FINANCE

From Zero to Masternode: A Newbie’s Journey

Introduction

Masternodes represent a promising avenue for generating passive income in the cryptocurrency space. These powerful nodes perform essential functions within a blockchain network, offering rewards in return for their services. This guide will walk you through the process of setting up a masternode, from understanding its basic principles to implementing advanced strategies for maximizing returns. To better understand and navigate the complexities of setting up a masternode, it’s beneficial to consult resources like Immediate Halodex, an investment education firm that provides valuable insights and guidance.

Understanding Masternodes

Masternodes are specialized nodes within a blockchain network that perform critical functions beyond those of standard nodes. These include transaction validation, instant transactions, and governance participation. Unlike regular nodes that only keep a copy of the blockchain and relay transactions, masternodes enable advanced features and maintain network integrity. This higher level of responsibility comes with rewards, making them attractive for investors looking for passive income opportunities.

Choosing the Right Cryptocurrency for Your Masternode

When selecting a cryptocurrency for your masternode, consider factors such as collateral requirements, potential returns, and network stability. Popular options include:

- Dash: Requires 1000 DASH as collateral. Known for enabling instant transactions, Dash masternodes earn 45% of block rewards.

- Pivx: A fork of Dash, requiring 10,000 PIVX. Pivx masternodes contribute to network security and governance, earning transaction fees and rewards.

- Zcoin (now Firo): Requires 1000 XZC, focusing on privacy through zero-knowledge proofs. Znodes earn 30% of block rewards.

- Syscoin: Requires 100,000 SYS. Offers rewards and additional bonuses for long-term participation.

Setting Up Your First Masternode

Setting up a masternode involves several technical steps:

- Acquire Collateral: Purchase the necessary amount of cryptocurrency required for the masternode.

- Choose a Server: Opt for a Virtual Private Server (VPS) to ensure 24/7 uptime and a static IP address. A VPS offers an independent operating system installation ideal for hosting a masternode.

- Install Masternode Software: Follow the specific cryptocurrency’s guidelines to download and install the masternode software. Ensure your server meets all technical requirements.

- Synchronize with the Blockchain: Download the full blockchain and keep it synchronized. This is crucial for the masternode to function correctly.

- Configuration: Configure your masternode by editing the necessary configuration files and securing your server.

The Technical Side: Ensuring Smooth Operations

Running a masternode requires ongoing technical maintenance to ensure smooth operations:

- Ensure Uptime: Continuous operation is critical. Utilize monitoring tools and services to alert you of any downtime.

- Regular Updates: Keep your masternode software up to date to protect against vulnerabilities and maintain compatibility with the network.

- Security: Implement strong security measures, including firewalls and regular backups, to protect your node from attacks and data loss.

Earning Potential and Reward Structures

Masternode operators earn rewards through several mechanisms:

- Block Rewards: A portion of the rewards generated from mining blocks is allocated to masternode operators.

- Transaction Fees: Masternodes earn a share of the fees from transactions they validate.

- Additional Services: Some networks offer extra incentives for masternodes performing additional functions, such as governance voting or facilitating instant transactions.

The exact earnings depend on the network’s reward structure, the number of active masternodes, and the overall activity within the blockchain.

Risks and Challenges of Running a Masternode

While masternodes offer attractive returns, they come with inherent risks:

- Market Volatility: The value of the collateral can fluctuate significantly, affecting the overall profitability.

- Security Risks: Masternodes are targets for cyberattacks. Securing your server and regularly updating software is crucial.

- Technical and Operational Risks: Downtime can lead to missed rewards and penalties. Ensure your setup is robust and well-maintained.

Mitigating these risks involves diversifying your investments, securing your operations, and staying informed about the network’s developments.

Beyond the Basics: Advanced Strategies for Maximizing Returns

To further enhance your masternode profitability, consider these advanced strategies:

- Running Multiple Masternodes: Diversify across different cryptocurrencies and networks to spread risk and increase earnings.

- Reinvesting Rewards: Use the rewards earned to set up additional masternodes or invest in other passive income opportunities.

- Leveraging Staking: Combine masternode operations with staking mechanisms where possible to maximize returns.

