BUSINESS

Enhancing Industrial Efficiency with Cutting-Edge Flow Meters

In today’s fast-paced industrial landscape, efficiency is no longer optional — it’s essential for staying competitive. Precise measurements are crucial in optimizing operations, reducing waste, and driving productivity. Flow meters, the unsung heroes of industrial processes, monitor and measure the movement of liquids, gases, or steam with unmatched accuracy, playing a vital role in maintaining smooth and cost-effective operations.

Why Flow Meters Are Essential in Modern Industries

Flow meters aren’t a new concept, but their importance has grown significantly with advancements in technology. In today’s industries, where even slight inefficiencies can lead to significant financial losses or safety risks, these devices ensure that resources are used optimally and operations are running smoothly.

Here’s why flow meters are critical:

- Precise Monitoring: Accurate flow measurement helps maintain the balance of inputs and outputs, which is essential for process efficiency. For instance, in chemical manufacturing, precise monitoring ensures that the correct amount of raw materials is used, preventing waste and ensuring product consistency.

- Cost Efficiency: By detecting leaks, inefficiencies, or overuse of resources, flow meters help businesses lower operational costs while improving overall efficiency.

- Process Control: Modern flow meters seamlessly integrate with automation systems, enabling real-time adjustments for maximum efficiency and minimizing downtime in critical operations.

- Environmental Compliance: With stricter regulations governing emissions and resource usage, flow meters help industries remain compliant while reducing their environmental footprint. Accurate measurements allow companies to monitor and control their outputs, contributing to a greener, more sustainable future.

Types of Flow Meters and Their Applications

Flow meters come in various types, each designed to meet specific industrial needs. Their versatility makes them suitable for a wide range of applications, from managing fuel supplies to monitoring water usage. Below are some of the most common types of flow meters and their key applications:

- Electromagnetic Flow Meters

These are ideal for measuring the flow of conductive liquids, such as water or chemicals. They are widely used in water treatment plants and the chemical industry because of their high accuracy and minimal maintenance requirements. - Ultrasonic Flow Meters

Known for their precision, ultrasonic meters measure flow rates by sending ultrasonic waves through the fluid. They are particularly useful in the oil and gas sector for monitoring liquid and gas flow without disrupting the system. - Thermal Mass Flow Meters

Designed to measure the flow rate of gases, these devices are commonly used in HVAC systems, biogas production, and other applications where gas flow needs to be monitored and controlled. - Turbine Flow Meters

With a simple yet effective design, turbine meters are suitable for measuring the flow of liquids in industries like pharmaceuticals and food processing. Their accuracy and reliability make them a popular choice in these sectors.

For industries dealing with energy resources, fuel flow meters are indispensable. These devices ensure accurate measurements of diesel, gasoline, and other fuels, helping businesses optimize resource utilization and maintain operational efficiency.

How Cutting-Edge Flow Meters Drive Efficiency

Modern flow meters are not just about measuring flow; they are about driving smarter, more efficient operations. The latest generation of these devices incorporates advanced features and technologies that go beyond traditional measurement capabilities. Here’s how cutting-edge flow meters contribute to industrial efficiency:

- Smart Integration

Many modern flow meters come equipped with IoT capabilities, allowing businesses to monitor data remotely and make real-time adjustments. This connectivity ensures greater control and responsiveness, even in complex operations. - Improved Accuracy

Advanced sensors and algorithms have significantly reduced the margin of error in flow measurements, even in challenging environments. This level of precision is critical in industries where even minor discrepancies can lead to costly outcomes. - Durability and Reliability

Designed to withstand harsh industrial conditions, cutting-edge flow meters deliver consistent performance over extended periods. This reliability minimizes maintenance costs and ensures uninterrupted operations. - Data-Driven Insights

By analyzing flow data, companies can identify trends, optimize processes, and plan maintenance activities proactively. This data-driven approach not only improves efficiency but also reduces the risk of unexpected downtime.

In the oil and gas sector, for example, flow meters for fuel ensure precise monitoring of natural gas and petroleum products. This level of accuracy helps businesses reduce wastage, improve profitability, and meet stringent regulatory standards.

Advantages of Using Flow Meters Across Industries

Flow meters provide several key benefits that make them indispensable in various industries:

- Energy Efficiency: By accurately measuring flow rates, these devices help industries reduce energy consumption, leading to lower utility bills and a reduced carbon footprint.

- Process Optimization: Real-time data from flow meters allows businesses to fine-tune their processes for maximum efficiency, resulting in higher output with fewer resources.

