HEALTH

Expat Medical Insurance Plans in Latvia

Moving to Latvia can be thrilling and rewarding. But, getting the right Latvia expat health coverage is key. Expats in Latvia face special healthcare challenges. They need good medical insurance to get quality care.

Understanding latvia expat medical insurance is essential for a smooth transition. Knowing the legal requirements and the differences between public and private healthcare is crucial. With the right expatriate health insurance options in Latvia, expats can maintain their health and avoid significant medical expenses, making the move to Latvia much easier.

Overview of Expat Medical Insurance

When moving to Latvia, knowing about expat medical insurance is key. It’s made for people living abroad, giving them medical support. This ensures they can get the care they need while away from home.

What is Expat Medical Insurance?

Expat medical insurance covers health needs for those living outside their home country. It includes emergency care, hospital stays, and sometimes dental and vision. It gives peace of mind, knowing medical costs are covered if you get sick or hurt.

Why Do You Need Expat Medical Insurance in Latvia?

The healthcare in Latvia is good but has its own challenges for expats. Services can vary, and language barriers make getting care hard. Without insurance, medical costs can be very high.

So, it’s important to understand your insurance needs to avoid financial risks. Without it, you might face big expenses for medical care. This could make your time in Latvia uncomfortable. So, getting the right insurance is key for a safe and comfortable stay.

Latvia Expat Medical Insurance Coverage Options

Latvia offers many options for expat medical insurance. These plans are designed to fit different health needs and lifestyles. They ensure that expats in Latvia get the healthcare they need.

Inpatient care is a key part of these insurance plans. It covers hospital stays, surgeries, and specialist visits. This is important because Latvia’s healthcare system is strong. It gives peace of mind for serious health issues.

Outpatient care is also crucial. It includes doctor visits, tests, and day surgeries. This helps catch health problems early and keeps you healthy while living abroad.

Emergency services are vital in any good healthcare plan. They help with sudden health problems. From ambulances to emergency rooms, they ensure quick and effective care.

Many plans also cover dental and vision care. Regular dental visits and treatments are key for oral health. Vision care, like eye exams and glasses, is important for overall health. These benefits are great for expats, helping with both routine and urgent care.

For those who travel a lot, coverage outside of Latvia is a big plus. It means you’re protected wherever you go. This gives you peace of mind and ensures you get the care you need, no matter where you are.

In short, Latvia’s expat medical benefits offer a wide range of healthcare protection. By understanding these options, expatriates can find a plan that meets their health needs. This makes living in Latvia safe and enjoyable.

Choosing the Right Expat Medical Insurance for Your Needs

When picking expat insurance in Latvia, it’s key to look at several important factors. This ensures the insurance fits your personal needs. Knowing these points can make choosing the right coverage easier.

Factors to Consider

When choosing expat insurance in Latvia, there are many things to think about. First, check if the insurance covers what you need. It should match your health care needs, whether you need a lot or just a little. Also, think about the cost. It’s important to find affordable insurance without sacrificing quality.

Another important thing is the reputation of the insurance company. Look for companies with good reviews. This shows they are reliable and care about their customers.

Comparing Plans and Providers

It’s important to compare different medical insurance plans carefully. Look at the benefits, costs, and customer service each provider offers. By carefully looking at each plan, you can find one that offers great coverage at a good price.

Also, check if the insurance has a good network of hospitals and clinics. This makes it easier to get the care you need.

Understanding Policy Exclusions and Limitations

Understanding the coverage exclusions and limitations of each plan is crucial. These can affect how much you pay out of pocket and your overall coverage. Read each policy carefully to know what’s not covered. This includes things like pre-existing conditions and certain treatments.

Knowing these exclusions helps you make a smart choice. It prevents unexpected costs that could be a big problem.

By considering these factors and comparing different plans, you can find the best expat medical insurance for your needs in Latvia.

How to Apply for Latvia Expat Medical Insurance Plans

Starting your application for expat insurance in Latvia means first gathering all needed documents. You’ll need to show your ID, proof of where you live, and any past health records. This makes the Latvia health insurance enrollment process easier. Make sure your documents are valid to avoid any delays.

