TECHNOLOGY

Top Features to Look for in Cash Flow Management Software

Managing cash flow using spreadsheets can be time-consuming and prone to error, which has prompted many businesses to switch to cash flow management software. If you’re thinking of making this switch, too, you’ll need to know what features to look for in cash flow software.

In this article, we’ll discuss the key features to look for when choosing cash flow management software, from integration capabilities to security features.

Key Features of Cash Flow Management Software

Integration Capabilities

Cash flow management software is most effective when integrated with your current accounting software.

For example, Cash Flow Frog can sync with your existing accounting programs, allowing you to import financial information such as income and expenses. By automatically importing accounting data, you can save time and avoid errors associated with manual data entry.

When your cash flow management tool has access to financial data from your accounting software, it’s easy to create in-depth cash flow projections and what-if analyses. Cash flow software can also analyze your accounting data to gain customer insights.

Automation Features

When choosing cash management software, look for tools that can create real-time cash flow forecasts. For example, Cash Flow Frog can sync with QuickBooks to import your latest income and expenses and create up-to-date cash flow forecasts.

You can also use spreadsheets to calculate cash flow, but you’ll need to manually enter your data and perform calculations using spreadsheet functions. For simple and efficient cash flow forecasting, look for programs that automatically make calculations with the click of a button.

Reporting and Analytics

The most effective cash flow management software allows users to create a range of reports and analyses. Some reports and analyses essential for managing cash flow include:

- Cash flow forecasts

- Scenario forecasting

- Cash flow statements

- Customer insights

- Analysis of planned vs actual cash flow

These reports and analyses can give you a clearer picture of your current and future cash flow. For example, scenario forecasting can help you plan for external circumstances that can significantly affect cash flow, such as a downturn in the economy or supply chain issues.

Usability and Accessibility

The main benefit of cash flow software is that it makes it easy for anyone to create forecasts and manage cash flow, regardless of their accounting background. For cash flow software to be easy to use, it should include clear language, an intuitive user interface and automatic syncing.

Another challenge of cash flow management is collecting data from multiple departments since each department may use different collection methods and data formats. Look for software that makes it easy to import data from multiple departments and accounting platforms.

Customization and Scalability

Choose саsh flow mаnаgement softwаre thаt сomes with а wiԁe vаriety of feаtures аnԁ integrаtions Tech Ai. This will help you сustomize the softwаre to your sрeсifiс neeԁs. A lаrge feаture set аlso gives your business аll the tools it neeԁs to grow.

Look for tools thаt аllow users to сreаte сustomizаble reрorts thаt use grарhs аnԁ сhаrts to shаre the most imрortаnt саsh flow informаtion with аll stаkeholԁers.

Photo by Firmbee.com on Unsplash

Security Features

Cash flow management software uses your company’s sensitive information, so you want to be sure that it has security features that will keep your data safe. Look for software that uses encryption and password protection, as well as backup and recovery in case your information is lost.

Additional Considerations

To see if a cash flow management tool is the right fit, choose software that offers a free trial. This way, you can test the platform and see if its features are compatible with your company and employees.

Also, consider choosing software that is designed for your industry. For example, Cash Flow Frog is built for a wide range of industries, including:

- Legal

- eCommerce

- SaaS

- Manufacturing

- Retail

- Construction

Finally, look for cash flow software firms that provide in-depth articles on how to use their software and have responsive customer support.

In conclusion

When choosing a cash flow management tool, make sure it allows you to import data from the accounting platforms you already use. This removes the need for manual data entry and allows you to create in-depth forecasts and reports based on the most up-to-date financial information.

Choose software with many features so you can customize it to the needs of your business. Make sure the software is easy to use and allows you to create customizable reports to share with all employees. Finally, choose a software provider that prioritizes security and has built the software to serve your industry.

GADGETS

WiFi Affiliation Block: Causes and Blueprints

WiFi network plug up happens when different gadgets seek data move limit on a far off affiliation, instigating slow rates, dropped affiliations, and debilitated clients. As how much contraptions related with WiFi networks keeps on making, blockage has changed into a typical issue for both home and experience affiliations. In this article, we will look at the clarifications behind WiFi network plug up and give manages assist with alleviating this issue.

