BUSINESS

VOO vs VFIAX: Analyzing S&P 500 Index Fund Options

Are you looking to invest in the S&P 500 but feeling overwhelmed by the multitude of options available? Well, you’re in luck! In this blog post, we’ll dive into a comparison between two popular S&P 500 index funds: VOO Vs VFIAX. By the end of this read, you’ll have a clear understanding of which fund might be the right fit for your investment goals. Let’s explore the world of index funds together!

Understanding Index Funds and S&P 500

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific market index, like the S&P 500. The S&P 500 is an index that includes the 500 largest publicly traded companies in the US. Investing in an index fund gives you exposure to a diversified portfolio without having to buy individual stocks.

One key advantage of investing in index funds is their typically lower fees compared to actively managed funds. By mirroring the performance of the underlying index, they often offer lower expense ratios and minimal turnover.

S&P 500 index funds like VOO and VFIAX provide investors with broad exposure to large-cap U.

S. companies across various industries. This diversification helps reduce risk because it’s not dependent on one particular company’s success but rather on the overall performance of multiple companies within the index.

Whether you’re new to investing or a seasoned pro, understanding how index funds work can be instrumental in building a well-rounded investment portfolio tailored to your financial goals and risk tolerance.

What is VOO and VFIAX?

Are you looking to invest in S&P 500 index funds but feeling overwhelmed by the options available? Let’s break it down for you. VOO, known as the Vanguard S&P 500 ETF, is an exchange-traded fund that mirrors the performance of the S&P 500 Index. On the other hand, VFIAX is a mutual fund provided by Vanguard that also tracks the same index.

Both VOO and VFIAX offer investors exposure to some of America’s largest companies like Apple, Microsoft, and Amazon. By investing in these funds, you essentially own a small piece of each company within the S&P 500 Index without having to buy individual stocks.

These two investment options have gained popularity due to their low expense ratios and ability to provide broad market exposure with minimal effort on behalf of investors. Choosing between VOO and VFIAX depends on your preferences regarding ETFs versus mutual funds and how you prefer to manage your investments.

Performance Comparison: VOO vs VFIAX

When it comes to comparing the performance of VOO and VFIAX, investors often look at historical returns to gauge how these two S&P 500 index funds have fared over time. Both funds aim to track the performance of the S&P 500 index, providing exposure to some of the largest companies in the U.

S. market.

VOO, offered by Vanguard, has consistently shown strong performance with its low expense ratio and efficient tracking of the index. On the other hand, VFIAX by Fidelity is known for its long-standing history and stability in mirroring the S&P 500’s movements.

Analyzing their past performance can give investors valuable insights into how each fund has navigated through various market conditions and economic cycles. However, it’s essential to remember that past performance does not guarantee future results when making investment decisions.

Understanding key factors beyond just historical returns can help investors make informed choices between VOO and VFIAX based on their individual financial goals and risk tolerance levels.