After you have your documents ready, you’ll need to fill out an application form. This form asks for your personal info, health history, and any pre-existing conditions. Being honest is key here because hiding information can cause problems later on. Knowing how the underwriting process works helps you prepare for any questions from the insurer.

The time it takes to get a response can vary from a few days to a couple of weeks. This depends on how complex your health situation is. The insurance company will check your info and might ask for more details or tests. Quick responses to their requests can speed up the process. For a smoother application, consider talking to a healthcare advisor who knows about getting medical insurance in Latvia. They can help make sure you get the right coverage for your needs.

HEALTH

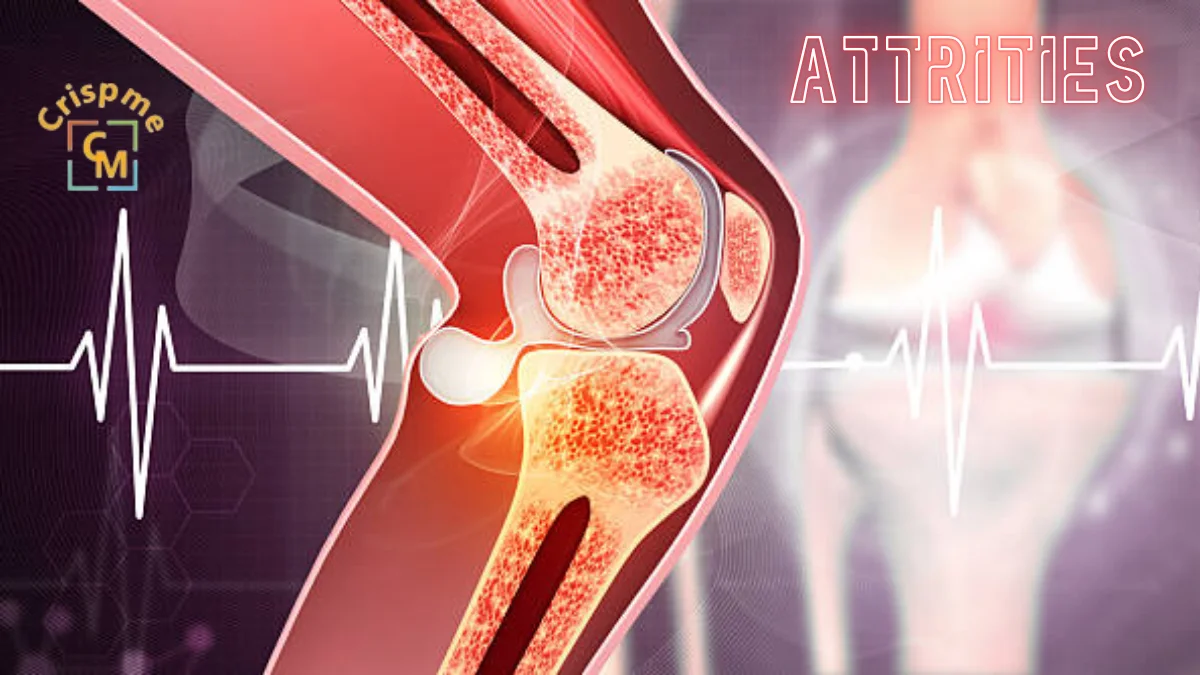

Attrities: Causes, Symptoms, and Ways to Improve Quality of Life

Attrities is a term that often surfaces in conversations about joint pain, but its impact goes far beyond mere discomfort. For millions of people, attrities can encroach on daily activities and affect quality of life. Understanding this condition is vital for anyone navigating its challenges or supporting someone who does.

With various types presenting unique hurdles, it’s crucial to recognize the symptoms early and seek appropriate treatment. From lifestyle changes to exercises tailored for relief, there are numerous ways to manage attrities effectively. This blog post will explore the intricacies of attrities: its causes and symptoms, diagnosis options, effective treatments, and supportive therapies designed to enhance well-being.

Whether you’re newly diagnosed or have been living with attrities for years, understanding your path forward can empower you in managing this condition successfully. Let’s delve into what you need to know about living well with arthritis.

