FINANCE

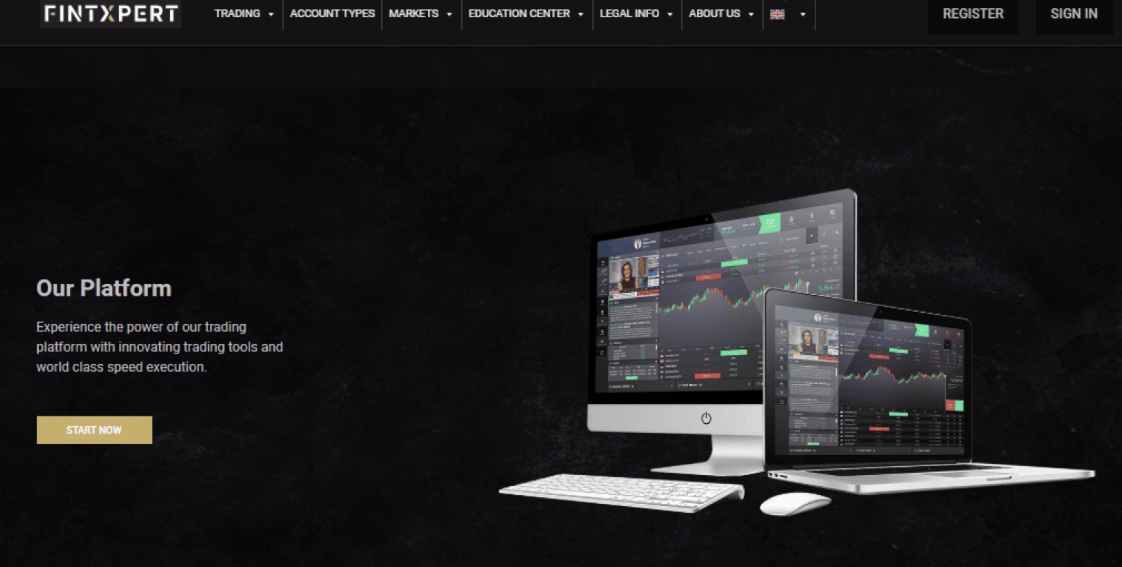

Fintxpert.com Review – Smarter Trading in Portugal and Spain

In this Fintxpert.com review, we explore a comprehensive online trading platform that is revolutionizing how investors in Portugal and Spain approach financial markets.

With its user-friendly interface, diverse investment instruments, and a range of account types to suit varying needs, Fintxpert.com is carving out a reputation as a trusted and innovative trading solution.

Whether you’re a novice trader or an experienced investor, this platform offers something for everyone.

Fintxpert.com Review: An Overview of the Platform

Fintxpert.com is an online trading platform designed to provide a seamless experience for traders looking to invest in a wide range of financial instruments.

From Forex and stocks to commodities and indices, Fintxpert.com allows you to access global markets at your fingertips. The platform boasts robust security measures, ensuring that your investments and personal data are protected.

What sets Fintxpert.com apart is its focus on delivering a user-centric experience. The platform is equipped with advanced analytical tools, educational resources, and responsive customer support, making it a popular choice among traders in Portugal and Spain.

Fintxpert.com Review: The Registration Process

Getting started on Fintxpert.com is straightforward, ensuring that even beginners can quickly dive into trading. Here’s a step-by-step guide to registering on the platform:

- Visit the Website: Go to Fintxpert.com and click on the “Sign Up” button.

- Provide Your Information: Fill in your details, including name, email address, and phone number. You’ll also need to create a strong password.

- Verification: Verify your email address and phone number as part of the security measures.

- Select an Account Type: Choose an account type that matches your trading experience and financial goals (more on this below).

- Deposit Funds: Make your initial deposit to start trading. The minimum deposit requirement depends on your chosen account type.

- Begin Trading: Once your account is funded, you can explore the platform and start making investments.

Fintxpert.com Review: Investment Instruments

One of the highlights of Fintxpert.com is its diverse range of investment instruments, catering to traders with varied interests and risk appetites. Here’s a look at what you can trade:

- Forex: Trade major, minor, and exotic currency pairs with competitive spreads.