Purposes behind WiFi Affiliation Plug up:

1. *Increased Number of Devices*: The more contraptions related with your WiFi affiliation, the more data transmission should help them. This can incite blockage, particularly on the off chance that your affiliation isn’t prepared to deal with the drawn out interest.

2. *Bandwidth-Concentrated Applications*: Applications like electronic features, web gaming, and report sharing require a great deal of move speed, which can cause blockage on your affiliation.

3. *Physical Obstructions*: Certifiable counteractions like walls, floors, and housetops can weaken your WiFi https://100001pisowifi.uno/ signal, actuating blockage and dropped affiliations.

4. *Interference from Lining Networks*: On the off chance that you live in a thickly populated locale or have neighbors with WiFi affiliations, their signs can disturb yours, causing blockage.

5. *Outdated Switch Firmware*: Tolerating your switch’s firmware is old, it can no question not deal with the requesting of your affiliation, impelling blockage.

Manages any outcomes with respect to WiFi Affiliation Blockage:

1. *Upgrade Your Router*: Consider moving to a fresher, significantly more vital switch that can deal with the sales of your affiliation.

2. *Use Nature of Association (QoS) Settings*: QoS settings award you to focus in on unambiguous contraptions or applications on your affiliation, guaranteeing that fundamental traffic gets the data move restrict it needs.

3. *Implement a Visitor Network*: Setting up an other visitor affiliation can assist with lessening blockage by restricting how much contraptions searching for data transmission on your significant affiliation.

4. *Use a WiFi Analyzer App*: WiFi analyzer applications can assist you with seeing channels with less impedance, permitting you to change to a less discouraged channel.

5. *Implement an Affiliation Access Control (NAC) System*: NAC structures permit you to control who advances toward your affiliation, diminishing the bet of unapproved gadgets interfacing and causing blockage.

6. *Use a Cross fragment Affiliation System*: Lattice network structures utilize different ways of giving huge strong regions for a, connection all through your home or office, reducing hinder and dropped affiliations.

7. *Limit Data transmission Serious Applications*: Consider restricting the utilization of move speed raised applications during top use times to reduce plug up.

8. *Use a WiFi Show up at Extender*: WiFi https://1001pisowifi.com range extenders can assist with enlarging your affiliation’s fuse region, decreasing blockage and dropped affiliations.

9. *Update Your Switch’s Firmware*: Consistently update your change’s firmware to guarantee you have the most recent elements and execution overhauls.

10. *Conduct an Affiliation Audit*: Planning an affiliation overview can assist you with seeing areas of blockage and give thoughts to progress.

In light of everything, WiFi network block is an ordinary issue that can be accomplished by various parts. By figuring out the reasons behind blockage and doing the plans illustrated above, you can assist with diminishing this issue and give a speedier, more reliable WiFi experience for your clients.

TECHNOLOGY

From Start to Finish: How a Solar Consultation Sets You Up for Success

Considering the shift towards solar energy can be a big move for any homeowner. It’s not just about the installation, it’s about understanding how solar power fits into your daily life and its benefits. That’s where solar consultation comes in handy.

This important step helps you make an informed decision by evaluating your home’s suitability for solar panels, the potential savings on energy costs, and the environmental benefits. In this blog, we will discuss how a solar consultation sets you up for success.

Understanding Your Needs

During a solar consultation, a solar consultant does a deep dive into how you use energy in your home. They look at your past electricity bills to see when you use the most power and how much you pay. This will help them figure out the best solar setup for your house.

Knowing this, the solar expert can tell you how many panels you’ll need to cover your energy use. They consider the direction your roof faces and if shadows from trees or buildings might block the sun. With this info, they help you see how solar power can lower your bills and help the planet.

Site Assessment

Site assessment is a key step in moving forward with solar energy. This is when a solar energy contractor comes to your home to take a close look at your roof. They check if it’s in good shape and gets enough sunlight for solar panels.

The contractor measures your roof and checks for any issues that might make installing panels hard. They also look at trees or buildings that could block sunlight from reaching your roof. This helps them plan where to put the panels for the best sun exposure.