Understanding Attrities

Attrities is a complex condition that primarily affects the joints, causing inflammation and pain. It can occur in various forms, each with its own characteristics and triggers.

At its core, attrities results from the immune system mistakenly attacking healthy joint tissues or wear and tear over time. This leads to swelling, stiffness, and often significant discomfort.

The prevalence of attrities is staggering; it affects people of all ages, genders, and backgrounds. Understanding this condition begins with recognizing that it’s not just an “older person’s disease.”

Genetics, lifestyle factors like diet and exercise habits, as well as environmental influences can all contribute to developing attrities. Knowing these details helps demystify the challenges faced by those living with this chronic illness.

Types of Attrities and their Causes

Attrities is not just one condition; it encompasses over 100 types. Every form presents distinct causes and features.

Osteoattrities, the most common form, often results from wear and tear on joints over time. Aging plays a significant role here. Joint injuries can also lead to this degenerative condition.

Rheumatoid attrities is an autoimmune condition in which the immune system wrongly targets the joints. Genetics and environmental factors contribute to its onset.

Psoriatic attrities occurs in some individuals with psoriasis, linking skin issues with joint inflammation. The exact cause remains elusive but may involve genetic predisposition.

Gout arises from excess uric acid in the bloodstream, leading to sudden, severe pain usually in the big toe. Dietary choices can influence these levels significantly.

Understanding these different types helps tailor appropriate treatment strategies for those affected by attrities.

Common Symptoms of Attrities

Attrities presents a range of symptoms that can vary from person to person. Joint pain is the most common complaint, often described as a dull ache or sharp sensation during movement.

Swelling around affected joints may also occur. This inflammation can lead to stiffness, making it difficult for individuals to perform everyday tasks.

Another notable symptom is fatigue. Many people with attrities experience tiredness that seems unrelated to their activity level. This overall exhaustion can impact daily life significantly.

Additionally, some might notice changes in joint appearance. Deformities or nodules may develop over time, signaling progression of the condition.

Reduced flexibility is a frequent issue associated with attrities. People often find they cannot bend or stretch their joints fully without discomfort, limiting mobility and independence in activities.

Diagnosis and Treatment Options

Diagnosing attrities involves a thorough examination of your medical history and physical condition. Healthcare providers often perform blood tests and imaging studies, such as X-rays or MRIs, to determine the type and severity of the disease.

Once diagnosed, treatment options vary widely based on the specific type of attrities you have. Nonsteroidal anti-inflammatory drugs (NSAIDs) are commonly prescribed to reduce pain and inflammation. For some patients, corticosteroids may be recommended to suppress immune responses.

Disease-modifying antirheumatic drugs (DMARDs) can help slow disease progression in inflammatory types like rheumatoid attrities. Physical therapy is also beneficial for improving joint function.

In serious cases, surgery may be required to restore or replace affected joints. It’s crucial to work closely with healthcare professionals to tailor treatments that suit individual needs for optimal management of attrities symptoms.

Lifestyle Changes to Improve Quality of Life

Making small lifestyle changes can have a significant impact on your quality of life when dealing with attrities. Start by focusing on nutrition. A balanced diet rich in antioxidants, omega-3 fatty acids, and whole grains can help reduce inflammation.

Staying hydrated is equally important. Water aids joint lubrication and overall bodily functions. Aim to drink enough water daily to keep your body functioning optimally.

Sleep also plays a crucial role in managing attrities symptoms. Establishing a consistent sleep routine enhances rejuvenation and reduces fatigue.

Incorporating stress-reduction techniques like meditation or yoga can improve mental well-being too. These practices not only calm the mind but may also alleviate physical tension caused by stress.

Setting realistic goals for activity levels encourages movement without overwhelming yourself. Gentle activities promote mobility while respecting your body’s limits, empowering you to take control of your journey with attrities.

Exercises for Attrities Relief

Exercise plays a vital role in managing attrities symptoms. It helps to maintain mobility and reduce stiffness. Even gentle movements can make a significant difference.

Low-impact activities are ideal for those dealing with attrities. Swimming and cycling provide excellent cardiovascular benefits without putting pressure on the joints. These exercises keep the body active while minimizing discomfort.