- Stocks: Invest in shares of global companies, including tech giants, pharmaceutical firms, and financial institutions.

- Commodities: Trade popular commodities such as gold, silver, oil, and agricultural products.

- Indices: Gain exposure to the performance of global indices like the S&P 500, FTSE 100, and NASDAQ.

- Cryptocurrencies: Trade leading digital currencies, including Bitcoin, Ethereum, and Litecoin, with high liquidity.

The platform provides real-time market data, ensuring you make informed decisions. Advanced charting tools and indicators are also available to support your trading strategies.

Fintxpert.com Review: Account Types

Fintxpert.com offers five account types, each tailored to suit different levels of trading expertise and financial objectives. Below is a detailed breakdown of the available accounts:

- Standard Account:

- Minimum deposit: €250

- Ideal for beginners.

- Access to basic trading tools and educational resources.

- Silver Account:

- Minimum deposit: €2,500

- Includes advanced trading tools.

- Offers enhanced market insights and customer support.

- Gold Account:

- Minimum deposit: €10,000

- Designed for intermediate traders.

- Features priority customer support and access to exclusive webinars.

- Platinum Account:

- Minimum deposit: €50,000

- Tailored for experienced traders.

- Provides personalized account management and in-depth market analysis.

- VIP Account:

- Minimum deposit: €100,000

- The premium choice for professional traders.

- Offers the highest level of service, including one-on-one mentoring and priority access to new features.

Each account type includes benefits like secure transactions, multiple deposit options, and withdrawal flexibility. You can upgrade your account as your trading experience grows.

Fintxpert.com Review: Testimonials

User testimonials highlight the strengths of Fintxpert.com and the trust it has built among traders in Portugal and Spain. Here are a few examples:

- Maria L., Lisbon: “I started trading with the Standard Account, and the platform’s intuitive interface helped me gain confidence. Now, I’m using the Silver Account and seeing great returns.”

- Carlos R., Madrid: “Fintxpert.com offers excellent customer service and a wide range of trading tools. The Gold Account is perfect for someone like me who wants to take trading seriously.”

- Ana S., Porto: “The educational resources on Fintxpert.com are a game-changer. I’ve learned so much, and the Platinum Account features have taken my investments to the next level.”

These testimonials underscore the platform’s appeal to traders at various stages of their financial journey.

Fintxpert.com Review: Educational Resources

One of the standout features of Fintxpert.com is its commitment to trader education. The platform offers a rich library of resources, including:

- Tutorials: Step-by-step guides on using the platform and understanding market fundamentals.

- Webinars: Live sessions with trading experts who share insights and strategies.

- E-books: Comprehensive guides covering topics like technical analysis, risk management, and trading psychology.

- Market News: Regular updates on global market trends and economic events.

These resources are designed to empower traders with knowledge, enabling them to make informed decisions.

Fintxpert.com Review: Security and Regulation

Security is a top priority for Fintxpert.com. The platform uses advanced encryption technologies to protect user data and transactions. Additionally, it adheres to strict compliance standards, ensuring transparency and fairness.

While Fintxpert.com is not explicitly regulated by a specific financial authority, its operational practices reflect a commitment to upholding high standards of service and security.

Fintxpert.com Review: Customer Support

Responsive customer support is a hallmark of Fintxpert.com. The platform provides multiple channels for assistance, including:

- Live Chat: Instant help for technical and account-related queries.

- Email Support: Prompt responses to more detailed questions.

- Phone Support: Direct assistance for urgent issues.

Traders with higher-tier accounts, such as Gold and Platinum, enjoy priority customer support, ensuring their needs are addressed swiftly.

Fintxpert.com Review: Advantages of the Platform

Here are some of the key advantages of using Fintxpert.com:

- User-Friendly Interface: The platform is designed to be intuitive, making it accessible to traders of all levels.

- Diverse Investment Options: A wide range of assets allows you to diversify your portfolio.

- Tailored Account Types: Choose an account that fits your trading goals and upgrade as you grow.

- Educational Tools: Comprehensive resources to enhance your trading knowledge.