- Enhanced Safety: In industries handling hazardous materials, flow meters play a crucial role in ensuring safe operations by monitoring flow rates and detecting anomalies.

- Regulatory Compliance: Accurate measurements enable industries to meet legal and environmental standards, avoiding penalties and maintaining their reputation.

Real-World Applications of Flow Meters

Flow meters are used across a wide range of industries, including:

- Oil and Gas: Monitoring the flow of crude oil, natural gas, and refined products for optimal resource management.

- Water Treatment: Measuring water flow to ensure efficient processing and distribution in treatment plants.

- Manufacturing: Controlling the flow of liquids and gases in production lines to maintain product quality and reduce waste.

- Energy: Managing fuel consumption in power plants and ensuring the efficient use of resources.

Their adaptability and precision make flow meters valuable in virtually any industry that requires accurate flow measurement and control.

Conclusion

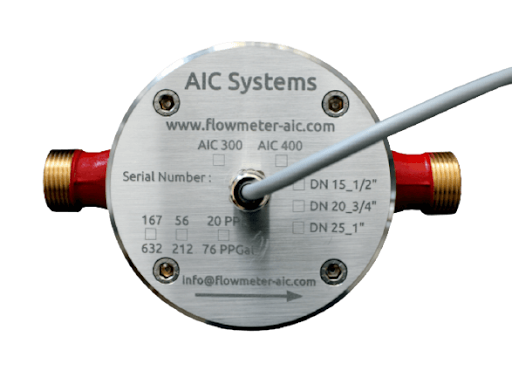

For industries seeking reliable and advanced solutions, AIC Systems AG offers precision-engineered devices tailored to meet diverse industrial needs. Investing in flow meter technology today ensures that businesses are equipped to handle the challenges of tomorrow, fostering long-term success and growth.

REAL ESTATE

Investing in Dubai Real Estate: Why Off-Plan Properties in Dubai Continue to Attract Global Capital

You are not late for Dubai. You are early if you know where to look. Global investors are not chasing hype here. They are chasing structure, regulation, and timing. That is why investing in Dubai real estate, especially off-plan projects, continues to attract capital from Europe, the UK, and Asia.

Dubai does not sell dreams. It sells math. Fixed entry prices. Regulated escrow accounts. Predictable delivery cycles. For a first-time buyer, that clarity matters more than glossy brochures.

Why Off-Plan Properties in Dubai Make Financial Sense

Buying off-plan property in Dubai works for one reason. You lock today’s price while the city builds tomorrow’s value. Developers release units at below-market rates to fund construction. You benefit from that gap.

Payment plans stretch over several years. Many off-plan projects in Dubai require only 10 to 20 percent upfront. The rest is spread across construction milestones. Some extend even after handover. This lowers your cash exposure and increases flexibility.

Rental demand does the rest. Dubai’s population keeps growing. Apartments for sale in Dubai near business hubs and transport corridors rarely sit empty. Investors targeting dubai property investment often see rental yields between 6 and 8 percent when projects are completed. Appreciation comes on top if you bought well.

Investor Protection and DLD Regulations You Must Understand

Here is the part most brokers skip. Safety. Dubai Land Department regulations control every off-plan sale. Developers must register projects. Funds go into escrow. Money cannot be touched unless construction milestones are met.

You get a registered sales contract. Your ownership is recorded. Title deeds are issued upon completion. This is why serious investors buy property in Dubai rather than gamble in unregulated markets.

Transparency is not optional here. It is enforced. That is why real estate investment in UAE attracts institutional and private capital year after year.

Where Smart Buyers Focus Today

Not all properties in Dubai for sale are equal. Honestly, some should be avoided. Smart buyers focus on master-planned communities, infrastructure-backed zones, and developers with a proven track record of delivery.

Off-plan villas in Dubai near schools and transport outperform speculative towers. Apartments in mixed-use districts have stronger rental demand. Luxury properties in Dubai attract end-users, not just flippers. That stability matters when markets shift.

How First-Time Investors Should Approach the Market

Start with clarity. Budget. Timeline. Exit plan. Then shortlist off-plan projects in Dubai that match those numbers. Do not buy because a showroom feels impressive. Buy because the yield works and the developer delivers.

This is where guidance matters. At Professor Property, deals are structured, not pushed. We review contracts, explain DLD fees, and filter projects before you commit capital. That discipline protects returns and sleep.

Dubai rewards prepared investors. If you want to buy off-plan property in Dubai with logic instead of noise, start with the numbers. Then take the next step.

Visit Professor Property for clear guidance, vetted projects, and a strategy built around your goals. Smart capital always follows structure.

