makes it easier to follow stock movements across various trading platforms.

Metallica Metals Corp primarily aims at advancing its high-quality projects while maintaining strong environmental standards. The company’s focus includes critical minerals that are essential for technologies such as batteries and renewable energy systems.

By analyzing trends associated with CRUUF, investors gain better clarity on how external factors influence Metallica’s financial health. Understanding this connection helps in making informed decisions when considering investments tied to this promising venture in the mining sector.

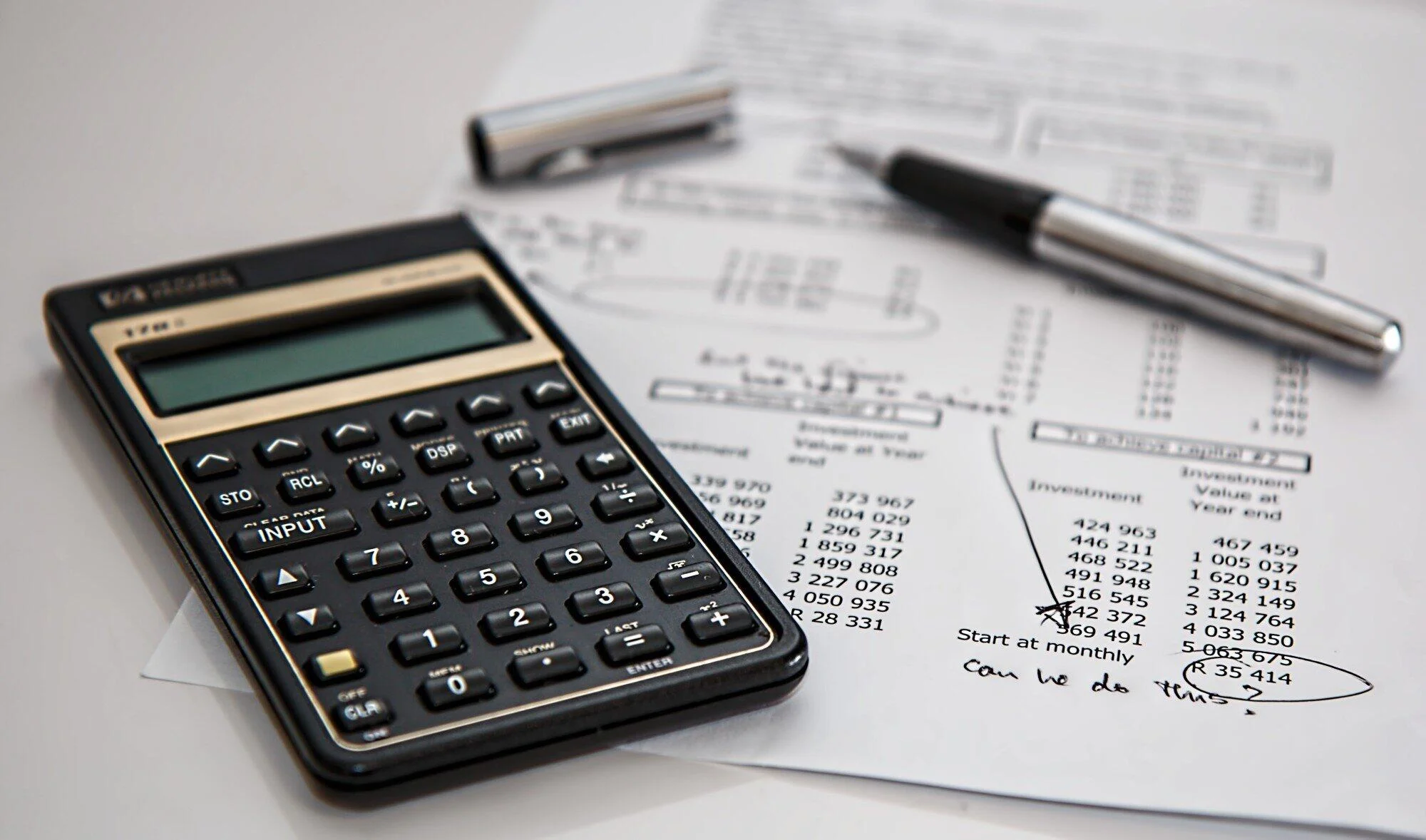

Key Financial Insights on Metallica Metals Corp Stock through CRUUF Analysis

CRUUF analysis provides a comprehensive look at Metallica Metals Corp’s financial health. By examining key metrics, investors can gauge the company’s performance in the competitive metals market.