- Secure Transactions: Advanced security measures protect your investments and data.

- Excellent Support: Reliable customer service ensures a smooth trading experience.

Fintxpert.com Review: Trading Tools and Technology

Fintxpert.com equips traders with advanced trading tools and technology, ensuring they have everything needed to succeed in the fast-paced financial markets. Key features include:

- Advanced Charting: Interactive charts with customizable indicators and overlays for technical analysis.

- Economic Calendar: Stay updated on important market-moving events and data releases.

- Automated Trading: Integration with trading bots and algorithms for hands-free execution of strategies.

- Mobile-Friendly Design: Trade on-the-go using the platform’s responsive web design, compatible with all devices.

These tools enable traders to analyze markets effectively, implement strategies, and execute trades efficiently.

Fintxpert.com Review: Deposits and Withdrawals

Fintxpert.com ensures smooth and secure transactions, making deposits and withdrawals straightforward for its users. Key features of the platform’s transaction system include:

- Multiple Payment Methods: Options include bank transfers, credit/debit cards, and popular e-wallets.

- Fast Processing: Deposits are processed almost instantly, while withdrawals are completed within a few business days, depending on the payment method.

- Transparency: No hidden fees, with clear information on any applicable charges.

- Security: Advanced encryption protects financial transactions, ensuring your funds are secure.

The platform’s focus on providing seamless financial operations enhances the overall trading experience for its users.

Fintxpert.com Review: Key Takeaways

Fintxpert.com stands out as a comprehensive and reliable trading platform for investors in Portugal and Spain. With its diverse investment instruments, tailored account options, and a strong focus on education, it caters to traders of all experience levels.

While there is room for improvement in areas like regulatory transparency, the platform’s many strengths make it a compelling choice for anyone looking to trade smarter.

If you’re ready to explore new trading opportunities, Fintxpert.com might just be the gateway to achieving your financial goals.

BUSINESS

How Do You Send Money to Nigeria Without Losing Out on Exchange Rates?

Sending money internationally can sometimes be challenging, especially when trying to ensure that your funds do not lose their value due to fluctuating exchange rates. This is particularly true when sending money to Nigeria, where the exchange rate can significantly impact how much money arrives in the local currency, Naira (NGN). This article will explore various strategies to help you send money to Nigeria without losing out on exchange rates.

Understanding Exchange Rates

Before sending money, it’s crucial to understand how exchange rates work. Exchange rates determine how much one country’s currency is worth in another country’s currency. They fluctuate due to various factors, including economic stability, inflation, and political events. When you send money to Nigeria, the amount of Naira you get for your dollars, euros, or any other currency depends on the current USD to NGN exchange rate.

Choosing the Right Money Transfer Service

Selecting the right money transfer service is one of the first steps to ensure a good exchange rate. Not all services offer the same rates or fees. Some may offer competitive exchange rates but high fees, while others might have low fees but less favorable exchange rates. It’s important to compare different services to find the best combination of rates and fees for your transfer.

Timing Your Transfer

Exchange rates fluctuate constantly, so the timing of your transfer can make a big difference in the amount of money the recipient receives. Monitor market trends and send money when the exchange rate is favorable. Various online tools and apps can help you monitor real-time exchange rates.

Sending Money in Local Currency

When sending money to Nigeria, choose to send it in the local currency (NGN) rather than in foreign currencies. This way, you avoid double conversion fees — converting your money to another major currency and Naira. Sending directly in NGN can save you money and ensure more arrives at your destination.

Use Fixed Exchange Rate Services

Some money transfer services offer fixed exchange rates. This means that you can lock in an exchange rate for a future transfer, protecting you against unfavorable market shifts. If you anticipate that the exchange rate will worsen shortly, using a service with fixed exchange rates can save you money.

Reducing Transfer Fees

In addition to getting a good exchange rate, minimizing transfer fees is crucial. Some services charge a flat fee, while others take a percentage of the transfer amount. Look for services with low or no fees to ensure more of your money makes it to Nigeria.