BUSINESS

Logisths: Smarter Supply Chain Automation for Business Growth

Introduction to logisths

In today’s high-speed business world, efficiency is no longer optional—it’s essential. The supply chain plays a pivotal role in driving success for organizations of all sizes. Enter logisths a game-changing approach to supply chain automation that promises to revolutionize the way businesses operate. Imagine streamlining processes, reducing costs, and enhancing customer satisfaction all while keeping your competitive edge sharp. As we delve deeper into this transformative concept, you’ll discover how embracing logisths can propel your business toward unprecedented growth and innovation. Let’s explore the dynamic world of smart logistics together!

The Benefits of Supply Chain Automation

Supply chain automation streamlines processes, reducing manual tasks. This efficiency leads to quicker order fulfillment and improved customer satisfaction.

Cost savings are another significant benefit. By minimizing human errors and optimizing resource allocation, businesses can cut expenses in various areas.

Enhanced visibility is a game changer too. Automated systems provide real-time data on inventory levels and shipment statuses. This transparency enables proactive decision-making.

Additionally, automation fosters collaboration among teams. It breaks down silos by integrating various functions within the supply chain, leading to better communication and coordination.

Scalability becomes more attainable with automated solutions. As a business grows, these systems can adapt without needing extensive rework or additional labor hours.

The Evolution of Logistics: From Traditional to Smart

The logistics industry has changed significantly across the years. Traditionally, businesses relied heavily on manual processes and paper-based systems. This often led to inefficiencies, delays, and miscommunication.

As technology progressed, logistics began to embrace automation. Warehouses introduced conveyor belts and barcode scanning. These innovations streamlined operations but still lacked real-time data insights.

The rise of the internet paved the way for smarter solutions. Companies started adopting integrated software that connected suppliers, manufacturers, and retailers seamlessly. Communication improved significantly.

Today’s logistics landscape is dominated by smart technologies like artificial intelligence and IoT devices. These tools provide actionable insights at every stage of the supply chain process.

Businesses can now anticipate demand fluctuations with predictive analytics while optimizing routes using machine learning algorithms. The shift from traditional methods to these innovative approaches marks a new era in logistics efficiency and effectiveness.

What is Logisths?

Logisths is a cutting-edge solution designed to transform the logistics landscape. It harnesses advanced technology to streamline supply chain operations, making them more efficient and responsive.

At its core, Logisths integrates various tools that automate processes like inventory management, order fulfillment, and transportation planning. This eliminates manual errors and enhances accuracy across the board.

What sets Logisths apart is its ability to adapt in real time. Businesses can adjust their strategies based on current data analytics. This responsiveness helps companies stay ahead of market trends.

Moreover, Logisths promotes collaboration among stakeholders in the supply chain. With shared insights and transparency, teams can work together seamlessly toward common goals.

This innovative system empowers businesses not merely to survive but thrive in an increasingly competitive marketplace.

How Logisths Can Help Businesses Thrive and Grow?

Logisths offers innovative solutions that streamline operations, enabling businesses to enhance efficiency. By automating various supply chain processes, it reduces manual errors and saves time.

With real-time data analytics, Logisths empowers decision-makers with insights into inventory levels and demand trends. This allows for more accurate forecasting and improved resource allocation.

Additionally, Logisths enhances collaboration among stakeholders. With integrated communication tools, teams can coordinate efforts seamlessly across different departments or locations.

Cost savings also play a crucial role in business growth. By optimizing logistics routes and reducing waste, companies can significantly lower operational expenses while maintaining high service levels.

Furthermore, adaptation becomes easier with Logisths. As market demands shift rapidly, its flexible solutions allow businesses to pivot quickly without sacrificing quality or customer satisfaction.

Case Studies: Real-Life Examples of Successful Implementation of Logisths

One compelling case study involves a global retail giant that adopted Logisths to streamline its supply chain. By integrating real-time data analytics, the company reduced delivery times by 30%. This enhancement increased customer satisfaction significantly.

Another success story comes from an automotive parts manufacturer. After implementing Logisths, they optimized inventory management. The result was a dramatic decrease in excess stock and related costs.

A food distribution service also saw remarkable outcomes with Logisths technology. They improved route planning, which minimized fuel consumption and expedited deliveries across multiple regions.

These examples highlight how diverse industries can leverage Logisths for operational excellence, fostering growth while maintaining efficiency. Each implementation showcases tailored solutions that address specific challenges faced by businesses today.

Future Predictions for the Role of Logisths in Business Growth

The future of Logisths is poised to redefine how businesses approach supply chain management. With advancements in artificial intelligence and machine learning, we can expect even more personalized solutions that cater to specific business needs.