One vital aspect is revenue growth. Recent reports show an upward trend, indicating increased demand for their products. This growth could signal robust operational efficiency and market positioning.

Another critical factor is cash flow management. Metallica has demonstrated strong cash reserves, allowing it to weather market fluctuations more effectively than competitors. Healthy cash flow often points to a resilient business model.

Investors should also consider debt levels relative to equity. A balanced approach here suggests that Metallica is not over-leveraged, which minimizes financial risk during downturns.

Assessing price-to-earnings ratios against industry averages offers insight into whether CRUUF presents a discounted or overpriced stock opportunity within its sector.

Potential Risks and Benefits of Investing in CRUUF

Investing in CRUUF can be an intriguing opportunity, but it’s important to weigh both risks and benefits. One major benefit is the potential for significant returns. The demand for metals is steadily increasing, driven by advancements in technology and renewable energy.

On the flip side, market volatility poses a risk. Prices can fluctuate based on geopolitical events or changes in global demand. Investors should remain aware of these external factors.

Another consideration is liquidity. While CRUUF may provide access to promising projects, not all investments are easily convertible to cash when needed.

Additionally, regulatory hurdles could impact operations within Metallica Metals Corp. Understanding local regulations is crucial before committing funds.

Diversification remains key in mitigating risk while maximizing potential gains from this investment avenue. Balancing your portfolio with various assets can help shield against unforeseen downturns associated with specific stocks like CRUUF.

Expert Recommendations for Investing in CRUUF and Metallica Metals Corp Stock

When considering an investment in CRUUF, experts emphasize thorough research. Understand the fundamentals of Metallica Metals Corp first. Analyze their recent performance and market trends.

Diversification is key. Don’t put all your funds into one stock, even if CRUUF appears promising. Balance your portfolio with various assets to mitigate risk.

Seek advice from financial advisors who specialize in mining stocks. Their insights can provide clarity about potential pitfalls and opportunities within the sector.

Monitor industry developments closely as well. News affecting metal prices or mining regulations could impact Metallica’s stock significantly.

Patience often pays off in this field. Short-term volatility may tempt you to act quickly but staying informed allows for better long-term strategies when investing in CRUUF.

Conclusion: Is CRUUF a Good Investment Opportunity?

Evaluating the potential of CRUUF as an investment opportunity involves weighing various factors. Metallica Metals Corp has shown promising developments, yet its stock performance can fluctuate based on market conditions and global trends in the metals industry.

Investors should consider both the benefits and risks associated with CRUUF. The key insights from our analysis provide a comprehensive overview of what to expect. With expert recommendations emphasizing a cautious approach, it’s crucial for investors to stay informed about market movements.

Whether CRUUF is a suitable investment depends on individual financial goals and risk tolerance. Those looking for growth within the mining sector may find it merits further exploration. A well-rounded perspective will help in making an informed decision regarding this intriguing opportunity in Metallica Metals Corp stock.

FAQs

What is CRUUF?

CRUUF is the stock ticker symbol for Metallica Metals Corp, a company focused on exploring and developing mineral resources in Canada.

How has CRUUF performed recently?

CRUUF has seen fluctuations, with some positive gains driven by increased demand for precious metals, but it also faces market volatility and regulatory challenges.

What are the key financial metrics to watch in CRUUF?

Key metrics include revenue growth, cash flow management, debt levels, and price-to-earnings ratios, all of which provide insight into the company’s financial health.

What risks should investors consider with CRUUF?

Risks include market volatility, liquidity concerns, and potential regulatory hurdles that could impact Metallica Metals Corp’s operations and stock value.

What do experts recommend for investing in CRUUF?

Experts advise thorough research, diversification of investments, monitoring industry developments, and patience for long-term strategies when considering CRUUF.