Consider Peer-to-Peer Transfer Services

Peer-to-peer (P2P) transfer services can offer more favorable exchange rates and lower fees than traditional banks or transfer services. P2P platforms match people looking to exchange currencies, bypassing traditional banking fees and offering more competitive rates.

Using Cryptocurrency Transfers

Cryptocurrency is becoming a popular way to send money across borders, including to Nigeria. While the cryptocurrency market can be volatile, some services allow you to convert your money to a stablecoin (a cryptocurrency pegged to a stable asset like the USD) and then send it. This method can offer low fees and competitive exchange rates.

With Western Union, “Send money from USD to NGN the way that’s convenient for you: online, with our app, or in person at an agent location.” In conclusion, sending money to Nigeria without losing out on exchange rates requires research and planning. By understanding exchange rates, choosing the right transfer service, timing your transfer wisely, and considering alternative methods like P2P services or cryptocurrency, you can ensure your money reaches its destination without unnecessary loss. Remember to regularly review your approach and stay informed about the latest trends in money transfer services and exchange rates.

BUSINESS

Breaking Barriers: Quick Loans Promoting Inclusivity and Accessibility

In recent years, the financial industry has observed a revolutionary change in the way services are provided, with a specific emphasis on making them more inclusive and accessible. A particularly instrumental factor contributing to this shift is the emergence of quick loans. As their name suggests, these loans enable users to secure funds in a relatively short time span which is essential in urgent situations. They are efficiently breaking barriers, providing a quicker, simpler, and more transparent service to a wider demographic, thereby promoting inclusivity and accessibility.

Breaking Barriers: Making Financial Assistance Accessible

The primary barrier in accessing financial services, especially loans, has historically been the prolonged paperwork and analysis. It often excluded individuals who needed instant financial aid or those without substantial credit history. The process of applying for traditional loans is cumbersome and time-consuming. However, quick loans have pushed the envelope by simplifying this process. Most providers now offer an online application process that only requires basic personal and financial information, allowing almost anyone to apply.

Fostering Inclusivity: Loans for Everyone

Another barrier within traditional lending practices is the high level of scrutiny, which in many cases leads to rejection, leaving a significant number of individuals and small businesses marginalized. By focusing on a wider range of applicant profiles, quick loans have democratized access to capital, fostering inclusivity. They are designed to provide services to a broad spectrum of society, including those with less-than-perfect credit scores, irregular income, or even those who are entirely new to borrowing.

Promoting Transparency

Quick loans providers have driven the agenda for financial transparency. They’ve eliminated hidden fees and clauses, making the entire process transparent. Applicants know exactly what they have to pay back, when, and why, taking the guesswork out of borrowing and repaying loans.

Stimulating Economic Growth

Inclusivity and accessibility in financial services have broader implications as well. By empowering a larger section of society with financial tools, quick loans have the potential to stimulate economic growth. People who were previously excluded from the mainstream financial system now have opportunities to contribute to the economy by starting small businesses, thereby promoting economic development, and reducing poverty.

Conclusion

In conclusion, the emergence of quick loans is a game-changer, redefining the lending landscape. They are successfully breaking barriers and making loans more accessible and inclusive. Though they are not without their challenges, with responsible use, they have a significant role to play in promoting financial health and economic stability in society.

BUSINESS

Navigating Tax Season With the Help of an Outsourced Accounting Firm

Tax season can be a perplexing and harrowing affair. This is especially true for businesses that are attempting to steer through a thicket of numbers and regulations.

It’s a seasonal responsibility that shouldn’t overshadow the year-round operational demands of a company. An optimal approach is to enlist the expertise of an outsourced accounting firm.

Here, we’ll explore the various reasons companies turn to these firms. Let’s look into how they add value by simplifying a chaotic task into a strategic calendar event for business optimization.

Let’s begin!

Multiple Revenue Streams

Outsourced accounting firms have a diverse portfolio of clients. They have experience dealing with various types of businesses and industries.

This expertise allows them to handle a wide range of financial tasks. This can span from bookkeeping and tax preparation to financial analysis and budgeting.

Outsourced accounting firms can offer a higher level of quality and efficiency in their services. They can achieve this by leveraging their knowledge and experience.