Fees and Expenses

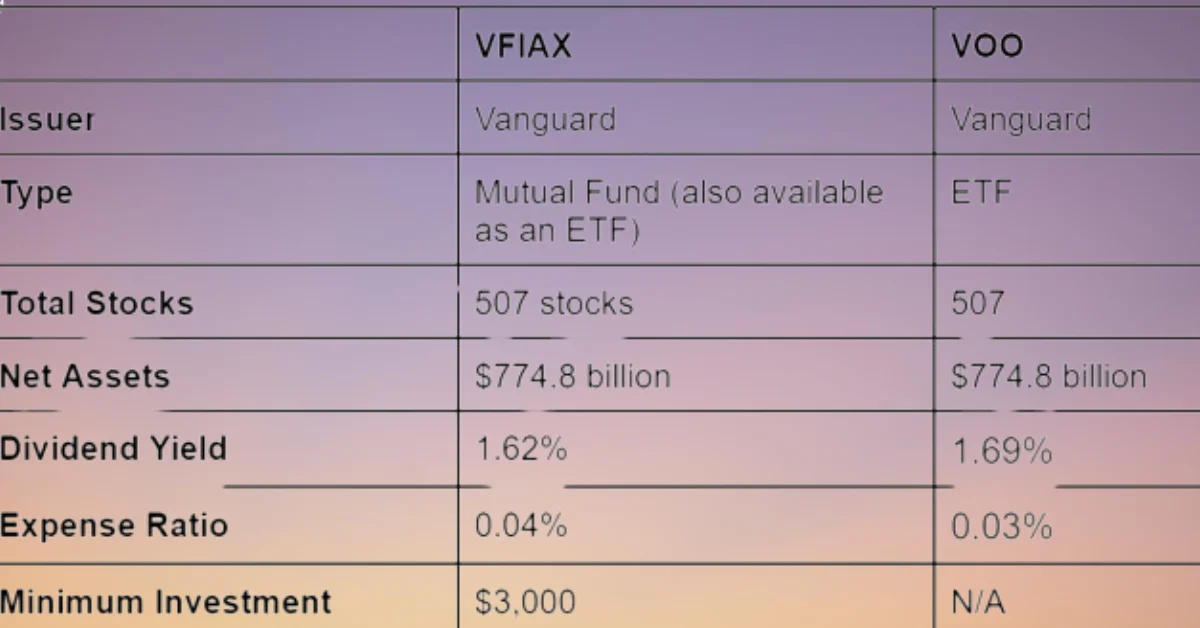

When considering investment options like VOO and VFIAX, it is crucial to take into account the fees and expenses associated with each fund. These costs can have a significant impact on your overall returns in the long run.

Both VOO and VFIAX are known for their low expense ratios, making them cost-effective choices for investors looking to track the performance of the S&P 500 index. However, it’s essential to delve deeper into the fee structure of each fund to understand any potential differences that may exist.

While comparing fees, make sure to look beyond just the expense ratio. Some funds may have additional costs such as transaction fees or sales charges that could eat into your profits over time. By evaluating all expenses involved, you can make a more informed decision about which fund aligns best with your financial goals.

Understanding the fee structure of both VOO and VFIAX will play a crucial role in determining which option suits your investment strategy better.

Factors to Consider When Choosing Between VOO and VFIAX

When deciding between VOO and VFIAX, it’s essential to consider your investment strategy and goals. Evaluate whether you’re looking for long-term growth or stable returns.

Take into account the fees and expenses associated with each index fund. Even small differences can add up over time and impact your overall returns.

Consider the historical performance of both funds. Past performance is not a guarantee of future results, but it can provide valuable insights into how each fund has fared in different market conditions.

Look at the composition of the underlying assets in VOO and VFIAX. Understanding what companies make up these funds can help you assess their risk exposure and diversification.

Think about your risk tolerance and time horizon when choosing between VOO vs VFIAX. Assess how comfortable you are with potential fluctuations in value over time.

Investment Strategy and Goals

When deciding between VOO and VFIAX, it’s essential to consider your investment strategy and goals. Are you looking for long-term growth or more stable returns? Understanding your risk tolerance is crucial in making the right choice.

If you’re aiming for broad market exposure with low expenses, VOO might be the better option. On the other hand, if you prefer investing in a fund with a track record of outperforming its benchmark index like the S&P 500, VFIAX could be more suitable.

Consider whether you want to reinvest dividends automatically or receive them as cash payouts. This decision can impact your overall investment strategy and tax implications.

Don’t forget to reassess your goals periodically and adjust your investments accordingly. Stay informed about market trends and updates that could affect the performance of these index funds in the long run.

Conclusion

After analyzing the key points of VOO vs VFIAX, it’s clear that both index funds offer investors a solid way to gain exposure to the S&P 500.

VOO may appeal to those seeking a lower expense ratio and broader diversification since it includes mid-cap stocks in addition to large-cap ones. On the other hand, VFIAX might be preferred by investors looking for slightly better historical performance and a longer track record.