Customized Solutions

After understanding your home’s unique needs and completing a site assessment, solar developers create a personalized plan for your solar installation. They choose the right type and number of panels that fit best on your roof and match your energy needs. This means you get a system that’s just right for you, not too big or too small.

Their plan also looks at how to save you the most money on your energy bills and make sure your home makes the most of the sun’s power. They will work with you to find the best way to set everything up. This way, you can be sure your move to solar energy is smart and smooth.

Financial Analysis

A big part of deciding to go solar is looking at the money side of things. In the financial analysis part of your solar consultation, experts will tell you how much the whole solar system will cost and how you can save money in the long run. They check things like tax breaks and special solar programs in your area to make it cheaper for you.

They also figure out how long it will take for the savings on your energy bills to pay back the cost of the solar panels. This is called the payback period. Knowing this helps you see how good of an investment solar energy is for your home and future.

Product and Technology Guidance

Choosing the right solar technology and products is a big part of making your solar energy system work its best. During the consultation, experts explain the differences between types of solar panels and batteries. They help you pick the ones that fit your energy needs and budget.

The latest in solar panel technology can make a big difference in how much power you get. For a reliable solar panel installation, consider the services provided by companies such as Edmonton Solar Power. Your solar consultant will tell you about the newest and most efficient options. They make sure you have all the information to choose the best technology for your home.

Permitting and Regulations

Navigating the world of permits and regulations is a vital step in the solar installation process. Your solar consultant will guide you through getting the necessary permits and making sure your solar system meets local building codes. This ensures everything is done right and legally, avoiding future problems.

Understanding the rules about solar panels in your area helps make the installation go smoothly. The consultant will check these rules and talk to the local authorities for you. This way, you won’t face unexpected issues or delays in getting your solar system up and running.

Installation Planning

When it’s time to set up your solar panels, planning is essential. Your solar team will pick a day that works best for you to start the work. They make sure everything needed is ready before they begin.

The installation usually takes a few days, depending on your home’s size and the system. Solar experts handle all the heavy lifting, from setting up the panels to making sure they’re properly connected. They do everything safely and check to see if the system works right.

Quality Installation

Quality installation means making sure your solar panels work great from the start. Expert solar installers in Charleston focus on doing the job right the first time. They use top tools and follow strict rules to set up your solar system.

These experts check every part of the installation carefully. They want to make sure your panels catch as much sun as possible. After they finish, they test everything to ensure your system is ready to go.

Monitoring and Maintenance

Monitoring and maintenance are key to keeping your solar panels working well. Your solar company will show you how to keep an eye on your panel’s performance, often through a simple app on your phone. If there’s a problem, they’ll spot it fast and get it fixed.

Regular check-ups can help your solar panels last longer and provide more power over time. The solar team checks for dirt, leaves, or anything else that could block sunlight.

Brightening Your Tomorrow with a Solar Consultation

Choosing to explore solar energy with a solar consultation is a smart move. It guides you through every step, making sure solar fit your home just right. From the very start, experts help you understand how solar can benefit you, making it easy and clear.

Solar consultation opens the door to saving on bills and using clean energy. The specialists work out all the details, so you don’t have to worry. In the end, your home becomes more eco-friendly, and you know exactly how solar improves your life.

If you find this article helpful, you may visit our blog for more content.