Conclusion

From understanding the fundamentals to setting up and maintaining a masternode, this guide has provided a comprehensive roadmap for new investors. With careful planning, technical diligence, and strategic diversification, masternodes can offer a rewarding pathway to passive income in the dynamic world of cryptocurrencies. Stay informed, stay secure, and explore the evolving opportunities within the masternode ecosystem.

FINANCE

Unlock Opportunities with JerryClub’s Premium CVV2 Shop

In today’s digital world, access to reliable and secure financial services is essential for individuals and businesses alike. With the increasing complexity of online transactions, users are seeking platforms that offer efficiency, accuracy, and advanced solutions. JerryClub’s Premium CVV2 Shop has emerged as a trusted platform in this space, providing high-quality CVV2 services that cater to modern jerryclub.cc users’ needs. From robust security to user-friendly design, JerryClub offers a comprehensive solution for those looking to optimize their digital operations. This blog explores how JerryClub’s Premium CVV2 Shop unlocks opportunities and why it stands out as a leading platform.

Understanding CVV2 and Its Importance

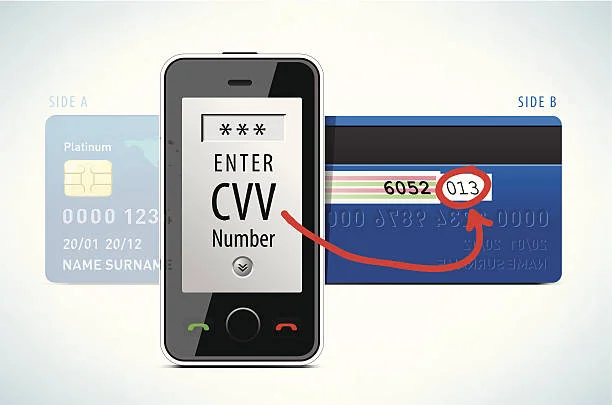

Before diving into the features of JerryClub, it is important to understand what CVV2 services are and why they are crucial in online financial operations.

CVV2, or Card Verification Value 2, is a three- or four-digit code found on credit and debit cards. It is primarily used for verifying online and card-not-present transactions, ensuring that the card is valid and authorized for use. Accurate CVV2 data is critical for secure transactions, minimizing errors, and protecting against unauthorized access.

A reliable platform offering CVV2 services ensures that users can perform online transactions with confidence. JerryClub’s Premium CVV2 Shop specializes in providing verified, secure, and up-to-date CVV2 information, giving users the tools they need for seamless financial operations.

Why JerryClub’s Premium CVV2 Shop Is the Go-To Platform

1. Reliability You Can Count On

Reliability is a key factor when choosing a CVV2 service provider. JerryClub ensures consistent performance, delivering accurate and functional CVV2 solutions that users can depend on.

Unlike other providers that may experience downtime or provide inconsistent data, JerryClub prioritizes operational stability. Users can rely on the platform to handle transactions efficiently, reducing the risk of errors and delays. This dependable performance makes JerryClub a top choice for both individuals and businesses.

2. Advanced Security Measures

Security is a top priority in the CVV2 services sector. JerryClub employs advanced encryption, secure server infrastructure, and continuous monitoring to safeguard user data.

These protocols prevent unauthorized access and protect sensitive information, giving users confidence in the platform’s security. While many competitors provide only basic protection, JerryClub’s proactive approach ensures that every transaction is secure and confidential.

3. User-Friendly Interface

A seamless user experience is essential for efficiency and productivity. JerryClub’s Premium CVV2 Shop features a clean and intuitive interface that makes accessing services simple and convenient.

Whether you are an experienced user or new to CVV2 services, the platform is easy to navigate. Optimized for both desktop and mobile devices, JerryClub allows users to manage their tasks anywhere, anytime. This jerry club accessibility enhances convenience and sets the platform apart from competitors with more complicated systems.

4. High-Quality CVV2 Solutions

Quality is a defining feature of JerryClub’s services. The platform provides accurate, verified, and reliable CVV2 data, ensuring that users can complete transactions without errors.