When choosing between VOO and VFIAX, it’s essential to consider your investment goals, risk tolerance, and fee structure preferences. Both funds have their strengths and can play a valuable role in a well-diversified investment portfolio.

Whichever option you decide on – whether it’s Vanguard’s VOO or Fidelity’s VFIAX – remember that consistency in investing over the long term is key to achieving financial success. Happy investing!

FAQs

Q: What are index funds like VOO and VFIAX?

Ans: Index funds like VOO (ETF) and VFIAX (mutual fund) track the S&P 500, offering diversified exposure to top U.S. companies with low costs.

Q: How do VOO and VFIAX differ in structure?

Ans: VOO is an ETF, traded like stocks with intraday pricing. VFIAX is a mutual fund, offering NAV-based pricing and suitability for long-term investors.

Q: What factors should I consider when choosing between VOO and VFIAX?

Ans: Consider your preference for ETFs vs. mutual funds, trading frequency, and fee structures to align with your investment strategy and goals.

Q: Which has better historical performance, VOO or VFIAX?

Ans: Both funds aim to mirror S&P 500 performance, historically tracking closely. Performance variations can occur due to fee structures and management styles.

Q: What are the fees associated with VOO and VFIAX?

Ans: Both VOO and VFIAX have low expense ratios, but VOO may incur brokerage fees. Compare total costs, including transaction fees, to make an informed choice.

BUSINESS

Miuzo: A Strategic Framework for Clarity in Digital Business

Introduction to Miuzo

In the fast-paced world of digital business, clarity can often feel like a rare commodity. With countless strategies and frameworks vying for attention, it’s easy to become overwhelmed. Enter Miuzo a strategic framework designed specifically to cut through the noise. This innovative approach focuses on four critical components that not only streamline operations but also enhance user experiences and drive innovation.

Imagine having a clear roadmap guiding your decisions while keeping your mission front and center. Miuzo offers exactly that, enabling businesses to thrive in an ever-evolving digital landscape. Whether you’re just starting out or looking to refine existing processes, understanding Miuzo could be the game-changer you’ve been searching for. Get ready to explore how this powerful framework can bring clarity and success to your digital endeavors!

The Importance of Clarity in Digital Business

Clarity is the backbone of any successful digital business. It shapes how you communicate your brand’s vision and values to customers. When clarity is present, it fosters trust and engagement.

A well-defined message cuts through the noise in an oversaturated market. Customers are bombarded with choices daily. Clear communication helps them navigate their options effortlessly.

Moreover, clarity enhances internal alignment within teams. When everyone understands the mission and goals, collaboration becomes smoother. This unified approach leads to increased productivity and innovation.

In a world where attention spans are fleeting, being clear about what you offer sets you apart from competitors. It allows for quicker decision-making by potential customers who know exactly what problem you’re solving for them.

Clarity drives conversion rates higher while minimizing confusion or hesitation among users. Without it, even exceptional products can struggle to gain traction in today’s fast-paced digital landscape.

Understanding the Four Components of Miuzo: Mission, User Experience, Innovation, and Operations

The Miuzo framework is built on four essential components that drive clarity in digital business.

First, the Mission defines a company’s core purpose. It answers why the business exists and what it aims to achieve. A well-articulated mission unites teams and inspires action.

Next, User Experience (UX) is about creating meaningful interactions with customers. An effective UX design enhances satisfaction, making users more likely to engage with your brand repeatedly.

Innovation comes next as a catalyst for growth. This involves continually adapting products or services to meet evolving market demands. Embracing change can set companies apart from competitors.

Operations focus on efficiency and effectiveness in delivering value. Streamlined processes ensure that resources are utilized optimally, resulting in better overall performance across all levels of the organization.

How to Apply Miuzo in Your Digital Business?

Applying Miuzo in your digital business starts with defining your mission. What do you stand for? This clarity forms the foundation for everything that follows.

