BUSINESS

Outsourcing IT Support vs In-House: Which One is Right for Your Business?

Have you ever wondered if your business should start Outsourcing IT Support or keep it in-house?

Making the right choice can save money and boost your company’s efficiency. Each option has its benefits, but the best fit depends on your business’s needs.

Keep reading to learn more about both paths and find out which one suits your company the best.

Benefits of Outsourcing

Outsourcing IT support involves hiring outside experts to help with your tech needs. This can seem like a big step, but it has many perks.

It can save money, give you access to the latest technology, and free your team to focus on what they do best. Below, we’ll explore these benefits in detail, helping you decide if outsourcing is the right choice for your business.

Cost Efficiency

Outsourcing IT support can be more budget-friendly than having an in-house team. Instead of paying salaries, benefits, and ongoing training for IT staff, your business pays only for the services it needs.

This approach can reduce costs significantly, especially for small or mid-sized companies. Plus, you get the expertise of professionals who are up-to-date with the latest tech trends without the extra expense.

Expertise and Scalability

Outsourcing lets you work with IT pros who know the latest in tech. This means you can handle more work or bigger projects without hiring more people.

It’s great for when your business starts to grow fast. You can quickly get more help from your IT team without the hassle of finding and training new employees. This makes things easier and helps your business keep up with new opportunities.

Pros of In-House

However, having an in-house IT team has its own set of advantages. Keeping things internal means your staff is always on-site, ready to tackle problems right away.

They get to know your business inside out, which can be great for personalized service. Below, we’ll look into the specific benefits of having an in-house IT support team.

Immediate Access

Having an in-house IT team means help is always there when you need it. If something goes wrong, they’re on it in no time because they’re right there in your office.

This can be a big deal for businesses where even a little downtime can mean lost money. Plus, they get what your business is all about, which makes solving problems faster and keeps everything running smoothly.

Control and Security

Having your IT team in-house lets you have more control over your projects and data. You decide how to manage your technology and who gets to see your information. This is key for businesses that handle sensitive data or need strict data security.

Your in-house team knows your systems well, so they can protect them better and react fast if something goes wrong. This way, your business data stays safe and secure.

Evaluating Company Needs

When deciding between outsourcing and in-house IT support, think about what your business needs. Do you want total control or to save money? How fast does your company change and grow? Keep reading as we help you compare the two options based.

Size and Scalability

Your business size plays a big part in deciding if you should have an in-house IT team or outsource. Small to medium businesses might find outsourcing more affordable because it costs less upfront. Bigger companies might need an in-house team to keep everything running smoothly.

Also, think about how fast your business is growing. If your company is quickly getting bigger, you might need to change your IT support often. Outsourcing can make it easier to get more help when you need it, without the hassle of hiring more staff.

Specific IT Requirements

Your company’s unique tech needs also matter a lot. Some businesses need very specific IT skills that are hard to find. If your tech requirements are highly specialized, it may be tough to have all that expertise in-house.

Outsourcing can be a good choice because you can find experts who already know how to handle what you need. That means you don’t have to spend time and money training people; instead, you get someone who can start right away and do the job well.

Making the Decision

Deciding between outsourcing and in-house IT support isn’t easy. It’s like choosing between baking a cake at home or buying one from the store. Both have their sweet spots.

Consider what’s most important for your company – saving money, having control, or needing special skills. Keep these ideas in mind as we help you think through your choice.