FINANCE

Differences in Taxes Around the World

Taxes. That one word can conjure up feelings ranging from frustration to necessity. But have you ever stopped to wonder how taxes differ from country to country? It’s a fascinating peek into how governments raise revenue and shape their economies. Here, we’ll explore the top 10 differences in taxation policies across the globe.

Income Tax Brackets

This is probably the most familiar tax. Most countries tax your income, but the rate you pay depends on how much you earn. Think of it like a staircase: the more you earn, the higher the tax bracket you climb into, and the higher percentage of your income you pay. However, where these brackets fall and the rates within them differ greatly. For instance, some countries might have very few brackets with a flat tax rate for most earners, while others have many brackets with progressively higher rates for the wealthy.

Value Added Tax (VAT)

Imagine a tax added to most things you buy, like clothes or groceries. That’s VAT in a nutshell. While not all countries have it, it’s a common way to raise revenue. The VAT rate varies; some countries keep it low to avoid burdening consumers, while others use it as a significant source of income. It may also be levied against games offered by platforms like www.avalon78.com/en-CA.

Social Security Taxes

These taxes fund social programs like pensions and healthcare. The contribution rates and who pays them (employees, employers, or both) can differ significantly. Some countries have a robust social safety net funded by high social security taxes, while others rely more on private systems with lower contributions.

Property Taxes

Ever get a bill for owning your home or land? That’s property tax. The rate and how it’s calculated can vary. Some countries base it on the property’s value, while others consider factors like location and size.

Corporate Taxes

Businesses pay taxes too! The corporate tax rate is the percentage of a company’s profit that goes to the government. Countries compete to attract businesses by offering lower corporate tax rates, while others prioritise raising revenue with higher rates.

Capital Gains Tax

Sold an investment for a profit? You might owe capital gains tax on the difference between the purchase and sale price. This tax rate and how long you held the investment before selling can affect the amount owed. Some countries exempt certain assets like your primary residence from capital gains tax.

Inheritance Tax

Inheriting money or property from a loved one can be a blessing, but some countries tax that inheritance. The tax rate and who it applies to can vary. Some countries only tax large inheritances, while others might have a lower threshold or exempt certain beneficiaries like spouses or children.

Payroll Taxes

These are taxes deducted directly from your paycheck, often funding social security and unemployment programs. The rate and who pays (employee or employer) can differ. Some countries might have a combined payroll tax, while others separate employer and employee contributions.

Exemptions and Deductions

Tax breaks! Many countries offer ways to reduce your tax bill through exemptions and deductions. This could include things like medical expenses, charitable contributions, or mortgage interest. The types of exemptions and deductions offered, and the limits on how much you can claim, can vary greatly.

Tax Administration

How easy (or difficult!) filing your taxes can depend on the country’s tax administration. Some countries have streamlined online filing systems, while others require more complex paperwork. The level of support and resources offered to taxpayers can also differ.

Tax Residency

Where you live can significantly impact your taxes. Many countries consider you a tax resident if you spend a certain amount of time there each year. This can mean you owe taxes on your worldwide income, not just what you earn in that country. Understanding residency rules is crucial for international travellers. It is also important for those considering a move abroad.

Tax Treaties

Countries often enter into tax treaties to avoid double taxation. It also helps to encourage international trade and investment. These treaties can specify how income is taxed by each country. It might also offer benefits like reduced withholding taxes on dividends . Tax treaties can be complex, but understanding their basic principles can be helpful for individuals and businesses with international connections. Remember, tax laws can be complex, so consulting a tax professional in your country is always recommended for specific advice. But hopefully, this exploration has shed some light on the fascinating and sometimes frustrating! World of taxes around the globe.

FINANCE

The Benefits of Utilizing Expert Tax Services for Managing Your 529 Plan

Navigating the complexities of a 529 Plan can feel overwhelming. Especially when considering tax implications. That’s where expert tax services come into play.

But what makes a tax accountant invaluable in this scenario? They bring clarity to intricate tax laws and regulations. By doing so, they ensure you’re compliant and maximizing your savings.

Their guidance becomes a beacon, illuminating the path to financial efficiency. In managing your 529 Plan, the expertise of a tax accountant is indispensable. They turn a daunting task into a manageable and strategic financial decision.