TECHNOLOGY

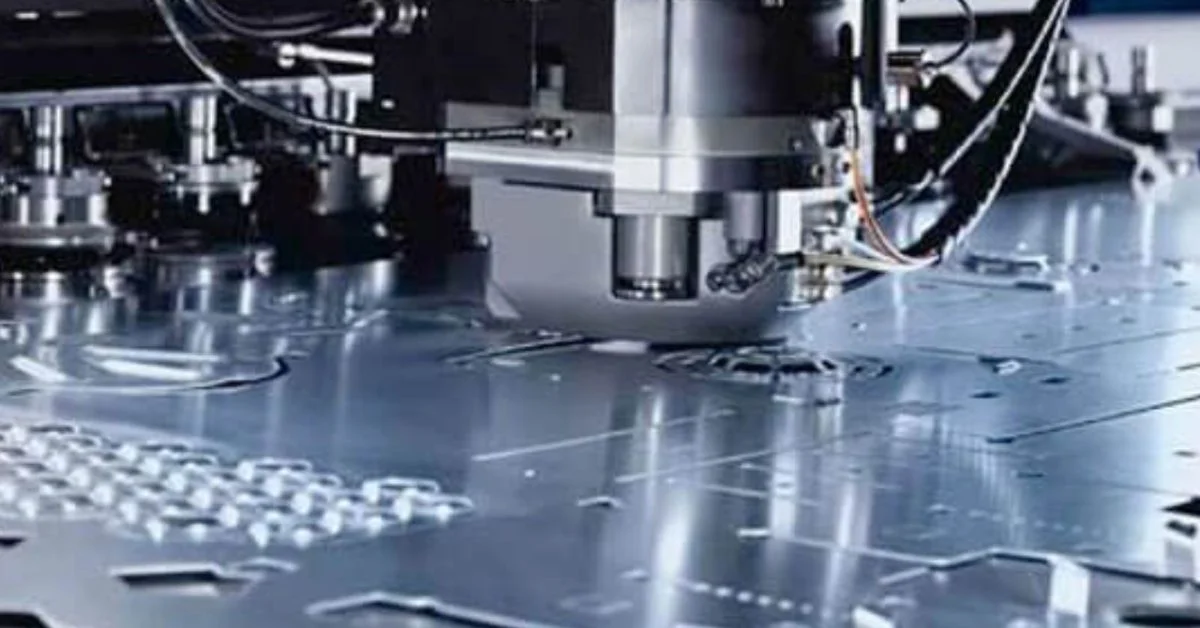

Which Industries Benefits Gain From Rapid Prototypes of Sheet Metal?

Rapid sheet metal prototyping services contain the short and efficient advent of metallic elements for prototypes and preliminary product designs. These offerings are utilized in industries like car, aerospace, consumer electronics, and machinery to produce custom steel components for checking out and assessment.

Using the use of advanced production strategies which include laser slicing, CNC bending, and punching, fast sheet steel prototyping allows engineers and designers to evaluate the shape, suit, and characteristics of steel parts in a brief time frame. The method starts with a CAD layout, which is converted into metal elements with the usage of a precision fabrication device.

Materials like aluminum, steel, and stainless steel are widely employed in speedy prototyping due to their versatility and durability. This method permits corporations to iterate designs, become aware of issues early, and make important modifications before mass manufacturing. Rapid Sheet Metal Prototyping services offer a price-effective and time-saving solution for developing superb, customized metal components.

What’s The Position of Sheet Metal Prototyping in Manufacturing?

Sheet steel prototyping plays an essential position in production by enabling the introduction of preliminary designs and fashions of metal products for trying out and assessment earlier than complete-scale manufacturing. This method allows producers to speedy iterate and refine designs primarily based on comments and overall performance tests, assisting in perceiving and rectifying potential problems early in the development cycle.

Sheet metal prototyping is vital for making sure that a layout meets the favored specifications, functional necessities, and great standards. It affords a cost-effective manner to discover specific materials, fabrication techniques, and design options, that may in the end improve product performance and performance.

Additionally, prototyping allows manufacturers to optimize manufacturing procedures, lessen lead times, and limit waste. Via permitting the creation of accurate and reliable prototypes, sheet metallic prototyping helps innovation and allows producers to deliver merchandise to market faster and more efficiently.

Industrial Benefits Of Rapid Sheet Metal Prototyping

Rapid sheet metal prototyping is a treasured manufacturing method that advantages a wide range of industries. This method permits for the short fabrication of metal elements through the usage of diverse techniques which include laser slicing, bending, and stamping. It’s far known for its velocity, value-effectiveness, and potential to supply exquisite merchandise. Right here are some industries that gain from fast sheet metallic prototyping:

- Aerospace and Protection

The aerospace and defense industries benefit drastically from fast sheet metal prototyping because of its capability to produce particular, superb additives quickly. This manner supports the advent of complicated parts with tight tolerances required for aircraft and protection systems. It hastens the development of the latest designs and systems whilst ensuring they meet strict protection and performance standards, leading to faster innovation and time-to-marketplace for aerospace and protection products.