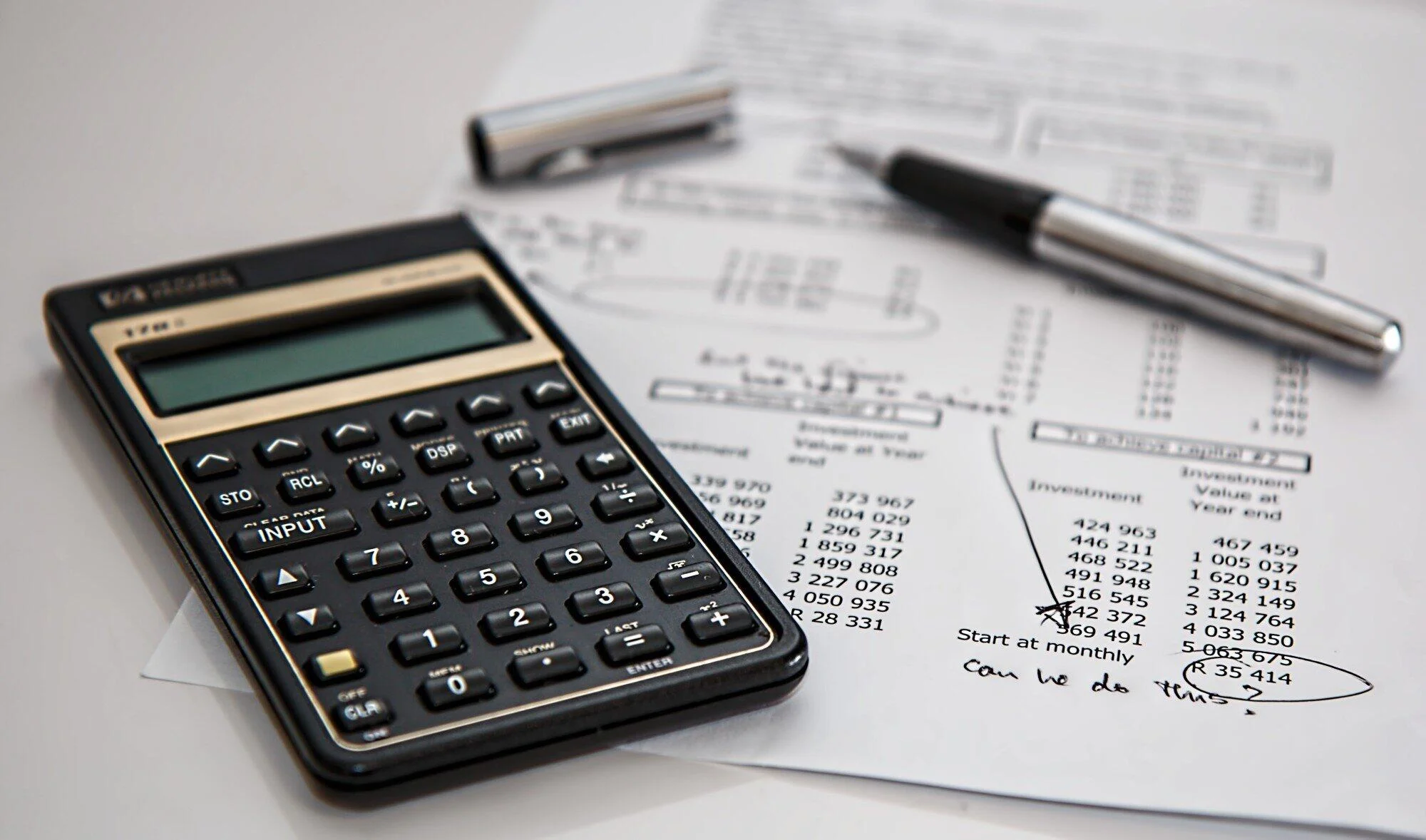

Cost-Benefit Analysis

When choosing between outsourcing IT and keeping it in-house, doing a cost-benefit analysis can greatly help. Think of it like weighing the pros and cons.

Look at how much you would spend in each case and what you get for your money. This includes everything from salaries and training to the cost of new technology. For example, learn about HaaS (Hardware as a Service) to see if it could save you money compared to buying and updating your tech gear.

Remember to also consider the value, like having experts ready when you need them, or the benefits of quick, in-person help from an in-house team. Pick the option that offers the best mix of savings and advantages for your business.

Long-Term Strategic Planning

In your long-term planning, you need to think about where your business is heading. Ask yourself, how will IT needs change as your company grows? If you think you’ll need more IT help in the future, outsourcing might be a smart move now.

It makes it easier to adjust as you grow. But if you believe having a team who knows your business well is important, building an in-house team could be better. This decision affects how well your business can adapt to new challenges and opportunities.

Should You Consider Outsourcing It Support?

In the end, choosing between keeping IT in-house or Outsourcing IT Support isn’t easy. It’s like picking the right tool for a job. Think of your business goals and what you need most.

Do you want more help without hiring more folks? Then, Outsourcing IT Support might be best. This choice can make things better for your company, letting you focus on what you do best.

Are you looking for other helpful content? If so, stay with us and continue reading for more.

BUSINESS

Tips for Choosing the Right Yard Waste Dumpster Rental

When it comes to managing yard waste, having the right dumpster rental can make a world of difference. Whether you’re tackling a landscaping project or simply cleaning up your outdoor space, having a convenient and efficient way to dispose of yard waste is essential.

With numerous options available, it’s important to know what to look for when choosing a yard waste dumpster rental.

Here are some valuable tips to help you make the right decision.

Assess Your Needs

Before you dive into searching for a yard waste dumpster rental, pause for a second to think about what you need. Think about how much yard waste you think you’ll end up with and the size of the stuff you’re tossing out. This will give you a good idea of what size dumpster you should go for. Rental services usually have different sizes to choose from, so knowing your needs will make picking one a breeze.