Understanding the Tax Benefits of a 529 Plan

529 plan is a type of savings plan that allows you to invest funds for future education expenses without incurring federal taxes on earnings or withdrawals. Many states offer additional tax incentives for contributing to a 529 Plan.

These can include deductions or credits on state income taxes. It makes it an even more attractive option for families saving for education expenses. Yet, it’s crucial to understand the specific tax benefits of your state’s plan.

It is where expert tax services come in. They have an in-depth understanding of state-specific tax laws and regulations. They take advantage of all available tax benefits.

The Expertise of Tax Accountants in Maximizing Savings

One of the benefits of utilizing expert tax services for your 529 education savings plans is their ability to maximize your savings. Tax accountants have a deep understanding of tax laws and regulations, including those specific to 529 Plans. They can help you navigate the complex tax implications of your contributions, earnings, and withdrawals from the plan.

This knowledge allows them to identify opportunities for tax savings. It ensures that you are compliant with all tax laws related to 529 education savings plans.

By leveraging their expertise, you can make informed decisions. It optimizes your financial benefits and secures your future educational savings.

Strategic Planning for Your 529 Plan

An expert tax service can help you develop a strategic plan for your 529 Plan. They can analyze your financial situation and determine the most helpful ways to contribute, invest, and withdraw funds from the plan.

Tax accountants can also guide how to coordinate 529 Plan contributions with other education-related tax benefits. These includes the following:

- American Opportunity Tax Credit

- Lifetime Learning Credit

Peace of Mind and Ongoing Support

Managing a 529 Plan can be a time-consuming and complex task. By utilizing expert tax services, you can have peace of mind knowing that your plan is being managed efficiently and effectively.

Tax accountants can also provide ongoing support and guidance as your financial situation changes or as new tax laws are implemented. It allows you to focus on other important aspects of your life while still ensuring that your 529 Plan is being managed in the most beneficial way possible.

Discovering the Benefits of Expert Tax Services

Expert tax services make 529 Plans manageable. They decode complex tax issues, revealing paths to savings. Their insight ensures compliance and optimizes your investment.

Affordable tax service transforms daunting tasks into strategic success. It’s about maximizing benefits while minimizing stress. Choose expert tax services for peace of mind.

They safeguard your educational savings, ensuring future success. Remember, investing in expert advice pays dividends in financial health.

Did you find this article helpful? If so, check out the rest of our site for more informative content.

FINANCE

What Are the Advantages of Choosing an FHA Cash Out Refinance?

In the realm of monetary management, homeowners regularly find themselves in search of avenues to leverage the equity accumulated in their homes. One such resource that is gaining traction, particularly within the colourful housing market of Texas, is the FHA cash-out refinance.

FHA cash out in Texas offers a plethora of advantages for owners trying to use the benefit that their home benefit offers, while enjoying the benefits of Federal Housing Administration (FHA) backing.

The Benefits of Choosing an FHA Cash Out Refinance

Here are the merits of choosing an FHA cash out in Texas refinance..

1. Accessing Home Equity: One of the primary merits of selecting an FHA cash out in Texas is the capability to get entry to the equity collected in your home. Over time, as belongings values increase and mortgage balances decrease, homeowners build equity. With an FHA cash-out refinance, Texans can faucet into this equity by refinancing their present mortgage for a quantity greater than what they currently owe, receiving the distinction in cash. This infusion of finances may be helpful for various functions, which include home improvements, debt consolidation, or financing predominant prices.

2. Flexible Eligibility Criteria: FHA cash-out refinances in Texas offer bendy eligibility standards, making them available to a broader range of owners. Unlike conventional refinancing alternatives, which may additionally have stringent credit score rating and earnings necessities, FHA loans are greater forgiving. Borrowers with much less-than-best credit score or lower income levels can also nonetheless qualify for an FHA cash-out refinance, provided they meet positive criteria. This inclusivity guarantees that more Texans can leverage their home equity to gain their monetary desires.