Automation will continue to evolve, enhancing efficiency and reducing human error. As smart logistics systems integrate seamlessly with other technologies, companies will benefit from real-time data analysis for quicker decision-making.

Sustainability will also play a crucial role. Businesses are increasingly prioritizing eco-friendly practices within their supply chains. Logisths can help monitor carbon footprints and optimize routes for reduced emissions.

Furthermore, the growing emphasis on customer experience means that agile logistics strategies are essential. Companies leveraging Logisths will be equipped to respond swiftly to market changes and customer demands.

As these trends unfold, organizations embracing Logisths will likely see significant competitive advantages in an ever-evolving marketplace.

Conclusion

The logistics landscape is rapidly evolving, and the emergence of Logisths represents a significant leap forward in supply chain automation. By embracing innovative technologies and intelligent systems, businesses can streamline operations, reduce costs, and improve customer satisfaction.

As companies navigate this new terrain, the successful integration of Logisths into their processes will be crucial for maintaining competitiveness in an increasingly demanding market. Real-life case studies have already shown that organizations leveraging these smarter solutions enjoy enhanced efficiency and growth.

Looking ahead, it’s clear that Logisths will play a pivotal role in shaping the future of business logistics. Companies willing to adapt to this paradigm shift are not only investing in operational excellence but also setting themselves up for long-term success. With continued advancements on the horizon, now is the time for businesses to explore how Logisths can transform their supply chains into agile engines of growth.

FINANCE

Unlock Opportunities with JerryClub’s Premium CVV2 Shop

In today’s digital world, access to reliable and secure financial services is essential for individuals and businesses alike. With the increasing complexity of online transactions, users are seeking platforms that offer efficiency, accuracy, and advanced solutions. JerryClub’s Premium CVV2 Shop has emerged as a trusted platform in this space, providing high-quality CVV2 services that cater to modern jerryclub.cc users’ needs. From robust security to user-friendly design, JerryClub offers a comprehensive solution for those looking to optimize their digital operations. This blog explores how JerryClub’s Premium CVV2 Shop unlocks opportunities and why it stands out as a leading platform.

Understanding CVV2 and Its Importance

Before diving into the features of JerryClub, it is important to understand what CVV2 services are and why they are crucial in online financial operations.

CVV2, or Card Verification Value 2, is a three- or four-digit code found on credit and debit cards. It is primarily used for verifying online and card-not-present transactions, ensuring that the card is valid and authorized for use. Accurate CVV2 data is critical for secure transactions, minimizing errors, and protecting against unauthorized access.

A reliable platform offering CVV2 services ensures that users can perform online transactions with confidence. JerryClub’s Premium CVV2 Shop specializes in providing verified, secure, and up-to-date CVV2 information, giving users the tools they need for seamless financial operations.

Why JerryClub’s Premium CVV2 Shop Is the Go-To Platform

1. Reliability You Can Count On

Reliability is a key factor when choosing a CVV2 service provider. JerryClub ensures consistent performance, delivering accurate and functional CVV2 solutions that users can depend on.

Unlike other providers that may experience downtime or provide inconsistent data, JerryClub prioritizes operational stability. Users can rely on the platform to handle transactions efficiently, reducing the risk of errors and delays. This dependable performance makes JerryClub a top choice for both individuals and businesses.

2. Advanced Security Measures

Security is a top priority in the CVV2 services sector. JerryClub employs advanced encryption, secure server infrastructure, and continuous monitoring to safeguard user data.

These protocols prevent unauthorized access and protect sensitive information, giving users confidence in the platform’s security. While many competitors provide only basic protection, JerryClub’s proactive approach ensures that every transaction is secure and confidential.

3. User-Friendly Interface

A seamless user experience is essential for efficiency and productivity. JerryClub’s Premium CVV2 Shop features a clean and intuitive interface that makes accessing services simple and convenient.

Whether you are an experienced user or new to CVV2 services, the platform is easy to navigate. Optimized for both desktop and mobile devices, JerryClub allows users to manage their tasks anywhere, anytime. This jerry club accessibility enhances convenience and sets the platform apart from competitors with more complicated systems.

4. High-Quality CVV2 Solutions

Quality is a defining feature of JerryClub’s services. The platform provides accurate, verified, and reliable CVV2 data, ensuring that users can complete transactions without errors.

Some competitors may prioritize quantity over quality, leading to inconsistencies or outdated data. JerryClub, however, maintains strict standards, delivering premium solutions that meet modern users’ expectations. This focus on quality allows users to operate efficiently and with confidence.