Next, focus on user experience. Map out the customer journey and identify pain points. Enhancing this aspect can significantly boost satisfaction and loyalty.

Innovation is crucial. Foster a culture that encourages creative thinking. Regular brainstorming sessions can trigger new ideas that align with your mission while staying relevant to users’ needs.

Operations should not be overlooked. Streamline processes to enhance efficiency without compromising quality. A well-oiled machine keeps the momentum going as you implement changes across the board.

Engage your team throughout this journey. Their buy-in is essential for successful implementation of Miuzo’s framework in everyday practices.

Real Life Examples of Companies Using Miuzo Successfully

Companies across various sectors have embraced Miuzo to enhance their digital strategies. One notable example is Airbnb, which effectively clarifies its mission of belonging anywhere. Their user experience is optimized for ease of use, making it simple for travelers and hosts alike.

Spotify has also integrated the Miuzo framework into its operations. By prioritizing innovation, they consistently roll out features that enhance user engagement while maintaining a clear operational structure that supports rapid growth.

Another standout is Zappos, renowned for its customer service excellence. They align every aspect of their business with their core mission, ensuring clarity in user interaction and operational efficiency.

These companies demonstrate how implementing Miuzo can lead to significant improvements in business performance while creating memorable experiences for users.

Potential Challenges and Solutions for Implementing Miuzo

Implementing Miuzo can present several challenges for digital businesses. One major obstacle is employees being hesitant to accept change. Shifting mindsets takes time and patience.

Another challenge may arise from a lack of clear understanding of the framework itself. Teams might struggle if they don’t fully grasp how each component interrelates.

Resources can also be a hurdle, especially for smaller companies. Limited budgets may prevent comprehensive training or tool acquisition essential for effective implementation.

To overcome these obstacles, fostering open communication is key. Engaging your team early in the process encourages buy-in and collaboration.

Providing thorough training sessions helps demystify Miuzo’s components, enabling everyone to see its value clearly. Additionally, leveraging existing resources creatively can reduce costs while still facilitating necessary changes within the organization.

Conclusion: Achieving Clarity and Success with Miuzo in Your Digital Business

Embracing the Miuzo framework can transform your digital business landscape. By focusing on clarity through its four essential components Mission, User Experience, Innovation, and Operations you position yourself for sustainable growth.

Clarity is not just an operational benefit; it’s a strategic advantage. As you implement Miuzo in your organization, you’ll find that aligning these elements fosters better decision-making and enhances collaboration across teams.

Real-world success stories showcase how companies thrive by adopting this approach. They demonstrate that with clear missions and innovative practices, businesses resonate more profoundly with users while maintaining efficient operations.

As you embark on this journey toward clarity with Miuzo, be mindful of potential challenges. Whether it’s resistance to change or resource allocation issues, identifying solutions early will help smooth the path forward.

By integrating each component of the Miuzo framework effectively into your strategy, you’re not merely enhancing your business; you’re ensuring that it thrives amid ever-evolving digital landscapes. The pursuit of clarity becomes a powerful tool that channels focus and drives success in today’s competitive environment.

BUSINESS

cjmonsoon: The Rhythm of Sustainable Growth

Introduction to cjmonsoon and its mission

In a world bustling with change and challenges, finding a business that truly embodies the spirit of sustainability can feel like searching for a needle in a haystack. Enter cjmonsoon a company committed not just to profit but to purpose. With an innovative approach woven into its core mission, cjmonsoon is redefining what it means to grow responsibly while nurturing our planet.

At the heart of their operations lies an unwavering dedication to sustainable growth. This isn’t just about being green; it’s about creating lasting impacts for future generations. As we dive deeper into how cjmonsoon balances profitability with ecological responsibility, you’ll discover inspiring stories and actionable insights that can help pave the way for other businesses eager to make a difference. Join us as we explore this fascinating journey toward harmony between commerce and conservation!