Some competitors may prioritize quantity over quality, leading to inconsistencies or outdated data. JerryClub, however, maintains strict standards, delivering premium solutions that meet modern users’ expectations. This focus on quality allows users to operate efficiently and with confidence.

5. Regular Data Updates

Inaccurate or outdated data can hinder the effectiveness of CVV2 services. JerryClub addresses this issue by maintaining regularly updated databases to ensure accuracy and relevance.

By providing fresh and verified data, JerryClub enhances transaction success rates and reduces operational errors. Competitors who rely on outdated databases often frustrate users, but JerryClub’s commitment to regular updates ensures consistent reliability.

6. Responsive Customer Support

Reliable customer support is essential for any high-quality platform. JerryClub offers responsive and knowledgeable support to help users navigate the platform and resolve issues promptly.

Whether addressing technical concerns, providing guidance, or answering inquiries, the support team ensures timely and effective solutions. Many other platforms have limited or slow support, but JerryClub’s focus on customer assistance reinforces trust and satisfaction.

7. Competitive Pricing and Value

Affordability is an important consideration for users seeking CVV2 services. JerryClub provides competitive pricing without compromising on quality, security, or reliability.

While some providers offer lower rates at the expense of accuracy or service quality, JerryClub balances cost-effectiveness with premium performance. This combination of value and quality makes it an attractive choice for individuals and businesses seeking dependable CVV2 solutions.

8. Established Reputation and Trust

Trust is a critical factor when selecting a CVV2 platform. JerryClub has built a strong reputation based on consistent service delivery, quality offerings, and satisfied users.

Positive reviews, repeat users, and recommendations highlight the platform’s credibility. Users trust JerryClub because it consistently meets expectations, offering dependable and secure CVV2 services. This reputation gives the platform a clear advantage over competitors.

9. Innovation and Future-Ready Solutions

JerryClub stays ahead of the competition by embracing innovation. The platform continuously integrates modern technologies and methodologies to improve its CVV2 services.

By adopting a forward-thinking approach, JerryClub ensures that users have access to efficient, cutting-edge solutions that adapt to the evolving digital landscape. Competitors relying on outdated methods risk lagging behind, while JerryClub continues to offer modern solutions that meet users’ present and future needs.

How JerryClub Unlocks Opportunities for Users

JerryClub’s Premium CVV2 Shop offers multiple opportunities for users seeking reliable and secure financial solutions:

- Enhanced Efficiency: Streamlined access to verified CVV2 data allows users to perform transactions quickly and accurately.

- Improved Security: Advanced protection measures reduce the risk of data breaches and unauthorized access.

- Business Growth: Reliable services support operational efficiency and client trust, enabling business expansion.

- Convenience: Mobile optimization allows users to manage their services on the go, saving time and increasing productivity.

- Long-Term Reliability: Regular updates, quality services, and responsive support ensure users can depend on the platform for ongoing needs.

These benefits collectively allow users to maximize efficiency, security, and growth potential.

Conclusion

JerryClub’s Premium CVV2 Shop has established itself as a leading platform for users seeking secure, reliable, and high-quality CVV2 services. Its commitment to operational reliability, advanced security, user-friendly design, and innovation ensures a superior experience for all users.

Regularly updated data, competitive pricing, and responsive support make JerryClub an ideal solution for individuals and businesses looking to optimize financial operations. The platform’s strong reputation and commitment to quality further reinforce its status as a trusted and dependable service provider.

For anyone seeking opportunities to improve efficiency, security, and reliability in online financial transactions, JerryClub’s Premium CVV2 Shop provides the tools and solutions needed to succeed. By combining quality services, robust security, and a user-focused approach, JerryClub empowers users to unlock new opportunities and navigate the complexities of digital transactions with confidence.

FINANCE

Why Users Trust StashPatrick for CVV2 and Dumps Services

In the digital age, where online transactions and financial operations are increasingly sophisticated, reliability and security are critical. Users seeking CVV2 and dumps services require a platform that guarantees accuracy, protection, and efficiency. Among the leading providers in this field, StashPatrick has earned widespread trust and loyalty. Its reputation for consistent performance, high-quality services, stashpatrick.gl and robust security measures has made it a preferred choice for individuals and businesses alike. This blog explores why users trust StashPatrick for CVV2 and dumps services and what sets it apart from the competition.