5. Regular Data Updates

Inaccurate or outdated data can hinder the effectiveness of CVV2 services. JerryClub addresses this issue by maintaining regularly updated databases to ensure accuracy and relevance.

By providing fresh and verified data, JerryClub enhances transaction success rates and reduces operational errors. Competitors who rely on outdated databases often frustrate users, but JerryClub’s commitment to regular updates ensures consistent reliability.

6. Responsive Customer Support

Reliable customer support is essential for any high-quality platform. JerryClub offers responsive and knowledgeable support to help users navigate the platform and resolve issues promptly.

Whether addressing technical concerns, providing guidance, or answering inquiries, the support team ensures timely and effective solutions. Many other platforms have limited or slow support, but JerryClub’s focus on customer assistance reinforces trust and satisfaction.

7. Competitive Pricing and Value

Affordability is an important consideration for users seeking CVV2 services. JerryClub provides competitive pricing without compromising on quality, security, or reliability.

While some providers offer lower rates at the expense of accuracy or service quality, JerryClub balances cost-effectiveness with premium performance. This combination of value and quality makes it an attractive choice for individuals and businesses seeking dependable CVV2 solutions.

8. Established Reputation and Trust

Trust is a critical factor when selecting a CVV2 platform. JerryClub has built a strong reputation based on consistent service delivery, quality offerings, and satisfied users.

Positive reviews, repeat users, and recommendations highlight the platform’s credibility. Users trust JerryClub because it consistently meets expectations, offering dependable and secure CVV2 services. This reputation gives the platform a clear advantage over competitors.

9. Innovation and Future-Ready Solutions

JerryClub stays ahead of the competition by embracing innovation. The platform continuously integrates modern technologies and methodologies to improve its CVV2 services.

By adopting a forward-thinking approach, JerryClub ensures that users have access to efficient, cutting-edge solutions that adapt to the evolving digital landscape. Competitors relying on outdated methods risk lagging behind, while JerryClub continues to offer modern solutions that meet users’ present and future needs.

How JerryClub Unlocks Opportunities for Users

JerryClub’s Premium CVV2 Shop offers multiple opportunities for users seeking reliable and secure financial solutions:

- Enhanced Efficiency: Streamlined access to verified CVV2 data allows users to perform transactions quickly and accurately.

- Improved Security: Advanced protection measures reduce the risk of data breaches and unauthorized access.

- Business Growth: Reliable services support operational efficiency and client trust, enabling business expansion.

- Convenience: Mobile optimization allows users to manage their services on the go, saving time and increasing productivity.

- Long-Term Reliability: Regular updates, quality services, and responsive support ensure users can depend on the platform for ongoing needs.

These benefits collectively allow users to maximize efficiency, security, and growth potential.

Conclusion

JerryClub’s Premium CVV2 Shop has established itself as a leading platform for users seeking secure, reliable, and high-quality CVV2 services. Its commitment to operational reliability, advanced security, user-friendly design, and innovation ensures a superior experience for all users.

Regularly updated data, competitive pricing, and responsive support make JerryClub an ideal solution for individuals and businesses looking to optimize financial operations. The platform’s strong reputation and commitment to quality further reinforce its status as a trusted and dependable service provider.

For anyone seeking opportunities to improve efficiency, security, and reliability in online financial transactions, JerryClub’s Premium CVV2 Shop provides the tools and solutions needed to succeed. By combining quality services, robust security, and a user-focused approach, JerryClub empowers users to unlock new opportunities and navigate the complexities of digital transactions with confidence.

HOME IMPROVEMENT11 months ago

HOME IMPROVEMENT11 months agoThe Do’s and Don’ts of Renting Rubbish Bins for Your Next Renovation

BUSINESS12 months ago

BUSINESS12 months agoExploring the Benefits of Commercial Printing

BUSINESS12 months ago

BUSINESS12 months agoBrand Visibility with Imprint Now and Custom Poly Mailers

HEALTH7 months ago

HEALTH7 months agoThe Surprising Benefits of Weight Loss Peptides You Need to Know

HEALTH7 months ago

HEALTH7 months agoYour Guide to Shedding Pounds in the Digital Age

TECHNOLOGY10 months ago

TECHNOLOGY10 months agoDizipal 608: The Tech Revolution Redefined

HOME IMPROVEMENT7 months ago

HOME IMPROVEMENT7 months agoGet Your Grout to Gleam With These Easy-To-Follow Tips

HEALTH11 months ago

HEALTH11 months agoHappy Hippo Kratom Reviews: Read Before You Buy!