Stretching is essential too. Simple stretches can enhance flexibility and range of motion, making daily tasks easier. Consider incorporating yoga or tai chi into your routine; they promote balance alongside relaxation.

Strength training should not be overlooked either. Building muscle around affected joints provides extra support, which may help alleviate pain over time. Using resistance bands or light weights is an effective way to start safely.

Always consult with a healthcare professional before beginning any new exercise program tailored specifically for your needs and abilities will yield the best results in your journey toward better health.

Alternative Therapies for Managing Attrities Pain

Alternative therapies can offer relief for those managing attrities pain. Many individuals find comfort in practices like acupuncture, which involves inserting thin needles at specific points on the body to promote healing and reduce discomfort.

Herbal remedies are another popular option. Turmeric contains curcumin, a compound known for its anti-inflammatory effects. Incorporating it into your diet may help alleviate symptoms.

Practices that connect mind and body, like yoga and meditation, may also offer benefits. These practices not only improve flexibility but also foster relaxation, helping to combat stress that often exacerbates pain.

Essential oils like peppermint or lavender may provide soothing effects when used in massages or diffusers. The aroma can create a calming environment while potentially easing muscle tension.

Before trying any alternative therapy, consulting with a healthcare professional is wise to ensure safety and compatibility with existing treatments.

Coping with Emotional Effects of Attrities

Living with attrities can take a toll on emotional well-being. Chronic pain and fatigue often lead to feelings of frustration and sadness.

It’s essential to acknowledge these emotions. You’re not alone in what you feel. Many people experience similar challenges, which can help create a sense of connection.

Finding healthy coping mechanisms is crucial. Consider journaling your thoughts or engaging in creative activities like painting or knitting. These outlets can provide relief and distraction from daily discomforts.

Mindfulness practices, such as yoga or meditation, may also be beneficial. They encourage relaxation and foster a positive mindset.

Talking to friends, family, or support groups about your experiences can ease the burden too. Sharing your story creates understanding and allows for mutual support during tough times.

Remember that seeking professional help is always an option if feelings become overwhelming. Mental health matters just as much as physical health when managing attritieseffectively.

Support Systems for Attrities Patients

Support systems play a crucial role in managing attrities. They provide emotional strength and practical assistance when needed most.

Family and friends can be invaluable resources. Their understanding and encouragement help ease feelings of isolation often experienced by those living with chronic pain. Simple gestures, like cooking a meal or offering to run errands, make a significant impact.

Joining support groups is another excellent way to connect with others facing similar challenges. Sharing experiences fosters camaraderie and provides insights into coping strategies that work for different individuals.

Online forums also offer valuable connections without geographical limitations. Patients can seek advice, share stories, and even find motivation through digital communities.

Healthcare professionals should not be overlooked as part of the support system. Regular check-ins with doctors or physical therapists ensure tailored care while addressing concerns about medication or exercise routines effectively.

Conclusion

Attrities is a multifaceted disorder impacting millions of individuals around the globe. It’s not just an old person’s ailment; it can strike at any age and significantly impact daily life. Understanding the various types of arthritis, their causes, and symptoms is crucial for effective management.

Treatment options vary widely from medications to physical therapies. Each individual’s needs are unique, so personalized care plans are essential for improving quality of life. Lifestyle changes like diet modifications and regular exercise play a significant role in managing attrities symptoms.

For those seeking relief beyond traditional methods, alternative therapies such as acupuncture or massage can offer additional support. Emotional well-being should also be a priority; it’s important to acknowledge the psychological toll attrities can take on individuals and their families.

Fostering connections with support groups or communities dedicated to attrities can provide invaluable encouragement and advice through shared experiences. Embracing these strategies will help many navigate the challenges posed by this chronic condition more effectively while enhancing overall well-being.

HEALTH

GyneCube: Silicone Support for Women’s Wellness

Introduction to GyneCube

In a world where women are constantly juggling responsibilities, self-care often takes a backseat. Yet, prioritizing wellness is essential for every woman. Enter GyneCube a revolutionary silicone support designed specifically with women’s health in mind. This innovative product aims to empower women by addressing their unique needs and challenges. Whether you’re seeking relief from discomfort or simply aiming to enhance your overall well-being, GyneCube might just be the game-changer you’ve been waiting for. Let’s explore how this remarkable tool can transform your wellness journey and why it deserves a spot in your daily routine.