Understanding CVV2 and Dumps Services

To understand why StashPatrick is trusted, it is important to grasp what CVV2 and dumps services entail.

CVV2 (Card Verification Value 2) is a security feature on credit and debit cards that validates transactions, particularly in online and card-not-present scenarios. Reliable CVV2 data ensures transactions are secure and reduces the risk of errors or unauthorized use.

Dumps services refer to detailed card data sets used for authorized transactions. High-quality dumps services provide accurate, up-to-date information that enables users to complete operations efficiently.

StashPatrick specializes in delivering precise, secure, and dependable CVV2 and dumps services, meeting the needs of modern users who prioritize reliability and security.

Key Reasons Users Trust StashPatrick

1. Exceptional Reliability

Reliability is a cornerstone of StashPatrick’s services. Users depend on the platform to deliver accurate and consistent CVV2 and dumps solutions.

Unlike other providers who may experience downtime or data inconsistencies, StashPatrick ensures stable and dependable performance. This consistent reliability allows users to operate efficiently without worrying about service interruptions or errors, which is crucial for maintaining trust and confidence in the platform.

2. Advanced Security Measures

Security is a major concern when handling sensitive financial data. StashPatrick employs advanced encryption, secure servers, and continuous monitoring to protect user information.

These measures prevent unauthorized access and safeguard against potential cyber threats. While some competitors offer only basic security, StashPatrick’s proactive approach ensures that sensitive data is always protected, giving users peace of mind and reinforcing trust in the platform.

3. High-Quality CVV2 and Dumps Data

The accuracy and quality of CVV2 and dumps data are vital for successful operations. StashPatrick maintains strict quality standards, delivering verified and reliable data to its users.

Many providers in this sector compromise quality for quantity, which can lead to errors and operational inefficiencies. StashPatrick’s commitment to high-quality services ensures that users can depend stashpatrick on the data for accurate and effective results, enhancing operational efficiency and reliability.

4. User-Friendly Platform

A seamless user experience is essential for efficiency and convenience. StashPatrick offers a user-friendly interface that allows both new and experienced users to access CVV2 and dumps services with ease.

The platform is optimized for desktop and mobile use, enabling users to operate efficiently across multiple devices. Competitors with complicated or poorly designed interfaces often frustrate users, while StashPatrick’s intuitive design ensures a smooth, stress-free experience.

5. Regular Updates for Accuracy

In the world of CVV2 and dumps services, outdated data can compromise efficiency and success. StashPatrick addresses this issue by providing regularly updated information to ensure accuracy and reliability.

Fresh, validated data minimizes errors and improves transaction success rates. Many competitors rely on static or outdated databases, which can frustrate users. StashPatrick’s commitment to consistent updates ensures that users can rely on the platform for accurate and current data every time.

6. Responsive Customer Support

Even the best platforms require strong customer support. StashPatrick offers responsive and knowledgeable assistance to help users navigate the platform and resolve any issues promptly.

Whether addressing technical challenges, providing guidance, or answering inquiries, the support team ensures users receive timely and effective solutions. This level of support builds trust and enhances user satisfaction, differentiating StashPatrick from competitors who may offer limited or slow assistance.

7. Competitive Pricing and Value

Affordability is an important consideration for users seeking CVV2 and dumps services. StashPatrick balances cost-effectiveness with premium service quality, offering competitive pricing that provides excellent value.

While some platforms may provide lower-cost services, they often compromise accuracy, reliability, or security. StashPatrick ensures that users receive high-quality services at reasonable prices, making it a preferred choice for both individuals and businesses.

8. Established Reputation

A platform’s reputation is key to building trust. StashPatrick has developed a strong reputation for reliability, quality, and security. Positive reviews, repeat users, and word-of-mouth recommendations highlight the platform’s credibility.

Users trust StashPatrick because it consistently delivers on its promises, providing accurate, secure, and efficient CVV2 and dumps services. This established reputation gives StashPatrick a clear advantage over competitors in the market.