Research Local Providers

Before selecting a yard waste dumpster rental, it’s crucial to research local providers thoroughly. Explore this dumpster rental service in Delaware for insights on what to consider when choosing a rental company near you. Delve into reviews, compare pricing, and evaluate services provided. Ensuring you secure the most advantageous deal available while upholding quality is paramount.

Consider Sustainability

Going green is not only good for the environment, but it can also save you money on your rental. When searching for a yard waste dumpster rental, consider asking if they have environmental considerations in their waste management process or if they recycle the waste they collect. This will not only reduce your carbon footprint but may also result in lower fees.

Consider Pricing and Terms

When you’re checking out various yard waste dumpster rental choices, make sure to think about the pricing and terms. Look for clear pricing options with no sneaky fees, and ask about any extra charges for delivery, pickup, or going over weight limits.

Also, keep an eye on how long you can rent it and any rules about what kind of yard waste you can toss in. Knowing the ins and outs of the rental deal will help you dodge surprises and make sure your rental goes without a hitch.

Choose the Right Size

Choosing the perfect dumpster size is key for handling yard waste like a pro. If it’s too small, you’ll end up with overflow and extra charges; too big, you’re overspending. Think about how much waste you’ll have and pick a dumpster size that’s just right. Rental services usually have various options, so you can find the one that suits your needs best.

Prioritize Sustainability

When you’re renting a yard waste dumpster, think about going green. Check out dumpster rental services that give eco-friendly disposal choices like composting or recycling yard waste whenever they can. By picking a provider that cares about sustainability, you’re not just getting rid of waste, you’re helping out the planet too.

Making the Right Yard Waste Dumpster Rental Choice

Picking the perfect yard waste dumpster rental is a must for handling outdoor projects and keeping your outdoor area neat. By figuring out what you need, checking out local options, thinking about costs and terms, finding the right size, and focusing on sustainability, you can make sure renting goes smoothly.

Whether you’re sprucing up your yard or doing some landscaping, choosing the best dumpster rental service in your area will help you manage your yard waste well and in an eco-friendly way.

Share this article and other related content with your fellow readers as you continue exploring the articles on this site.

FINANCE

The Benefits of Utilizing Expert Tax Services for Managing Your 529 Plan

Navigating the complexities of a 529 Plan can feel overwhelming. Especially when considering tax implications. That’s where expert tax services come into play.

But what makes a tax accountant invaluable in this scenario? They bring clarity to intricate tax laws and regulations. By doing so, they ensure you’re compliant and maximizing your savings.

Their guidance becomes a beacon, illuminating the path to financial efficiency. In managing your 529 Plan, the expertise of a tax accountant is indispensable. They turn a daunting task into a manageable and strategic financial decision.

Understanding the Tax Benefits of a 529 Plan

529 plan is a type of savings plan that allows you to invest funds for future education expenses without incurring federal taxes on earnings or withdrawals. Many states offer additional tax incentives for contributing to a 529 Plan.

These can include deductions or credits on state income taxes. It makes it an even more attractive option for families saving for education expenses. Yet, it’s crucial to understand the specific tax benefits of your state’s plan.

It is where expert tax services come in. They have an in-depth understanding of state-specific tax laws and regulations. They take advantage of all available tax benefits.

The Expertise of Tax Accountants in Maximizing Savings

One of the benefits of utilizing expert tax services for your 529 education savings plans is their ability to maximize your savings. Tax accountants have a deep understanding of tax laws and regulations, including those specific to 529 Plans. They can help you navigate the complex tax implications of your contributions, earnings, and withdrawals from the plan.

This knowledge allows them to identify opportunities for tax savings. It ensures that you are compliant with all tax laws related to 529 education savings plans.

By leveraging their expertise, you can make informed decisions. It optimizes your financial benefits and secures your future educational savings.

Strategic Planning for Your 529 Plan

An expert tax service can help you develop a strategic plan for your 529 Plan. They can analyze your financial situation and determine the most helpful ways to contribute, invest, and withdraw funds from the plan.

Tax accountants can also guide how to coordinate 529 Plan contributions with other education-related tax benefits. These includes the following:

- American Opportunity Tax Credit

- Lifetime Learning Credit

Peace of Mind and Ongoing Support

Managing a 529 Plan can be a time-consuming and complex task. By utilizing expert tax services, you can have peace of mind knowing that your plan is being managed efficiently and effectively.

Tax accountants can also provide ongoing support and guidance as your financial situation changes or as new tax laws are implemented. It allows you to focus on other important aspects of your life while still ensuring that your 529 Plan is being managed in the most beneficial way possible.

Discovering the Benefits of Expert Tax Services

Expert tax services make 529 Plans manageable. They decode complex tax issues, revealing paths to savings. Their insight ensures compliance and optimizes your investment.

Affordable tax service transforms daunting tasks into strategic success. It’s about maximizing benefits while minimizing stress. Choose expert tax services for peace of mind.