The Importance of Women’s Wellness

Women’s wellness is a vital component of overall health. It encompasses physical, mental, and emotional well-being. Recognizing its significance can lead to improved quality of life.

Women face unique health challenges throughout their lives. From hormonal changes to reproductive health issues, these factors demand attention and care. Prioritizing wellness helps women navigate these complexities with grace.

Mental health deserves equal focus. Stressors from work, family, and societal expectations can take a toll on emotional stability. Engaging in self-care routines fosters resilience.

Additionally, the value of having community support is immense. Connecting with others who share similar experiences creates empowerment and enhances personal growth.

Investing in women’s wellness not only benefits the individual but also enriches families and communities as a whole. A healthier woman contributes positively to society’s fabric while inspiring future generations to prioritize their own well-being.

How GyneCube Works

GyneCube operates through a simple yet innovative design. This silicone support device is crafted to adapt seamlessly to the female anatomy.

Once inserted, it provides gentle but effective pressure on key points, promoting circulation and alleviating discomfort. The soft material ensures comfort during use, making it suitable for daily wear.

The ergonomic shape of GyneCube allows women to engage in their usual activities without hindrance. Whether you’re at work or exercising, GyneCube stays securely in place.

Additionally, this device works with your body’s natural rhythms. Its design encourages better hormonal balance by supporting pelvic health and overall wellness.

Many users report a noticeable difference within weeks of regular use. It becomes an integral part of their self-care routine, enhancing both physical and emotional well-being as they embrace life fully.

Benefits of Using GyneCube

GyneCube offers a range of benefits specifically designed for women’s wellness. Its innovative silicone support provides comfort and stability during various activities, whether at work or while exercising.

Many users report reduced discomfort associated with menstruation and pelvic pressure. The soft yet firm design aligns perfectly with the natural contours of the body, making it an ideal choice for daily use.

Additionally, GyneCube promotes better posture, which can lead to improved overall well-being. With its lightweight and portable nature, it easily fits into any lifestyle whether you’re on a yoga mat or running errands.

Women appreciate how discreetly GyneCube integrates into their routines. This ease of use helps foster a proactive approach to health without sacrificing convenience or style.

Embracing GyneCube enriches the journey toward enhanced physical comfort and empowerment in women’s lives.

Real-Life Success Stories from GyneCube Users

Many women have shared their transformative experiences with GyneCube. One user, Sarah, struggled with menstrual discomfort for years. After incorporating GyneCube into her wellness routine, she noticed a significant reduction in pain and bloating.

Another testimonial comes from Emily, who found that regular use of the silicone support helped regulate her cycle. She felt more balanced and energized throughout the month.

There’s also Amanda’s story she fumbled through postpartum recovery until discovering GyneCube. Its gentle support made her feel more comfortable during a challenging time.

These stories highlight not just relief but empowerment. Women are reclaiming their wellness journeys thanks to this innovative product. Each experience reflects how personalized care can lead to remarkable improvements in daily life and overall health.

Comparison to Other Women’s Wellness Products on the Market

When considering women’s wellness products, GyneCube stands out for its innovative design and targeted support. Unlike many traditional solutions that focus solely on symptom relief, GyneCube promotes overall well-being.

Many competitors rely heavily on pills or supplements, which can lead to unwanted side effects. In contrast, GyneCube’s silicone structure offers a natural approach without the complications of chemical ingredients.

Some products claim comprehensive benefits but lack specific functionality. GyneCube is tailored specifically for women’s needs, ensuring it addresses essential aspects of health effectively.

Price points vary widely among competing brands. However, GyneCube remains competitively priced while delivering unique advantages that justify the investment in one’s health.

Consumer reviews often highlight dissatisfaction with generic options lacking personalization; this is where GyneCube excels by providing customized support based on individual requirements. It truly redefines what women should expect from wellness solutions today.

How to Incorporate GyneCube into Your Daily Routine

Incorporating GyneCube into your daily routine is simple and intuitive. Start by placing it in a visible spot, like your bathroom counter or bedside table. This will serve as a gentle reminder to make it part of your day.