9. Commitment to Innovation

StashPatrick continuously evolves to meet the changing needs of its users. By embracing innovation and integrating modern technologies, the platform enhances its CVV2 and dumps services.

This forward-thinking approach ensures that users have access to efficient, modern, and effective solutions that keep pace with industry developments. Competitors relying on outdated methods risk falling behind, while StashPatrick remains a future-ready platform that adapts to users’ evolving requirements.

Benefits for Users

Choosing StashPatrick for CVV2 and dumps services provides users with a range of benefits:

- Efficiency: Access to reliable and accurate data enables smooth and effective operations.

- Security: Advanced protective measures minimize the risk of breaches and unauthorized access.

- Reliability: Consistent performance reduces operational disruptions and ensures dependable results.

- Convenience: Mobile-optimized access allows users to manage services anytime, anywhere.

- Value: Competitive pricing ensures users receive high-quality services without overspending.

- Support: Responsive customer assistance guarantees guidance and solutions when needed.

These benefits collectively reinforce why users place their trust in StashPatrick and continue to choose it over competitors.

Conclusion

StashPatrick has earned the trust of users for CVV2 and dumps services by prioritizing reliability, security, accuracy, and user experience. Its high-quality data, user-friendly platform, responsive support, and regular updates make it a preferred choice for individuals and businesses seeking dependable solutions.

In a competitive market, StashPatrick stands out by consistently delivering secure, accurate, and efficient services. Its strong reputation, commitment to innovation, and focus on customer satisfaction ensure that users can rely on the platform for both immediate needs and long-term operations.

For anyone seeking a trustworthy provider of CVV2 and dumps services, StashPatrick offers the tools, security, and support necessary to operate confidently and efficiently. By combining quality, reliability, and forward-thinking solutions, StashPatrick continues to demonstrate why it is the trusted choice for users worldwide.

FINANCE

Premium CVV2 Solutions Made Easy with JerryClub

In the ever-evolving world of digital services, customers increasingly demand platforms that combine efficiency, security, and ease of use. JerryClub has emerged as a leading provider, offering premium CVV2 solutions jerryclub that prioritize user convenience without compromising on reliability or security. By streamlining processes and providing a user-friendly experience, JerryClub has made accessing advanced digital solutions simpler than ever before.

This article explores how JerryClub delivers premium CVV2 services, highlighting the features and practices that make the platform a trusted and reliable choice for customers seeking top-quality solutions.

A Platform Built for Efficiency

One of the defining characteristics of JerryClub is its focus on efficiency. The platform has been designed to minimize complexity, allowing users to navigate services quickly and access solutions without unnecessary steps or delays.

The interface is clean, intuitive, and organized, ensuring that both new and experienced users can manage tasks effectively. This emphasis on usability saves time and reduces the learning curve, making it easier for customers to take full advantage of the platform’s capabilities.

Efficiency is not only about speed—it is also about providing a smooth and consistent experience. JerryClub ensures that users can rely on the platform to perform consistently, fostering confidence and satisfaction with every interaction.

Reliable Service Delivery

Reliability is a critical factor in any digital service, and JerryClub excels in this area. Users can depend on the platform to function seamlessly, even during periods of high demand. The underlying technical infrastructure is robust, designed to handle multiple tasks simultaneously without interruptions.

Consistency in service delivery builds trust. Customers know that JerryClub will meet expectations every time they use it, which encourages repeat usage and fosters long-term loyalty. A reliable platform is a foundation for premium service, and JerryClub consistently delivers on this front.

Advanced Security Features

Security is paramount in the digital services space, particularly when handling sensitive information. JerryClub has implemented advanced security protocols to ensure that user data is protected at every stage of the process.

From secure authentication methods to encrypted transactions, the platform prioritizes user safety. Continuous monitoring and proactive risk management further enhance protection, providing peace of mind for customers.

By combining security with ease of use, JerryClub ensures that users can focus on leveraging the platform’s services without worrying about potential vulnerabilities. Security is not an afterthought—it is an integral part of the premium experience offered by the platform.

Transparency and Clear Communication

Customers value transparency, and JerryClub delivers this through clear communication and well-defined processes. Users are informed about how services work, what to expect, and any updates or changes to the platform.