They safeguard your educational savings, ensuring future success. Remember, investing in expert advice pays dividends in financial health.

Did you find this article helpful? If so, check out the rest of our site for more informative content.

REAL ESTATE

The Cost of Inflation in Construction

Since 2022 inflation has been driving up costs for just about everything, from bread to gasoline to construction costs and manufacturing. At just about every level, cost increases from 10 to 200 percent have been realized, sometimes adding three to four layers onto the original cost from the producer before reaching the final end user or customer. Construction in particular has been significantly hammered by inflation in multiple areas, depending on so many different supplies, skills, trades and products to complete a project. That cost increase ultimately has to get passed on to the commercial or industrial customer who may not be so willing to take on such increases if they can be delayed until the market is more reasonable.

How Can it Be Fixed?

The primary tool used by the government involves reducing the amount of currency in the market, thereby driving up the value of the dollar and reducing inflation’s effect. While easy to say, the implementation aspect is hard. It means increasing the cost of borrowing, making new money more expensive to obtain. Other methods involve reducing the number of income earners generating new value as well. That in turn results in job loss. The list goes on with a singular, common feature – pain. Most solutions for inflation tend to cause more loss, which is why inflation is often feared as a double-damage effect on an economy.

What Can Construction Do as a Solution?

One method of fighting inflation in the construction industry involves finding lower-cost substitutes for supplies and services used. However, this is a bit of a limited option; going too low ends up lowering the quality of the goods or services provided. Since the construction company is ultimately liable for the quality of the entire project delivery, there is a practical floor to how low quality can go before a discounted price isn’t worth taking. After all, the old saying of, “You get what you pay for,” really does apply in construction.

A second method involves financing the inflation as a delay tactic. The thinking here is to let someone else’s money take the hit of inflation through borrowing and, when times are better and currency valuation rises, the financing can be paid off with a lower cost. It is, in essence, gambling that the future will provide a better exchange for the borrower than the cost of the borrowing today. In many cases, this kind of financing out of inflation doesn’t work, and the cost of the construction ends up being far more.

A third method involves maximizing local resources, labor and equipment. While some construction companies insist on bringing all of their resources, cost-sensitive operations focus on finding the resources locally wherever the project happens to be. Again, there is a bit of gambling here; if the resources are not available locally, the company will still have to bring them in to complete the job. At short notice, that could drive the cost higher than if the elements were retained to begin with well in advance.

The Most Sensitive Construction Areas Hit

Among the areas hardest hit, raw material suppliers and equipment fleet managers have been seeing the most noticeable ongoing expense impacts. Fuel for vehicles erodes operating budgets mercilessly. Where construction involves a lot of transport, fuel costs are going to remain a challenge.

Most construction requires raw materials for assembly and end product development. As raw materials go up, the cost of the project increases notably. Materials can reach as much as 60 percent of a construction project’s overall expense, so controlling procurement is essential to protect profit margins. Yet again, the quality issue ties the project’s hands from going too cheap on supplies.

Finally, labor will continue to be a pressure during periods where hiring is difficult. Combined with inflation, deficits in skilled labor and trades can easily drive up salary and wage costs on a project, even with outsourcing and contracting versus direct hires.

Inflation Doesn’t Last Forever, Right?

Much of the expectation in the U.S. is that the current inflation levels will be temporary. However, Japan was a good example where long-lasting economic problems hampered multiple industries for a decade or longer. There’s no rule that says inflation can only last one or two years. Instead, monetary policy tends to be the primary response that makes a difference, reducing supply of currency and increasing economic buying power.

ENTERTAINMENT4 days ago

ENTERTAINMENT4 days agoExploring the Kristen Archives: A Treasure Trove of Erotica and More

ENTERTAINMENT1 day ago

ENTERTAINMENT1 day agoKiss KH: The Streaming Platform Redefining Digital Engagement and Cultural Currents

EDUCATION1 day ago

EDUCATION1 day agoLingrohub Platform: A Complete Student Access Guide

LIFESTYLE4 months ago

LIFESTYLE4 months agoThe Disciplinary Wives Club: Spanking for Love, Not Punishment

TECHNOLOGY1 day ago

TECHNOLOGY1 day agoCasibom: The Digital Alchemy Reshaping Systems, Society, and Self

TECHNOLOGY23 hours ago

TECHNOLOGY23 hours agoSecuring Your Online Presence: The Ultimate Guide to Buying an SSL Certificate

TECHNOLOGY4 months ago

TECHNOLOGY4 months agoBlog Arcy Art: Where Architecture Meets Art

LIFESTYLE23 hours ago

LIFESTYLE23 hours agoTips for Prolonging the Lifespan of Truck Roll-Up Door Rollers