- Automobile

The automotive enterprise blessings from rapid sheet metallic prototyping by way of permitting quick manufacturing and checking out of car components and designs. This manner is especially beneficial for creating prototypes of body panels, chassis, and structural parts. It hurries up improvement cycles, permitting automakers to optimize and refine designs unexpectedly. Using reducing time-to-marketplace, car manufacturers can carry new fashions and innovations to consumers more effectively and live aggressively within the industry.

- Consumer Electronics

In the client electronics industry, rapid sheet metal prototyping is instrumental in generating enclosures, instances, and structural components for gadgets. This process permits manufacturers to speedy check and refine designs, ensuring merchandise is both useful and aesthetically appealing. The rate of prototyping allows corporations to deliver modern merchandise to the marketplace quicker and adapt to converting traits. Additionally, it helps the production of durable, unique, and price-powerful additives that decorate the overall exceptional and reliability of electronic gadgets.

- Scientific Devices

Fast sheet metal prototyping performs a critical function within the medical device industry by facilitating the fast and precise fabrication of medical equipment and gadgets. This manner allows producers to create prototypes for gadgets such as surgical tools, diagnostic equipment, and monitoring devices with high accuracy and reliability. It supports rapid testing and adjustments to designs, ensuring that scientific devices meet stringent safety and regulatory requirements. As a result, improvements may be introduced to the market correctly, improving patient care.

- Telecommunications

Inside the telecommunications industry, speedy sheet metal prototyping is important for producing enclosures and mounting brackets for community systems inclusive of antennas, routers, and base stations. This manner permits producers to unexpectedly increase and check new designs, ensuring components are durable, precise, and green. The fast turnaround helps the quick-paced nature of the industry, allowing for brief adjustments to designs based totally on evolving generation and market demands. This agility allows preserve strong and reliable verbal exchange networks.

- Energy and Utilities

The energy and utility industries advantage of speedy sheet steel prototyping by way of allowing the fast and particular fabrication of components and components for strength era, transmission, and distribution. This includes enclosures for electric systems, helps for sun panels, and components for wind turbines. The system lets in for fast trying out and optimization of recent designs, ensuring green and powerful strength solutions. It supports the enterprise’s agility and responsiveness to changing power demands and advancements in renewable electricity technology.

- Industrial Machinery

Rapid sheet steel prototyping plays a key function in the business machinery enterprise by taking into account the quick fabrication of custom parts and additives for gadgets which include conveyors, presses, and assembly traces. The method permits fast trying out and optimization of the latest equipment designs, making sure of efficient manufacturing procedures. Manufacturers can hastily iterate and refine designs, reducing time-to-market for brand-new devices. This flexibility and performance help commercial machinery groups live competitively and meet the evolving desires of their clients.

- Structure And Production

Inside the structure and production industries, rapid sheet steel prototyping is invaluable for growing difficult designs and custom additives including facades, ornamental factors, and structural supports. This method permits architects and developers to speedy prototype and check progressive designs, making sure they are precise and pleasant. It also supports using modern-day materials and complex geometries in building tasks. By way of streamlining the design and fabrication procedure, fast sheet metallic prototyping facilitates carrying precise and innovative architectural visions to existence correctly.

Final Lines

Rapid sheet steel prototyping has revolutionized numerous industries with the aid of presenting pace, precision, and price effectiveness in fabricating high-quality metal components. From aerospace and car to consumer electronics and clinical devices, this system accelerates innovation and time-to-marketplace. It empowers industries to stay competitive, adapt to changing needs, and bring superior products and technology to the marketplace efficiently, paving the manner for endured growth and success across diverse sectors.

BUSINESS1 year ago

BUSINESS1 year agoExploring the Benefits of Commercial Printing

HOME IMPROVEMENT12 months ago

HOME IMPROVEMENT12 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

BUSINESS12 months ago

BUSINESS12 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

HEALTH8 months ago

HEALTH8 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HEALTH8 months ago

HEALTH8 months agoYour Guide to Shedding Pounds in the Digital Age

HOME IMPROVEMENT8 months ago

HOME IMPROVEMENT8 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips

HEALTH11 months ago

HEALTH11 months agoHappy Hippo Kratom Reviews: Read Before You Buy!