This approach reduces uncertainty and increases user confidence. Whether it is through instructional resources, jerryclub.to detailed FAQs, or timely notifications, JerryClub keeps users informed at every step. Transparency creates trust, which is a key component of any premium service offering.

Responsive Customer Support

Even the most user-friendly and secure platforms require support, and JerryClub excels in this area. The customer support team is professional, knowledgeable, and readily available to address inquiries or resolve issues.

Multiple support channels, including live chat, email, and comprehensive documentation, ensure that users can get help in the way that suits them best. Responsive support enhances the overall experience, making it easier for users to navigate the platform confidently and efficiently.

Continuous Updates and Feature Enhancements

In a rapidly changing digital landscape, platforms must evolve to remain relevant. JerryClub demonstrates a commitment to continuous improvement, regularly updating its services to enhance performance, security, and usability.

These updates are informed by user feedback, industry trends, and technological advancements, ensuring that the platform remains current and effective. Continuous improvement is a hallmark of premium services, and JerryClub leverages this principle to maintain high standards and exceed customer expectations.

Flexible Access Across Devices

Modern users expect flexibility in how they access services. JerryClub is optimized for a wide range of devices, including desktops, tablets, and mobile devices, allowing users to interact with the platform wherever they are.

Seamless cross-device access ensures that the experience remains consistent, regardless of how users connect to the platform. Flexibility enhances convenience, contributing to overall satisfaction and making premium CVV2 solutions more accessible than ever.

Personalized Services for User Satisfaction

JerryClub recognizes that every user has unique needs and preferences. The platform offers personalized features that allow users to tailor their experience, including customizable dashboards, adjustable settings, and targeted recommendations.

Personalization improves engagement and creates a sense of value, as users feel that the platform is designed to meet their specific needs. By combining premium solutions with individualized experiences, JerryClub enhances satisfaction and encourages loyalty.

Why JerryClub Stands Out

Several factors distinguish JerryClub from competitors. The combination of reliability, security, transparency, user-friendly design, and responsive support creates a premium experience that users can trust.

Unlike platforms that focus solely on one aspect, JerryClub integrates multiple elements to provide a holistic service. Users know that they can rely on the platform for consistent performance, secure interactions, and efficient service delivery. This comprehensive approach ensures that JerryClub remains a top choice for those seeking premium CVV2 solutions.

Customer Feedback and Engagement

JerryClub values customer feedback and actively integrates it into its development process. By listening to users, the platform can refine existing features, introduce enhancements, and ensure that services align with user expectations.

Engaging with the community fosters a sense of collaboration and trust. Users feel valued when their suggestions are implemented, which strengthens loyalty and reinforces the platform’s reputation as a premium service provider.

Conclusion

JerryClub has successfully positioned itself as a provider of premium CVV2 solutions by combining efficiency, reliability, security, and user-focused design. Its intuitive platform, consistent performance, advanced security measures, and responsive support create a seamless experience that meets the needs of modern users.

Transparency, continuous updates, and personalized services further enhance the user experience, making JerryClub a trusted choice for customers seeking reliable and high-quality solutions. By prioritizing both functionality and user satisfaction, JerryClub demonstrates how premium services can be both accessible and dependable.

For users seeking an efficient, secure, and professional platform for CVV2 solutions, JerryClub stands out as a model of excellence. Its commitment to quality, innovation, and customer satisfaction ensures that users can achieve their goals with confidence and convenience. Premium CVV2 solutions have never been easier to access and navigate, thanks to JerryClub’s dedication to reliability and user experience.

HOME IMPROVEMENT11 months ago

HOME IMPROVEMENT11 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

BUSINESS12 months ago

BUSINESS12 months agoExploring the Benefits of Commercial Printing

BUSINESS12 months ago

BUSINESS12 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

HEALTH8 months ago

HEALTH8 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HEALTH7 months ago

HEALTH7 months agoYour Guide to Shedding Pounds in the Digital Age

HOME IMPROVEMENT7 months ago

HOME IMPROVEMENT7 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips

HEALTH11 months ago

HEALTH11 months agoHappy Hippo Kratom Reviews: Read Before You Buy!