Begin each morning with a quick session while you go about your morning rituals. Whether you’re brushing your teeth or preparing breakfast, take a few moments to use GyneCube for its intended purpose.

You can also set specific times during the day when you feel most stressed or uncomfortable. Pairing its use with relaxation techniques, such as deep breathing or meditation, can enhance its benefits significantly.

Consider integrating GyneCube into wind-down routines at night too; this could help ease tension accumulated throughout the day and promote better sleep quality. The key is consistency make it an effortless addition that flows seamlessly with what you already do every day.

Future Developments and Expansion of the GyneCube Brand

GyneCube is on an exciting path towards growth and innovation. The brand’s commitment to enhancing women’s wellness means that new products are always in the pipeline.

Future developments may explore additional silicone-based solutions tailored for specific health needs, addressing various stages of a woman’s life cycle. Research and feedback from users will drive these innovations, ensuring they resonate with real experiences.

Moreover, GyneCube aims to expand its reach globally. By partnering with healthcare professionals and wellness influencers, the brand hopes to spread awareness about its benefits further.

Educational campaigns could also emerge, focusing on empowering women through knowledge about their bodies and holistic health options. This strategy not only promotes the product but fosters a supportive community around women’s wellness.

With such plans in motion, GyneCube is set to become a pivotal player in reshaping how we think about women’s health products.

Conclusion: Empowering Women’s Health with GyneCube

GyneCube is more than just a product; it’s a commitment to improving women’s health and wellness. With its innovative silicone support design, it offers tangible benefits that can enhance daily life. Many users have shared their positive experiences, highlighting how GyneCube has brought relief during challenging times.

The importance of prioritizing women’s wellness cannot be overstated. With the right tools like GyneCube, women are empowered to take charge of their health journey. As this brand continues to grow and evolve, we can expect even more exciting developments aimed at fostering well-being for all women.

By incorporating GyneCube into your routine, you’re not only investing in yourself but also joining a community dedicated to supporting women’s health on every level. Embrace the change and feel the difference that GyneCube can make in your life today.

HEALTH

Jusziaromntixretos: The Future of Cognitive Training

Introduction to Jusziaromntixretos and Cognitive Training

In a world where cognitive abilities dictate success, the quest for improved mental performance has led to innovative solutions. Enter Jusziaromntixretos a groundbreaking approach to cognitive training that is transforming how individuals enhance their brainpower. As we navigate through an age filled with distractions and information overload, harnessing our cognitive potential becomes essential. This revolutionary method promises not only to sharpen focus but also to elevate overall mental agility. Are you ready to explore this exciting frontier in brain training? Let’s dive into what makes Jusziaromntixretos a game-changer in the realm of cognitive enhancement!

The Science Behind Jusziaromntixretos

Jusziaromntixretos is rooted in cutting-edge cognitive neuroscience. Its approach focuses on enhancing brain plasticity, enabling users to adapt and grow their mental capabilities.

The system employs various techniques such as neurofeedback and gamification. These elements work together to create an engaging environment for users, promoting deeper learning experiences.

Research indicates that targeted cognitive training can improve memory, attention, and problem-solving skills. Jusziaromntixretos harnesses this research by offering tailored exercises designed to stimulate specific areas of the brain.

Additionally, advancements in technology allow real-time tracking of progress. This feedback loop helps individuals understand their strengths and weaknesses more clearly than ever before.

By combining scientific principles with innovative design, Jusziaromntixretos paves a new path in cognitive development. It transforms traditional methods into dynamic experiences that captivate the user’s interest while delivering tangible results.

Benefits of Cognitive Training with Jusziaromntixretos

Cognitive training with jusziaromntixretos offers a wide array of advantages. One significant benefit is enhanced memory retention. Users often report improved recall abilities, which can positively impact daily tasks and learning experiences.

Another advantage lies in increased focus and concentration. Engaging with jusziaromntixretos encourages mental agility, helping individuals maintain attention over extended periods.

Moreover, stress reduction is an unexpected perk. The platform incorporates mindfulness techniques that promote relaxation while stimulating cognitive functions. This dual approach fosters a balanced state of mind.