Understanding sustainable growth and its importance

Sustainable growth is about striking a balance. It’s not just about profit; it encompasses environmental stewardship and social responsibility. Businesses today face increasing pressure to adapt their practices for our planet’s wellbeing.

This approach ensures that resources are used efficiently, minimizing waste while maximizing potential. A sustainable model leads to long-term resilience in an ever-changing market landscape.

Moreover, consumers are becoming more conscious of their choices. They prefer brands that prioritize sustainability. This shift affects purchasing decisions across various sectors.

Investing in sustainable growth can enhance brand loyalty and attract new customers. It fosters innovation as companies seek greener solutions, creating opportunities rather than limitations.

Understanding the importance of sustainable growth means recognizing its multifaceted benefits not just for businesses but for society and the environment at large. Embracing this concept paves the way toward a thriving future where everyone can succeed together.

How cjmonsoon incorporates sustainability in their business model?

cjmonsoon integrates sustainability at the core of its business model. The company prioritizes eco-friendly materials in their production processes. They carefully select suppliers who share a commitment to environmental responsibility.

Energy efficiency is another key aspect. By utilizing renewable energy sources, cjmonsoon minimizes its carbon footprint. This proactive approach not only benefits the planet but also reduces operational costs.

Waste reduction is central to their strategy as well. Through innovative recycling programs, cjmonsoon ensures that less material ends up in landfills. Employees are engaged and trained on sustainable practices, fostering a culture of awareness throughout the organization.

Community involvement plays a vital role too. cjmonsoon collaborates with local organizations for clean-up drives and education initiatives about sustainability. This creates a ripple effect, inspiring others to adopt environmentally friendly behaviors while strengthening community ties.

Success stories from cjmonsoon’s sustainable practices

One standout success story from cjmonsoon is its partnership with local farmers. By sourcing ingredients directly, they not only support the community but also reduce carbon footprints associated with transportation.

Their innovative water conservation techniques have made a significant impact. Through rainwater harvesting systems, cjmonsoon has dramatically decreased water usage in their operations. This initiative sets a benchmark for other businesses to follow.

Additionally, the launch of eco-friendly packaging has resonated well with consumers. By eliminating plastic and opting for biodegradable materials, they’ve significantly minimized waste while still maintaining product integrity.

These practices are more than just initiatives; they’re part of a broader commitment to environmental stewardship that drives customer loyalty and enhances brand reputation. Each small victory contributes to a larger narrative of sustainable innovation at cjmonsoon.

Future goals for sustainable growth at cjmonsoon

cjmonsoon is setting its sights on ambitious goals for sustainable growth. The company aims to enhance its eco-friendly practices by further reducing carbon emissions in the next five years.

Investing in renewable energy sources stands at the forefront of their strategy. This transition reduces operating expenses while supporting worldwide sustainability initiatives.

Engaging local communities plays a crucial role in cjmonsoon’s vision. By fostering partnerships, they plan to bolster awareness and education around environmentally responsible practices.

Innovation remains a key focus too. They are exploring cutting-edge technologies that can streamline processes while minimizing waste.

By prioritizing these initiatives, cjmonsoon envisions becoming a leader in sustainability within its industry, inspiring other businesses to follow suit and champion environmental responsibility.

Tips for businesses looking to implement sustainability

Start small. Implementing sustainability doesn’t require a complete overhaul overnight. Choose one area, like reducing plastic use or optimizing energy efficiency.

Engage your team. Encourage employees to share ideas and take ownership of sustainable initiatives. Collaboration can spark innovative solutions.

Set measurable goals. Define clear objectives for your sustainability efforts, whether that’s lowering waste by a certain percentage or increasing the use of renewable resources.

Communicate transparently with customers about your practices. Build trust by sharing both successes and challenges in your journey toward sustainability.

Consider partnering with local organizations focused on environmental issues. These collaborations can amplify impact and foster community support for shared goals.

Stay informed about industry trends in sustainability practices. Regularly update strategies to ensure relevance and effectiveness as new technologies emerge and consumer preferences evolve.