Complex Deductions and Regulations

It can be challenging for businesses to keep up and ensure compliance. This comes along with changing tax laws and extensive documentation requirements.

Outsourced accounting firms have a team of professionals. They can help businesses stay updated with the latest tax laws and regulations. This can help by ensuring that their clients are up-to-date and compliant.

They can also help businesses navigate through the complex world of tax deductions. Thus, finding opportunities for savings and maximizing their returns.

International Operations

The complexity of tax laws and regulations only increases for those who have global goals. It can be challenging to keep track of international tax laws and ensure compliance. This can come as along with operations in multiple countries.

Outsourced accounting firms have the knowledge and experience to handle international tax requirements. They can help businesses expand their operations. They can achieve this without getting bogged down by complex financial tasks.

State and Local Taxes

Besides federal taxes, businesses also have to deal with state and local taxes. Tax laws and regulations can vary from state to state. This can make it challenging for businesses operating in multiple locations.

Outsourced accounting firms have a deep understanding of state and local tax requirements. This can help by ensuring that their clients are compliant and taking advantage of all available deductions and credits.

Employee Taxes and Benefits

Managing employee taxes and benefits can be a daunting task for businesses. This is especially expected as they grow and hire more employees. Outsourced accounting firms can handle tasks like:

- payroll processing

- tax withholding

- benefit administration

This can help by freeing up valuable time for business owners to focus on other critical aspects of their company. Moreover, these firms can also offer expert advice on employee benefits and compensation packages.

This can help businesses attract and retain top talent. This can be a valuable resource for businesses looking to remain competitive in their industry.

Quarterly Tax Filings and Payments

To avoid penalties and charges, tax filings and payments must be paid. Yet, this can be a time-consuming task. It can take away valuable resources from running the business.

Outsourced accounting firms can handle all aspects of quarterly tax filings and payments. This can help by ensuring that businesses remain compliant without sacrificing their productivity.

Tax Credits and Incentives

Outsourced accounting firms can assist businesses in identifying and taking advantage of tax credits and incentives. These may include:

- research and development tax credits

- energy efficiency incentives

- economic development programs

Outsourced accounting firms can help businesses reduce their tax burden. They can also help increase their profitability. This can be a valuable service. It’s especially true for small businesses and startups with limited resources.

Tax Planning and Strategy

Outsourced accounting firms can provide valuable tax planning and strategy services for businesses. These firms can offer personalized advice on how to cut taxes and maximize profits. They can do this By analyzing financial data and understanding a company’s goals and objectives.

This strategic approach to taxation can help businesses make informed decisions. Such decisions will have to align with their long-term financial goals.

It also allows them to stay ahead of potential tax implications. It goes the same with making necessary adjustments to their operations.

Changing Tax Laws and Regulations

Tax laws and regulations can change, especially in times of economic uncertainties. Outsourced accounting firms stay updated with these changes. They can tell businesses on the best course of action to cut their tax liabilities.

This proactive approach helps businesses stay compliant and avoid any potential penalties or legal issues. It also allows them to adapt to changing financial landscapes and maintain their financial stability.

This can be a valuable service. It’s especially needed during times of uncertainty and economic downturns.

Financial Reporting and Analysis

Outsourced accounting firms can provide businesses with detailed financial reports and analysis. Both of these can help them make informed decisions about their operations. These reports offer valuable insights into a company’s financial health. Thus, highlighting areas for improvement and growth.

By leveraging these reports, businesses can make strategic decisions. Such decisions can align with their long-term goals and objectives. It also allows them to identify any red flags and make necessary adjustments. It can help ensure their financial stability.

Take note that financial reporting and analysis are not only useful for tax purposes. It is also useful for business optimization. Businesses can also make informed decisions that drive growth and success. They can do this by understanding their financial data.

Audits and Investigations

Outsourced accounting firms can be a valuable resource for businesses. This can be expected in the event of an audit or investigation by tax authorities.

With their expertise and experience, these firms can help companies navigate through the process. They can also ensure that all necessary information is provided accurately.