Social interaction also plays a vital role in the benefits provided by jusziaromntixretos. Many users connect through shared challenges and achievements, creating a supportive community focused on growth.

Regular engagement leads to better problem-solving skills. As users tackle various exercises, they develop innovative strategies for overcoming obstacles in both personal and professional spheres.

How to Get Started with Jusziaromntixretos

Getting started with jusziaromntixretos is easy and straightforward.

First, visit the official website to explore available resources and tools tailored for cognitive training. Registration is usually quick; just fill out a simple form.

Once you’re signed up, dive into the introductory materials. These will guide you through various exercises designed to enhance your cognitive abilities.

Next, set aside dedicated time each day for practice. Consistency is key in developing new skills and improving mental agility.

Connect with other users online or on social media platforms. Sharing experiences can provide motivation and insights that enrich your training journey.

Don’t hesitate to track your progress using built-in analytics features offered by jusziaromntixretos. Monitoring improvements can keep you engaged and focused as you advance in your cognitive training efforts.

Success Stories from Users of Jusziaromntixretos

Many users have shared their transformative experiences with jusziaromntixretos. One individual reported a significant boost in memory recall after just a few weeks of use. Tasks that once felt daunting became manageable.

Another user highlighted improvements in focus and concentration. They noted how they could engage better during meetings, leading to enhanced productivity at work.

Parents often express gratitude for the positive changes they’ve observed in their children’s learning abilities. Kids who struggled with attention now show remarkable enthusiasm for schoolwork.

Athletes are also reaping benefits, citing sharper decision-making skills during high-pressure situations. This cognitive edge can make all the difference in competitive environments.

Each story adds to the growing testament of jusziaromntixretos’ impact on daily life and performance across various domains.

Potential Future Developments for Jusziaromntixretos

As the landscape of cognitive training evolves, so does jusziaromntixretos. The future may see enhanced personalization features. Users could benefit from tailored programs that adapt to their specific needs and preferences.

Integrating artificial intelligence might open new avenues for deeper insights into user performance. Predictive analytics could offer suggestions based on individual progress patterns.

Gamification is another exciting frontier. By incorporating game-like elements, learning becomes more engaging and enjoyable, encouraging consistent use among participants.

Moreover, expanding access through mobile applications would allow users to train anytime and anywhere. This adaptability may encourage more people to get involved.

Collaborations with educational institutions or wellness programs might also emerge, bridging cognitive training with broader health initiatives for a holistic approach to mental well-being.

Conclusion

Cognitive training is evolving rapidly, and the introduction of jusziaromntixretos marks a significant milestone in this journey. As more people become aware of its potential, it’s clear that integrating this innovative approach into daily routines can lead to profound benefits. From enhancing memory to boosting cognitive agility, the possibilities are expansive.

As we look ahead, the future seems bright for jusziaromntixretos and those who embrace its power. With ongoing research and development, new features and applications will surely emerge. For anyone interested in maximizing their mental capacity or simply looking for a way to stay sharp as they age, exploring jusziaromntixretos could be a game-changer.

Getting started is easy; all it takes is curiosity and a willingness to engage with your mind on a deeper level. The success stories pouring in from users highlight just how transformative this experience can be. By joining the community around jusziaromntixretos today, you take an exciting step toward unlocking your brain’s full potential.

The path forward is filled with promise both for individuals seeking improvement and researchers excited about what comes next. The world of cognitive training continues to expand, inviting everyone along for the ride into uncharted territories of human capability.

HOME IMPROVEMENT11 months ago

HOME IMPROVEMENT11 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

BUSINESS11 months ago

BUSINESS11 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

BUSINESS12 months ago

BUSINESS12 months agoExploring the Benefits of Commercial Printing

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HEALTH7 months ago

HEALTH7 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

HEALTH7 months ago

HEALTH7 months agoYour Guide to Shedding Pounds in the Digital Age

HOME IMPROVEMENT7 months ago

HOME IMPROVEMENT7 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips

HEALTH10 months ago

HEALTH10 months agoHappy Hippo Kratom Reviews: Read Before You Buy!