Evaluate progress regularly to adjust tactics as needed, ensuring ongoing commitment to sustainable growth without losing sight of company values.

Conclusion and call to action for supporting sustainable businesses like cjmonsoon

Supporting sustainable businesses like cjmonsoon is more important than ever. The commitment to sustainability not only contributes to a healthier planet but also drives innovation and economic growth. By choosing to engage with companies that prioritize ecological responsibility, consumers can participate in a larger movement towards environmental stewardship.

Consider making small changes in your purchasing decisions. Opt for products from brands that align with sustainable practices, just like cjmonsoon does. Your choices matter, and they can influence other businesses to adopt greener initiatives.

Whether you’re a consumer or an entrepreneur, supporting sustainability is crucial for our shared future. Together, we can create a world where business success aligns harmoniously with ecological well-being. Explore the offerings of cjmonsoon today and join the journey toward sustainable growth!

BUSINESS

Eschopper: Where Tech Meets Modern Commerce

Introduction to Eschopper

Welcome to the future of shopping, where cutting-edge technology meets an unparalleled consumer experience. Eschopper is revolutionizing the way we shop by seamlessly blending modern commerce with innovative tech solutions. Imagine a platform that understands your needs and preferences, allowing you to make informed decisions and enjoy a unique shopping journey. Whether you’re a savvy shopper or a business owner looking for new avenues to connect with customers, Eschopper has something special in store for you. Dive into this article as we explore how Eschopper is changing the landscape of retail and what it means for consumers and businesses alike.

The Technology Behind Eschopper

Eschopper leverages cutting-edge technology to redefine online shopping. At its core, a robust algorithm analyzes customer preferences and behaviors, delivering personalized recommendations that resonate with individual shoppers.

The platform employs advanced machine learning techniques. These algorithms adapt in real-time based on user interactions, ensuring that the shopping experience evolves with each visit. This creates a seamless interface where products are tailored to fit unique tastes.

Additionally, Eschopper integrates secure payment gateways powered by encryption technologies. This guarantees consumer data is protected during transactions, fostering trust between buyers and sellers.

Mobile optimization plays a critical role as well. With an intuitive app designed for swift navigation, users can shop anywhere at any time without hassle or confusion. The blend of these technologies positions Eschopper not just as an e-commerce platform but as an innovative solution for modern retail challenges.

How Eschopper is Changing the Way We Shop?

Eschopper is redefining shopping by merging technology with convenience. It offers a seamless experience where consumers can browse, compare, and purchase products effortlessly.

With its user-friendly interface, shoppers navigate through categories quickly. Advanced search features help users find exactly what they need in seconds. No more endless scrolling through irrelevant items.

Personalization plays a key role as well. Eschopper uses data analytics to tailor recommendations based on individual preferences and past purchases. This means each shopper receives suggestions that resonate with their unique tastes.

Moreover, real-time inventory updates ensure customers know what’s available instantly. There’s no waiting or uncertainty about stock levels just straightforward access to the latest products.

The integration of secure payment options adds another layer of comfort for buyers. Security concerns are minimized while enhancing the overall shopping experience.

Benefits of Using Eschopper for Consumers

Eschopper offers a seamless shopping experience that prioritizes convenience. Consumers can browse and purchase products from the comfort of their homes, eliminating the need for crowded stores.

The platform features advanced search algorithms, making it easy to find exactly what you’re looking for. Personalized recommendations based on browsing habits enhance the shopping journey further.

With Eschopper, consumers enjoy real-time access to exclusive deals and promotions. This allows you to spend less while still enjoying high standards and diverse choices.

Security is paramount in online shopping, and Eschopper employs robust measures to protect customer data. Shoppers can feel confident knowing their transactions are safe.

Additionally, fast shipping options ensure that customers receive their purchases promptly. With just a few clicks, items arrive at your doorstep without delay giving you more time for what matters most in life.