This can mitigate any potential penalties or legal issues and protect a business’s reputation. It also allows business owners to focus on running their company while leaving the complex financial tasks to the experts.

A tax audit or investigation can be a stressful and time-consuming process. But, with the help of an outsourced accounting firm, businesses can cut its impact on their daily operations.

Entity Structure and Tax Planning

Choosing the right business structure can have significant tax implications for businesses. Outsourced accounting firms can offer expert advice on the best entity structure for a company. This takes into consideration factors such as:

- liability

- taxation

- growth potential

This strategic approach to entity structuring can help businesses cut their taxes and maximize their profits. It also allows them to stay compliant with all legal requirements and avoid any potential issues in the future.

Moreover, outsourced accounting firms can also assist businesses in tax planning. This can help them make strategic decisions that align with their entity structure and long-term goals. This can be a valuable service for businesses looking to optimize their operations and remain stable.

Estimated Tax Payments

Outsourced accounting firms can also handle estimated tax payments for businesses. This helps by ensuring that they stay on top of their tax obligations throughout the year. This can be especially beneficial for businesses with irregular income or those facing financial difficulties.

These firms can also help businesses avoid penalties and interest charges. They can do this while maintaining their cash flow. They can also do this by managing estimated tax payments.

It’s a valuable service that allows business owners to focus on their operations without worrying about tax deadlines.

Tax Disputes and Resolutions

In the event of a tax dispute, outsourced accounting firms can assist businesses in resolving the issue efficiently. With their expertise and knowledge of tax laws and regulations, these firms can help companies present their case. They can also help them find a resolution that minimizes any potential financial impact.

It’s a valuable service that offers peace of mind to business owners. This comes by knowing that they have an expert team on their side in case of any tax disputes. This also allows them to focus on their operations and continue running their business seamlessly.

Tax Compliance and Record-Keeping

Maintaining accurate tax records and staying compliant with all legal requirements is a crucial aspect of running a business. Outsourced accounting firms can help businesses with these tasks. This can help by ensuring that they have all the necessary documentation and information to follow tax laws and regulations.

This can save businesses valuable time and resources. It can also prevent any potential issues that may arise from inadequate record-keeping. Businesses can also avoid any legal and financial consequences. This can be achieved by keeping up with tax compliance.

Outsourced accounting firms can be a valuable resource for businesses of all sizes and industries. This is whether you are looking to experience a tax free weekend in Texas or are facing complex international tax laws.

Consider Hiring an Outsourced Accounting Firm

Tax season can be a stressful and overwhelming time for businesses, but it doesn’t have to be. An outsourced accounting firm can offer a wide range of services that can help simplify the complex world of taxes and finances.

Outsourced firms have the expertise and experience to provide valuable support for businesses. This can span from managing multiple revenue streams to handling compliance with international tax laws.

By leveraging their services, companies can focus on their core operations and achieve their long-term financial goals.

Consider hiring an outsourced accounting firm today and see the difference it can make for your business!

Should you wish to explore more topics, feel free to head to our main blog section. We’ve got more!

TECHNOLOGY4 months ago

TECHNOLOGY4 months agoBlog Arcy Art: Where Architecture Meets Art

ENTERTAINMENT2 weeks ago

ENTERTAINMENT2 weeks agoExploring the Kristen Archives: A Treasure Trove of Erotica and More

LIFESTYLE4 months ago

LIFESTYLE4 months agoThe Disciplinary Wives Club: Spanking for Love, Not Punishment

LIFESTYLE2 weeks ago

LIFESTYLE2 weeks agoWho Is Sandra Orlow?

GENERAL3 days ago

GENERAL3 days ago5 Factors That Affect Tattoo Removal Success

ENTERTAINMENT8 months ago

ENTERTAINMENT8 months agoYuppow: Your Free Source for Movies and TV Shows

ENTERTAINMENT1 week ago

ENTERTAINMENT1 week agoKiss KH: The Streaming Platform Redefining Digital Engagement and Cultural Currents

HOME IMPROVEMENT5 days ago

HOME IMPROVEMENT5 days agoGet Your Grout to Gleam With These Easy-To-Follow Tips