3. Lower Interest Rates: Another benefit of choosing an FHA cash-out refinance in Texas is the capability for securing decreased quotes. FHA loans commonly come with aggressive interest prices, which could bring about huge financial savings over the lifestyles of the loan as compared to other financing alternatives. By refinancing at a decreased fee, owners can lessen their month-to-month mortgage payments and doubtlessly keep hundreds of greenbacks in interest payments over the years. This economic gain adds to the attraction of selecting an FHA cash-out refinance for Texans seeking to optimize their mortgage terms.

4. Government Backing and Protection: FHA cash-out refinances offer the delivered advantage of presidency backing and protection. As a part of the U.S. Department of Housing and Urban Development (HUD), FHA loans are insured via the federal authorities, mitigating threats for creditors and borrowers alike. This authorities backing provides lenders with extra self belief to offer favorable terms to debtors, together with lower down fee requirements and more lenient qualification requirements. For Texans considering a cash-out refinance, the assurance of FHA backing can instill peace of mind and self belief of their financial decision.

5. Streamlined Application Process: FHA cash out in Texas regularly functions as a streamlined utility process compared to traditional refinancing alternatives. The FHA’s streamlined refinance program permits house owners to refinance their present FHA mortgage without the want for a full credit test, home appraisal, or giant documentation. This simplified manner can expedite the refinance procedure and reduce office work, making it greater convenient for borrowers. For Texans in search of a hassle-free manner to get right of entry to their home equity, the streamlined nature of FHA cash-out refinances can be notably wonderful.

6. Debt Consolidation Benefits: Many owners in Texas face the challenge of managing a couple of debts, starting from credit score cards to student loans. An FHA cash-out refinance provides an opportunity to consolidate excessive-hobby debt right into a single, more conceivable mortgage with a probable decrease in interest price. By the usage of the cash-out funds to pay off super debts, Texans can streamline their budget, reduce their basic debt burden, and doubtlessly keep money on interest payments. This debt consolidation gain can cause improved financial balance and greater peace of thoughts for homeowners within the Lone Star State.

7. Strengthening Financial Foundations: Ultimately, opting for an FHA cash-out refinance in Texas can make contributions to strengthening the financial foundations of homeowners. Whether it is funding domestic renovations to decorate belongings cost, consolidating debt to enhance cash flow, or financing vital lifestyles activities, including education or medical prices, the ability to get right of entry to home equity may be transformative. By leveraging the advantages of FHA cash-out refinancing, Texans have the possibility to obtain their financial goals at the same time as taking part in the safety and benefits of homeownership.

Wrap Up

In conclusion, the merits of selecting an FHA cash out in Texas are manifold. From getting access to home equity and securing lower hobby fees to enjoying bendy eligibility standards and authorities backing, FHA cash-out refinances offer a compelling answer for house owners looking to optimize their financial situation. Whether you’re trying to make domestic improvements, consolidate debt, or pursue other monetary goals, exploring the merits of an FHA cash-out refinance in Texas might be a prudent selection. By unlocking the equity in your own home, you can embark on a route towards greater monetary stability and prosperity inside the dynamic panorama of the Lone Star State.

ENTERTAINMENT4 days ago

ENTERTAINMENT4 days agoExploring the Kristen Archives: A Treasure Trove of Erotica and More

ENTERTAINMENT1 day ago

ENTERTAINMENT1 day agoKiss KH: The Streaming Platform Redefining Digital Engagement and Cultural Currents

TECHNOLOGY4 months ago

TECHNOLOGY4 months agoBlog Arcy Art: Where Architecture Meets Art

LIFESTYLE4 months ago

LIFESTYLE4 months agoThe Disciplinary Wives Club: Spanking for Love, Not Punishment

EDUCATION1 day ago

EDUCATION1 day agoLingrohub Platform: A Complete Student Access Guide

ENTERTAINMENT3 weeks ago

ENTERTAINMENT3 weeks agoMonkeyGG2: Your Personal Gaming Hub

TECHNOLOGY1 day ago

TECHNOLOGY1 day agoCasibom: The Digital Alchemy Reshaping Systems, Society, and Self

BUSINESS1 day ago

BUSINESS1 day agoDiversifying Your Portfolio: The Key to Successful Investing in Portland, Oregon