Benefits of Using Eschopper for Businesses

Eschopper offers businesses a streamlined approach to online retailing. By integrating cutting-edge technology, it simplifies inventory management and order processing. This efficiency directly translates into cost savings.

The platform allows for real-time analytics. Businesses can monitor sales trends and customer preferences, tailoring their services accordingly. Understanding the market dynamics helps in making informed decisions.

Additionally, Eschopper enhances customer engagement through personalized shopping experiences. Features like tailored recommendations attract more buyers and boost conversion rates.

Moreover, the user-friendly interface makes onboarding easy for employees. Less training time means that staff can focus on driving sales rather than learning complex systems.

With Eschopper, businesses also benefit from scalability. Whether a small startup or an established enterprise, the platform grows with your needs without compromising performance or quality of service.

Customer Success Stories and Testimonials

Eschopper has transformed the shopping experience for many users. One customer, Sarah, shared how effortless it became to find high-quality products at competitive prices. With just a few clicks, she discovered brands she’d never heard of before.

Another user, Mark, highlighted Eschopper’s intuitive interface. He loved how easy it was to navigate through various categories and quickly locate what he needed. His shopping time decreased significantly, allowing him to focus on other important tasks.

Businesses are also singing praises. A local boutique reported increased sales after joining Eschopper’s platform. They reached new customers who appreciated their unique offerings but wouldn’t have found them otherwise.

Testimonies flood in daily as more shoppers embrace this innovative approach to commerce. Each story reflects a growing satisfaction that underscores Eschopper’s impact on both consumers and businesses alike.

Future Plans and Innovations for Eschopper

Eschopper is on the brink of some exciting advancements. The team is actively working on integrating artificial intelligence to enhance user experience. This technology will personalize shopping experiences based on individual preferences and behaviors.

Additionally, augmented reality features are being developed for virtual try-ons. Imagine browsing through clothing or accessories and seeing how they look without leaving your home!

Sustainability initiatives are also at the forefront of Eschopper’s future plans. They aim to partner with eco-friendly brands, ensuring that consumers can shop responsibly.

Mobile app enhancements are underway too, aiming for seamless transactions and faster deliveries. With these innovations in place, Eschopper seeks to redefine what modern commerce looks like in the digital age. Each step taken reflects a commitment to evolving alongside consumer needs while embracing cutting-edge technology.

Conclusion: The Future of Shopping with Eschopper

Eschopper stands at the forefront of modern commerce, redefining how we shop and interact with technology. With its innovative platform, it seamlessly blends consumer needs with business efficiency. As retail continues to evolve, Eschopper is committed to adapting and enhancing user experiences.

The future holds exciting prospects for both consumers and businesses alike. Enhanced personalization features may emerge, allowing shoppers to find products tailored just for them more quickly than ever before. Businesses will benefit from advanced analytics that provide deeper insights into customer behavior.

As Eschopper grows, its community will expand too fostering a marketplace where innovation thrives and connections flourish. This journey is not only about transactions; it’s about creating relationships between brands and their customers in meaningful ways.

Embracing the changes brought by platforms like Eschopper signals a pivotal shift in shopping dynamics. Both consumers seeking convenience and businesses aiming for growth can look forward to an evolving landscape where tech-driven solutions enhance every experience. The possibilities are vast as we step boldly into this new era of shopping powered by Eschopper’s vision for the future.

HOME IMPROVEMENT12 months ago

HOME IMPROVEMENT12 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

BUSINESS1 year ago

BUSINESS1 year agoExploring the Benefits of Commercial Printing

BUSINESS12 months ago

BUSINESS12 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HEALTH8 months ago

HEALTH8 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

HEALTH8 months ago

HEALTH8 months agoYour Guide to Shedding Pounds in the Digital Age

HOME IMPROVEMENT8 months ago

HOME IMPROVEMENT8 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips

HEALTH11 months ago

HEALTH11 months agoHappy Hippo Kratom Reviews: Read Before You Buy!